3M 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

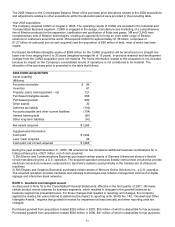

The 2006 impact on the Consolidated Balance Sheet of the purchase price allocations related to the 2006 acquisitions

and adjustments relative to other acquisitions within the allocation period were provided in the preceding table.

Year 2005 acquisitions:

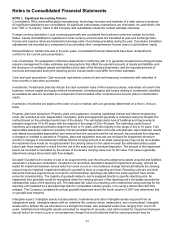

The Company acquired CUNO on August 2, 2005. The operating results of CUNO are included in the Industrial and

Transportation Business segment. CUNO is engaged in the design, manufacture and marketing of a comprehensive

line of filtration products for the separation, clarification and purification of fluids and gases. 3M and CUNO have

complementary sets of filtration technologies, creating an opportunity to bring an even wider range of filtration

solutions to customers around the world. 3M acquired CUNO for approximately $1.36 billion, comprised of

$1.27 billion of cash paid (net of cash acquired) and the acquisition of $80 million of debt, most of which has been

repaid.

Purchased identifiable intangible assets of $268 million for the CUNO acquisition will be amortized on a straight-line

basis over lives ranging from 5 to 20 years (weighted-average life of 15 years). In-process research and development

charges from the CUNO acquisition were not material. Pro forma information related to this acquisition is not included

because its impact on the Company’s consolidated results of operations is not considered to be material. The

allocation of the purchase price is presented in the table that follows.

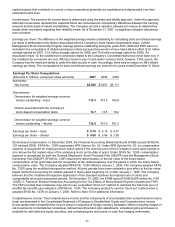

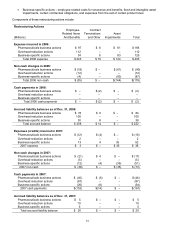

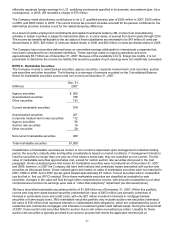

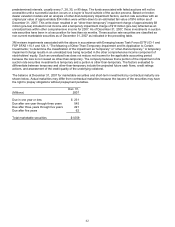

2005 CUNO ACQUISITION

Asset (Liability)

(Millions)

Accounts receivable $ 96

Inventory 61

Property, plant, and equipment – net 121

Purchased intangible assets 268

Purchased goodwill 992

Other assets 30

Deferred tax liability (102)

Accounts payable and other current liabilities (104)

Interest bearing debt (80)

Other long-term liabilities (16)

Net assets acquired $1,266

Supplemental information:

Cash paid $1,294

Less: Cash acquired 28

Cash paid, net of cash acquired $1,266

During the year ended December 31, 2005, 3M entered into two immaterial additional business combinations for a

total purchase price of $27 million, net of cash acquired.

1) 3M (Electro and Communications Business) purchased certain assets of Siemens Ultrasound division’s flexible

circuit manufacturing line, a U.S. operation. The acquired operation produces flexible interconnect circuits that provide

electrical connections between components in electronics systems used primarily in the transducers of ultrasound

machines.

2) 3M (Display and Graphics Business) purchased certain assets of Mercury Online Solutions Inc., a U.S. operation.

The acquired operation provides hardware and software technologies and network management services for digital

signage and interactive kiosk networks.

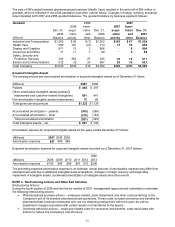

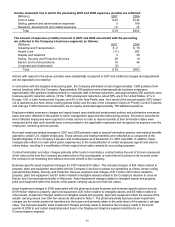

NOTE 3. Goodwill and Intangible Assets

As discussed in Note 16 to the Consolidated Financial Statements, effective in the first quarter of 2007, 3M made

certain product moves between its business segments, which resulted in changes in the goodwill balances by

business segment as presented below. For those changes that resulted in reporting unit changes, the Company

applied the relative fair value method to determine the impact to reporting units. SFAS No. 142, “Goodwill and Other

Intangible Assets,” requires that goodwill be tested for impairment at least annually and when reporting units are

changed.

Purchased goodwill from acquisitions totaled $326 million in 2007, $55 million of which is deductible for tax purposes.

Purchased goodwill from acquisitions totaled $536 million in 2006, $41 million of which is deductible for tax purposes.