Xcel Energy 2013 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.129

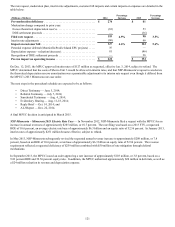

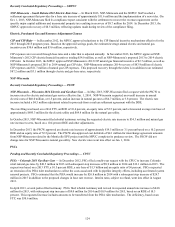

The original Complaint included two key components: 1) PNM’s claim regarding inappropriate allocation of fuel costs and 2) a base

rate complaint, including the appropriate demand-related cost allocator. The FERC previously determined that the allocation of fuel

costs and the demand-related cost allocator utilized by SPS was appropriate.

In the August 2013 Orders, the FERC clarified its previous ruling on the allocation of fuel costs and reaffirmed that the refunds in

question should only apply to firm requirements customers and not PNM’s contractual load. The FERC also reversed its prior

demand-related cost allocator decision. The FERC stated that it had erred in its initial analysis and concluded that the SPS system was

a 3CP rather than a 12CP system.

The pre-tax impact to 2013 earnings from these orders is approximately $36 million. Pending the timing and resolution of this matter,

the annual impact to revenues through 2014 could be up to $6 million and decreasing to $4 million on June 1, 2015.

In September 2013, SPS filed a request for rehearing of the FERC ruling on the CP allocation and refund decisions. SPS asserted that

the FERC applied an improper burden of proof and that precedent did not support retroactive refunds. PNM also requested rehearing

of the FERC decision not to reverse its prior ruling.

In October 2013, the FERC issued orders further considering the requests for rehearing. These matters are currently pending the

FERC’s action. If unsuccessful in its rehearing request, SPS will have the opportunity to file rate cases with the FERC and its retail

jurisdictions seeking to change all customers to a 3CP allocation method.

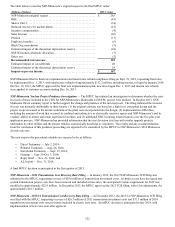

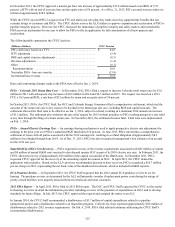

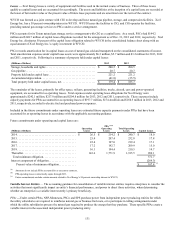

SPS Wholesale Rate Complaint — In April 2012, Golden Spread filed a rate complaint alleging that the base ROE included in the

SPS production formula rate of 10.25 percent, and the SPS transmission base formula rate ROE of 10.77 percent, are unjust and

unreasonable. Golden Spread alleged that the appropriate base ROE is 9.15 percent, or an annual difference of approximately $3.3

million. An additional 50 basis point incentive is added to the base ROE for the transmission formula rate for SPS’ participation in the

SPP RTO. Golden Spread is not contesting this transmission incentive. The FERC has taken no action on this complaint. If granted,

the complaint could reduce SPS revenues approximately $3.1 million per year prospectively from the effective date established by the

FERC.

Sale of Texas Transmission Assets — In March 2013, SPS reached an agreement to sell certain segments of SPS’ transmission lines

and two related substations to Sharyland. In 2013, SPS received all necessary regulatory approvals for the transaction. On Dec. 30,

2013, SPS received $37.1 million and recognized a pre-tax gain of $13.6 million. The gain is reflected in the consolidated statement

of income as a reduction to O&M expenses. Regulatory liabilities were recorded for jurisdictional gain sharing of $7.2 million.

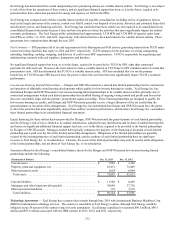

13. Commitments and Contingencies

Commitments

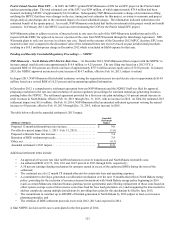

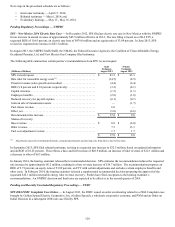

Capital Commitments — Xcel Energy has made commitments in connection with a portion of its projected capital expenditures. Xcel

Energy’s capital commitments primarily relate to the following major projects:

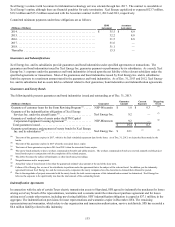

Southeast New Mexico Transmission Development — SPS is developing a transmission expansion plan for southeastern New Mexico.

The SPP, with input from SPS, is conducting a High Priority Incremental Load Study to review oil and natural gas load additions in

several areas, including southeastern New Mexico. A final report is expected by SPP in April 2014. SPS has started right-of-way

work on four projects for which NTCs are anticipated from SPP in early 2014.

CapX2020 — CapX2020 is an alliance of electric cooperatives, municipals and investor-owned utilities in the upper Midwest,

including the NSP System that has proposed several groups of transmission projects to be completed by 2020. Group 1 project

investments consist of four transmission lines. Major construction began in 2010 on the Group 1 transmission lines with an expected

completion date in 2015. NSP System’s investment depends on the routes and configurations approved by affected state commissions

and on the allocation of costs borne by other participating utilities in the upper Midwest.

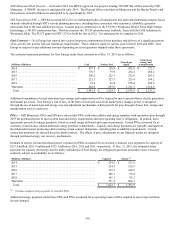

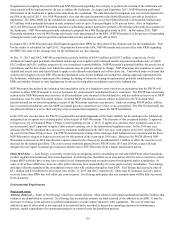

CACJA — The CACJA required PSCo to file a plan to reduce annual emissions of NOx by at least 70 to 80 percent or greater from

2008 levels by 2017 from its coal fired generation resources. In September 2012, the EPA formally approved the Colorado SIP for

regional haze, including resource planning changes that include early coal-fueled plant retirements, fuel switching and SCR

installation.

PSCo Gas Transmission Integrity Management Programs – PSCo is proactively identifying and addressing the safety and reliability of

natural gas transmission pipelines. The pipeline integrity efforts include system renewal projects and increased maintenance.