3M 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

damages to natural resources allegedly caused by the discharge of hazardous substances from two former waste

disposal sites in New Jersey. During the fourth quarter, the Company negotiated a settlement of New Jersey’s claims.

Under the terms of the settlement, the company will transfer to the State of New Jersey 150 acres of undeveloped land

with groundwater recharge potential, which the Company acquired for purposes of the settlement, and will pay the state’s

attorneys’ fees. Notice of the settlement was published for public comment in December 2007, and no objections were

received. As a result, the Company and the State of New Jersey have signed the formal settlement agreement pursuant

to which the Company will transfer title to the property and will be dismissed from the lawsuit, which will continue against

the codefendants.

Accrued Liabilities and Insurance Receivables Related to Legal Proceedings

The Company complies with the requirements of Statement of Financial Accounting Standards No. 5, “Accounting for

Contingencies,” and related guidance, and records liabilities for legal proceedings in those instances where it can

reasonably estimate the amount of the loss and where liability is probable. Where the reasonable estimate of the

probable loss is a range, the Company records the most likely estimate of the loss, or the low end of the range if there is

no one best estimate. The Company either discloses the amount of a possible loss or range of loss in excess of

established reserves if estimable, or states that such an estimate cannot be made. For those insured matters where the

Company has taken a reserve, the Company also records receivables for the amount of insurance that it expects to

recover under the Company’s insurance program. For those insured matters where the Company has not taken a

reserve because the liability is not probable or the amount of the liability is not estimable, or both, but where the Company

has incurred an expense in defending itself, the Company records receivables for the amount of insurance that it expects

to recover for the expense incurred. The Company discloses significant legal proceedings even where liability is not

probable or the amount of the liability is not estimable, or both, if the Company believes there is at least a reasonable

possibility that a loss may be incurred.

Because litigation is subject to inherent uncertainties, and unfavorable rulings or developments could occur, there can be

no certainty that the Company may not ultimately incur charges in excess of presently recorded liabilities. A future

adverse ruling, settlement, or unfavorable development could result in future charges that could have a material adverse

effect on the Company’s results of operations or cash flows in the period in which they are recorded. The Company

currently believes that such future charges, if any, would not have a material adverse effect on the consolidated financial

position of the Company, taking into account its significant available insurance coverage. Based on experience and

developments, the Company periodically reexamines its estimates of probable liabilities and associated expenses and

receivables, and whether it is able to estimate a liability previously determined to be not estimable and/or not probable.

Where appropriate, the Company makes additions to or adjustments of its estimated liabilities. As a result, the current

estimates of the potential impact on the Company’s consolidated financial position, results of operations and cash flows

for the legal proceedings and claims pending against the Company could change in the future.

The Company estimates insurance receivables based on an analysis of its numerous policies, including their exclusions,

pertinent case law interpreting comparable policies, its experience with similar claims, and assessment of the nature of

the claim, and records an amount it has concluded is likely to be recovered.

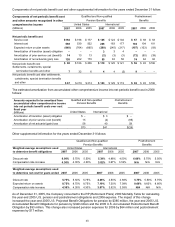

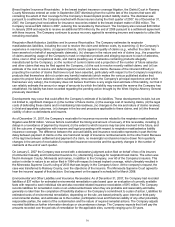

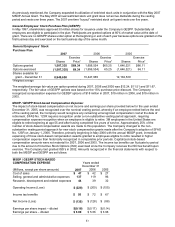

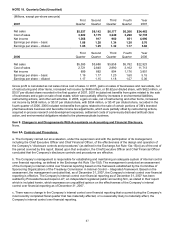

The following table shows the major categories of on-going litigation, environmental remediation and other

environmental liabilities for which the Company has been able to estimate its probable liability and for which the

Company has taken reserves and the related insurance receivables:

At December 31 (Millions) 2007 2006 2005

Breast implant liabilities $ 1 $ 4 $ 7

Breast implant receivables 64 93 130

Respirator mask/asbestos liabilities 121 181 210

Respirator mask/asbestos receivables 332 380 447

Environmental remediation liabilities 37 44 30

Environmental remediation receivables 15 15 15

Other environmental liabilities 147 14 8

For those significant pending legal proceedings that do not appear in the table and that are not the subject of pending

settlement agreements, the Company has determined that liability is not probable or the amount of the liability is not

estimable, or both, and the Company is unable to estimate the possible loss or range of loss at this time. The amounts

in the preceding table with respect to breast implant and environmental remediation represent the Company’s best

estimate of the respective liabilities. The Company does not believe that there is any single best estimate of the

respirator/mask/asbestos liability or the other environmental liabilities shown above, nor that it can reliably estimate

the amount or range of amounts by which those liabilities may exceed the reserves the Company has established.