3M 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

NEW ACCOUNTING PRONOUNCEMENTS

Information regarding new accounting pronouncements is included in Note 1 to the Consolidated Financial

Statements.

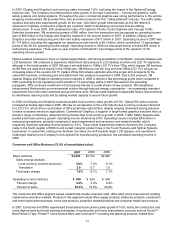

FINANCIAL CONDITION AND LIQUIDITY

The Company generates significant ongoing cash flow. Increases in long-term debt have been used, in part, to fund

share repurchase activities and acquisitions. On November 15, 2007, 3M (Safety, Security and Protection Services

Business) announced that it had entered into a definitive agreement for 3M’s acquisition of 100 percent of the

outstanding shares of Aearo Holding Corp. a global leader in the personal protection industry that manufactures and

markets personal protection and energy absorbing products for approximately $1.2 billion. The sale is expected to

close towards the end of the first quarter of 2008.

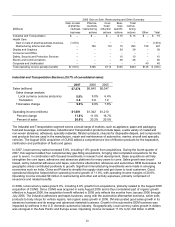

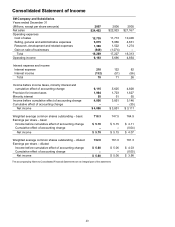

At December 31

(Millions) 2007 2006 2005

Total Debt $4,920 $3,553 $2,381

Less: Cash, cash equivalents and marketable securities 2,955 2,084 1,072

Net Debt $1,965 $1,469 $1,309

Cash, cash equivalents and marketable securities at December 31, 2007 totaled approximately $3 billion, helped by

strong cash flow generation and by the timing of debt issuances. At December 31, 2006, cash balances were higher

due to the significant pharmaceuticals sales proceeds received in December 2006. 3M believes its ongoing cash flows

provide ample cash to fund expected investments and capital expenditures. The Company has sufficient access to

capital markets to meet currently anticipated growth and acquisition investment funding needs. The Company does not

utilize derivative instruments linked to the Company’s stock. However, the Company does have contingently

convertible debt that, if conditions for conversion are met, is convertible into shares of 3M common stock (refer to Note

10 in this document).

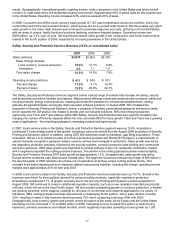

The Company’s financial condition and liquidity are strong. Various assets and liabilities, including cash and short-term

debt, can fluctuate significantly from month to month depending on short-term liquidity needs. Working capital (defined as

current assets minus current liabilities) totaled $4.476 billion at December 31, 2007, compared with $1.623 billion at

December 31, 2006. Working capital was higher primarily due to increases in cash and cash equivalents, short-term

marketable securities, receivables and inventories and decreases in short-term debt and accrued income taxes.

The Company’s liquidity remains strong, with cash, cash equivalents and marketable securities at December 31, 2007

totaling approximately $3 billion. Primary short-term liquidity needs are provided through U.S. commercial paper and

euro commercial paper issuances. As of December 31, 2007, outstanding total commercial paper issued totaled

$349 million and averaged $1.249 billion during 2007. The Company believes it unlikely that its access to the

commercial paper market will be restricted. In June 2007, the Company established a medium-term notes program

through which up to $3 billion of medium-term notes may be offered, with remaining shelf borrowing capacity of $2.5

billion as of December 31, 2007. On April 30, 2007, the Company replaced its $565-million credit facility with a new

$1.5-billion five-year credit facility, which has provisions for the Company to request an increase of the facility up to $2

billion (at the lenders’ discretion), and providing for up to $150 million in letters of credit. As of December 31, 2007,

there are $110 million in letters of credit drawn against the facility. At December 31, 2007, available short-term

committed lines of credit internationally totaled approximately $67 million, of which $13 million was utilized. Debt

covenants do not restrict the payment of dividends. The Company has a "well-known seasoned issuer" shelf

registration statement, effective February 24, 2006, to register an indeterminate amount of debt or equity securities for

future sales. The Company intends to use the proceeds from future securities sales off this shelf for general corporate

purposes.

At December 31, 2007, certain debt agreements ($350 million of dealer remarketable securities and $87 million of

ESOP debt) had ratings triggers (BBB-/Baa3 or lower) that would require repayment of debt. The Company has an AA

credit rating, with a stable outlook, from Standard & Poor’s and an Aa1 credit rating, with a negative outlook, from

Moody’s Investors Service. In addition, under the $1.5-billion five-year credit facility agreement, 3M is required to

maintain its EBITDA to Interest Ratio as of the end of each fiscal quarter at not less than 3.0 to 1. This is calculated

(as defined in the agreement) as the ratio of consolidated total EBITDA for the four consecutive quarters then ended

to total interest expense on all funded debt for the same period. At December 31, 2007, this ratio was approximately

35 to 1.