3M 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

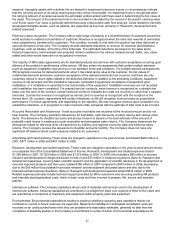

purchase price of several of these acquisitions is subject to increases, which could be triggered by the achievement of

certain milestones.

The largest of these acquisitions was the August 2006 purchase of 100 percent of the outstanding shares of Security

Printing and Systems Limited (Safety, Security and Protection Services Business) from authentos GmbH, Germany.

The acquired company is a producer of finished, personalized passports and secure cards.

In October 2006, 3M (Health Care Business) purchased 100 percent of the outstanding shares of Brontes

Technologies Inc. (Brontes), a Lexington, Massachusetts-based developer of proprietary 3-D imaging technology for

dental and orthodontic applications, for $95 million in cash. Brontes was a “development stage enterprise” that did not

yet have revenues from its principal operations and the technology acquired did not have any alternative future use.

This transaction resulted in a 2006 charge of $95 million, or $0.13 per diluted share, reflecting the write-off of acquired

in-process research and development costs, which are recognized as research, development and related expenses in

the Consolidated Statement of Income.

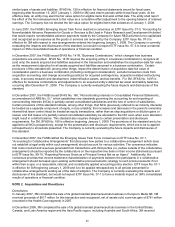

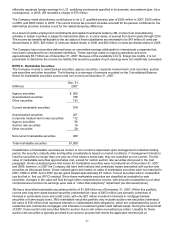

The 17 additional business combinations are summarized as follows:

1) In January 2006, 3M (Consumer and Office Business) purchased 100 percent of the outstanding common shares

of Interchemall Dom., a provider of household cleaning products based in Poland.

2) In March 2006, 3M (Industrial and Transportation Business) purchased certain assets of General Industrial

Diamond Company Inc., a U.S. operation. The acquired company is a manufacturer of superabrasive grinding wheels,

dressing tools and machines used to dimension and finish hard-to-grind materials in the industrial and commercial

markets.

3) In April 2006, 3M (Health Care Business) purchased 100 percent of the outstanding shares of OMNII Oral

Pharmaceuticals, a provider of differentiated preventive dental products, solutions and support for dental

professionals.

4) In April 2006, 3M (Health Care Business) purchased certain assets of ClozeX Medical LLC, a provider of unique

skin closure devices to treat lacerations and close surgical incisions. The agreement gives 3M exclusive worldwide

rights for the manufacturing and distribution of ClozeX Wound Closures.

5) In June 2006, 3M (Health Care Business) purchased 100 percent of the outstanding shares of SBG (Software und

Beratung im Gesundheitswesen) GmbH, a Berlin-based developer of software for managing diagnosis-related

information in hospitals.

6) In June 2006, 3M (Safety, Security and Protection Services Business) purchased certain assets of POMP Medical

and Occupational Health Products LLC, a Porto Alegre, Brazil-based provider of earplugs, eyewear and hand cream.

7) In July 2006, 3M (Industrial and Transportation Business) purchased certain assets of Pinnacle Distribution

Concepts Inc., a leading transportation management system (TMS) provider specializing in the delivery of Web-

based, “on-demand” solutions.

8) In July 2006, 3M (Electro and Communications Business) purchased certain assets of SCC Products Inc. and JJ

Converting LLC, both based in Sanford, N.C. SCC Products Inc. is a provider of flexible static control packaging and

workstation products for electronic devices. JJ Converting LLC is a producer of films used to make static control bags.

9) In August 2006, 3M (Display and Graphics Business) purchased 100 percent of the outstanding shares of Archon

Technologies Inc., a Denver, Colorado-based provider of enterprise software solutions for motor vehicle agencies.

10) In August 2006, 3M (Safety, Security and Protection Services Business) purchased 100 percent of the

outstanding shares of Aerion Technologies, a Denver, Colorado-based maker of safety products, including heat stress

monitors, thermal cameras and carbon monoxide detectors.

11) In September 2006, 3M (Electro and Communications Business) purchased 100 percent of the outstanding

shares of Credence Technologies Inc., a Soquel, California-based provider of instruments and high-end monitoring

equipment for electrostatic discharge control and electromagnetic compliance.

12) In October 2006, 3M (Consumer and Office Business) purchased certain assets of Nylonge Corp., a global

provider of household cleaning products, including cellulose sponges, scrub sponges and household wipes.

13) In October 2006, 3M (Industrial and Transportation Business) purchased 100 percent of the outstanding shares of

NorthStar Chemicals, Inc., a Cartersville, Georgia-based adhesive manufacturer.

14) In November 2006, 3M (Industrial and Transportation Business) purchased 100 percent of the outstanding shares

of Global Beverage Group Inc., a Canadian-based provider of delivery management software solutions for the direct-

store-delivery of consumer packaged goods.

15) In November 2006, 3M (Health Care Business) purchased 100 percent of the outstanding shares of Biotrace

International PLC, a Bridgend, UK-based manufacturer and supplier of industrial microbiology products used in food

processing safety, health care, industrial hygiene and defense applications.

16) In December 2006, 3M (Electro and Communications Business) purchased certain assets of Mahindra

Engineering and Chemical Products LTD, an India-based manufacturer of cable jointing kits and accessories.

17) In December 2006, 3M (Health Care Business) purchased 100 percent of the outstanding shares of SoftMed

Systems Inc., a Maryland-based provider of health information management software and services that improve the

workflow and efficiency of health care organizations.