3M 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

Other Exit Activities:

During the second half of 2007, the Company recorded net pre-tax charges of $45 million related to exit activities. These

charges related to employee reductions and fixed asset impairments, including the consolidation of certain flexible circuit

manufacturing operations ($23 million recorded in the Electro and Communications segment) and other actions, primarily

in the Display and Graphics segment and Industrial and Transportation segment. These charges were recorded in cost of

sales and selling, general and administrative expenses and research, development and related expenses.

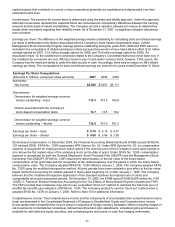

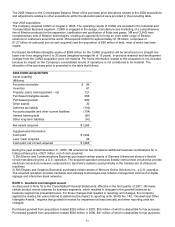

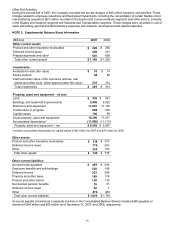

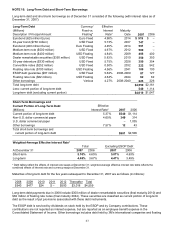

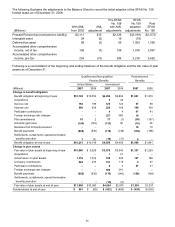

NOTE 5. Supplemental Balance Sheet Information

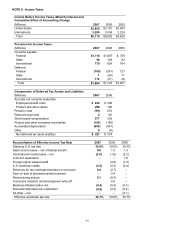

(Millions) 2007 2006

Other current assets

Product and other insurance receivables $ 220 $ 255

Deferred income taxes 428 412

Prepaid expenses and other 501 658

Total other current assets $ 1,149 $ 1,325

Investments

Available-for-sale (fair value) $ 16 $ 14

Equity-method 64 86

Cash surrender value of life insurance policies, real

estate and other (cost, which approximates fair value) 218 214

Total investments $ 298 $ 314

Property, plant and equipment – at cost

Land $ 303 $ 281

Buildings and leasehold improvements 5,496 5,002

Machinery and equipment 11,801 11,130

Construction in progress 684 505

Capital leases 106 99

Gross property, plant and equipment 18,390 17,017

Accumulated depreciation* (11,808) (11,110)

Property, plant and equipment – net $ 6,582 $ 5,907

*Includes accumulated depreciation for capital leases of $42 million for 2007 and $37 million for 2006.

Other assets

Product and other insurance receivables $ 318 $ 373

Deferred income taxes 176 253

Other 234 150

Total other assets $ 728 $ 776

Other current liabilities

Accrued trade payables $ 458 $ 556

Employee benefits and withholdings 228 168

Deferred income 323 299

Property and other taxes 169 176

Product and other claims 120 115

Non-funded pension benefits 35 31

Deferred income taxes 22 7

Other 478 409

Total other current liabilities $ 1,833 $ 1,761

Accounts payable (included as a separate line item in the Consolidated Balance Sheet) includes drafts payable on

demand of $44 million and $65 million as of December 31, 2007, and 2006, respectively.