3M 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

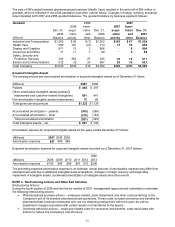

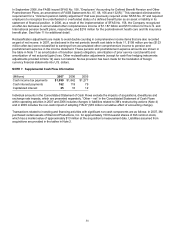

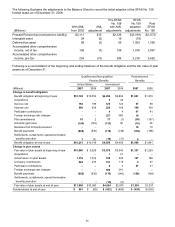

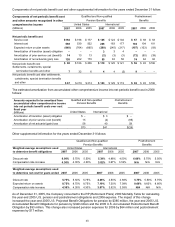

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106 and 132(R).” This standard eliminated the

requirement for a “minimum pension liability adjustment” that was previously required under SFAS No. 87 and required

employers to recognize the underfunded or overfunded status of a defined benefit plan as an asset or liability in its

statement of financial position. In 2006, as a result of the implementation of SFAS No. 158, the Company recognized

an after-tax decrease in accumulated other comprehensive income of $1.187 billion and $513 million for the U.S. and

International pension benefit plans, respectively, and $218 million for the postretirement health care and life insurance

benefit plan. See Note 11 for additional detail.

Reclassification adjustments are made to avoid double counting in comprehensive income items that are also recorded

as part of net income. In 2007, as disclosed in the net periodic benefit cost table in Note 11, $198 million pre-tax ($123

million after-tax) were reclassified to earnings from accumulated other comprehensive income to pension and

postretirement expense in the income statement. These pension and postretirement expense amounts are shown in

the table in Note 11 as amortization of transition (asset) obligation, amortization of prior service cost (benefit) and

amortization of net actuarial (gain) loss. Other reclassification adjustments (except for cash flow hedging instruments

adjustments provided in Note 12) were not material. No tax provision has been made for the translation of foreign

currency financial statements into U.S. dollars.

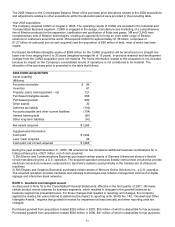

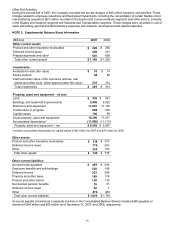

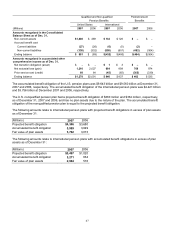

NOTE 7. Supplemental Cash Flow Information

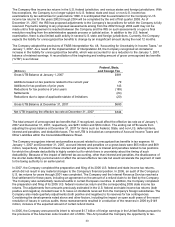

(Millions) 2007 2006 2005

Cash income tax payments $1,999 $1,842 $1,277

Cash interest payments 162 119 79

Capitalized interest 25 16 12

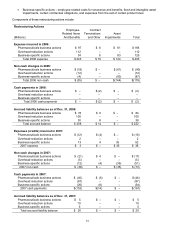

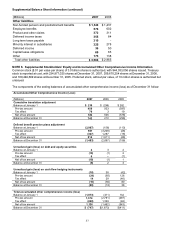

Individual amounts in the Consolidated Statement of Cash Flows exclude the impacts of acquisitions, divestitures and

exchange rate impacts, which are presented separately. “Other – net” in the Consolidated Statement of Cash Flows

within operating activities in 2007 and 2006 includes changes in liabilities related to 3M’s restructuring actions (Note 4)

and in 2005 includes the non-cash impact of adopting FIN 47 ($35 million cumulative effect of accounting change).

Transactions related to investing and financing activities with significant non-cash components are as follows: In 2007, 3M

purchased certain assets of Diamond Productions, Inc. for approximately 150 thousand shares of 3M common stock,

which has a market value of approximately $13 million at the acquisition’s measurement date. Liabilities assumed from

acquisitions are provided in the tables in Note 2.