3M 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

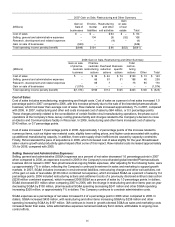

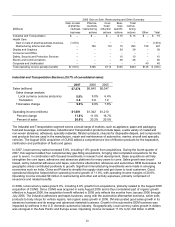

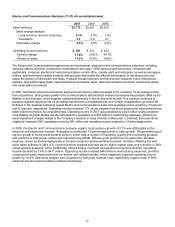

Electro and Communications Business (11.3% of consolidated sales):

2007 2006 2005

Sales (millions) $2,775 $2,631 $2,509

Sales change analysis:

Local currency (volume and price) 2.3% 4.0% 1.5%

Translation 3.2 0.8 0.7

Total sales change 5.5% 4.8% 2.2%

Operating income (millions) $ 481 $ 411 $ 422

Percent change 17.0% (2.6)% 40.7%

Percent of sales 17.3% 15.6% 16.8%

The Electro and Communications segment serves the electrical, electronics and communications industries, including

electrical utilities; electrical construction, maintenance and repair; OEM electrical and electronics; computers and

peripherals; consumer electronics; telecommunications central office, outside plant and enterprise; as well as aerospace,

military, automotive and medical markets; with products that enable the efficient transmission of electrical power and

speed the delivery of information and ideas. Products include electronic and interconnect solutions, micro interconnect

systems, high-performance fluids, high-temperature and display tapes, telecommunications products, electrical products,

and visual systems products.

In 2007, the Electro and Communications segment local-currency sales increased 2.3%, including 1.5 percentage points

from acquisitions. Strong sales growth in the communications and electrical markets businesses was partially offset by the

flexible circuits business, which supplies components primarily to the ink jet printer market. This business continues to

penalize segment results as the ink jet market has become commoditized and as a number of applications go end-of-life.

Softness in this business held back overall Electro and Communications sales and operating income growth by 2.5 percent

and 9.3 percent, respectively. Operating income increased 17% as this segment has driven productivity improvements and

taken actions to improve its competitiveness. Operating income in 2007 was penalized by a $23 million charge related to

consolidating its global flexible circuits manufacturing operations and $18 million in restructuring expenses, primarily for

asset impairment charges related to the Company’s decision to close a facility in Wisconsin. Combined, these two items

negatively impacted 2007 operating income by $41 million and operating income margins by 1.5 percentage points.

In 2006, the Electro and Communications business organic local-currency growth of 2.7% was attributable to the

electrical and electronics markets. Acquisitions contributed 1.3 percentage points to sales growth. 3M generated good

top-line growth in its electrical markets division, which sells a number of insulating, testing and connecting products

and solutions to both power utilities and manufacturing OEMs. 3M saw good growth from its electronics markets

business, driven by double-digit growth in its semi-conductor and assemblies business. Partially offsetting this was

some sales softness in 3M’s U.S. communications markets business due to higher copper costs and a decline in 3M’s

visual systems business, which traditionally offered analog overhead and electronic projectors and film. Operating

income declined by 2.6% to $411 million. Operating income included $46 million in restructuring expenses, primarily

comprised of asset impairments and severance and related benefits, which negatively impacted operating income

growth by 10.9%. Operating margins were impacted by rising raw material costs, specifically copper costs, in 3M’s

electrical and telecommunications markets businesses.