Xcel Energy 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.63

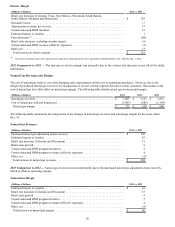

As disputes with the IRS and state tax authorities are resolved over time, we may adjust our unrecognized tax benefits and interest

accruals to the updated estimates needed to satisfy tax and interest obligations for the related issues. These adjustments may increase

or decrease earnings. See Note 6 to the consolidated financial statements for further discussion.

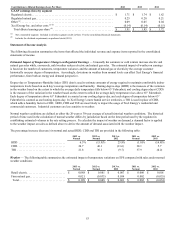

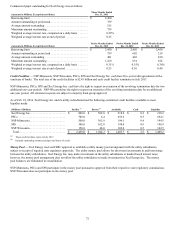

Employee Benefits

Xcel Energy’s pension costs are based on an actuarial calculation that includes a number of key assumptions, most notably the annual

return level that pension and postretirement health care investment assets will earn in the future and the interest rate used to discount

future pension benefit payments to a present value obligation. In addition, the pension cost calculation uses an asset-smoothing

methodology to reduce the volatility of varying investment performance over time. See Note 9 to the consolidated financial

statements for further discussion on the rate of return and discount rate used in the calculation of pension costs and obligations.

Pension costs are expected to decrease in 2014 and continue to decline in the following few years. Funding requirements are also

expected to decline in 2014 and then be flat in the following years. While investment returns exceeded the assumed levels from 2009

through 2012, investment returns were slightly below the assumed levels in 2013. The pension cost calculation uses a market-related

valuation of pension assets. Xcel Energy uses a calculated value method to determine the market-related value of the plan assets. The

market-related value is determined by adjusting the fair market value of assets at the beginning of the year to reflect the investment

gains and losses (the difference between the actual investment return and the expected investment return on the market-related value)

during each of the previous five years at the rate of 20 percent per year. As these differences between the actual investment returns

and the expected investment returns are incorporated into the market-related value, the differences are recognized in pension cost over

the expected average remaining years of service for active employees.

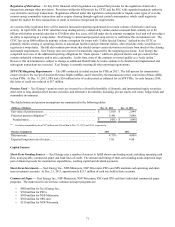

Based on current assumptions and the recognition of past investment gains and losses, Xcel Energy currently projects the pension

costs recognized for financial reporting purposes will decrease from an expense of $151.8 million in 2013 and $127.1 million in 2012

to an expense of $126.8 million in 2014 and $109.0 million in 2015. The expected decrease in the 2014 expense is due primarily to an

increase in the discount rate along with the reduced amortization of prior service costs and other historic loss amounts, including the

2008 market loss. Further, future year expenses are expected to decrease primarily as a result of reductions in loss amortizations and

an increase in expected return on assets as a result of increases in assets via planned contributions and the subsequent expected return

of current assets.

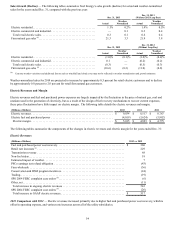

At Dec. 31, 2013, Xcel Energy set the rate of return on assets used to measure pension costs at 7.05 percent, which is a 17 basis point

increase from Dec. 31, 2012. The rate of return used to measure postretirement health care costs is 7.17 percent at Dec. 31, 2013 and

is a six basis point increase from Dec. 31, 2012.

Xcel Energy set the discount rates used to value the Dec. 31, 2013 pension and postretirement health care obligations at 4.75 percent

and 4.82 percent, which represent a 75 basis point and 72 basis point increase from Dec. 31, 2012, respectively. Xcel Energy uses a

bond matching study as its primary basis for determining the discount rate used to value pension and postretirement health care

obligations. The bond matching study utilizes a portfolio of high grade (Aa or higher) bonds that matches the expected cash flows of

Xcel Energy’s benefit plans in amount and duration. The effective yield on this cash flow matched bond portfolio determines the

discount rate for the individual plans. The bond matching study is validated for reasonableness against the Citigroup Pension Liability

Discount Curve and the Citigroup Above Median Curve. At Dec. 31, 2013, these reference points supported the selected rate. In

addition to these reference points, Xcel Energy also reviews general actuarial survey data to assess the reasonableness of the discount

rate selected.

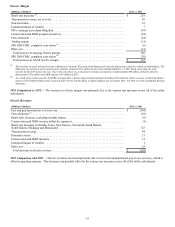

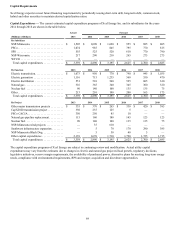

The following are the pension funding contributions, both voluntary and required, made by Xcel Energy for 2011 through 2014:

• In January 2014, contributions of $130.0 million were made across three of Xcel Energy’s pension plans;

• In 2013, contributions of $192.4 million were made across four of Xcel Energy’s pension plans;

• In 2012, contributions of $198.1 million were made across four of Xcel Energy’s pension plans; and

• In 2011, contributions of $137.3 million were made across three of Xcel Energy’s pension plans.

For future years, we anticipate contributions will be made as necessary. These contributions are summarized in Note 9 to the

consolidated financial statements. Future year amounts are estimates and may change based on actual market performance, changes in

interest rates and any changes in governmental regulations. Therefore, additional contributions could be required in the future.