Xcel Energy 2013 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

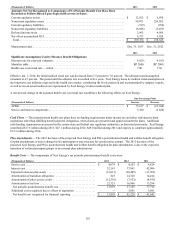

If forecasted costs of electric transmission congestion increase or decrease for a given FTR path, the value of that particular FTR

instrument will likewise increase or decrease. Given the limited observability of management’s forecasts for several of the inputs to

this complex valuation model – including expected plant operating schedules and retail and wholesale demand, fair value

measurements for FTRs have been assigned a Level 3. Non-trading monthly FTR settlements are included in the FCA as applicable in

each jurisdiction, and therefore changes in the fair value of the yet to be settled portions of most FTRs are deferred as a regulatory

asset or liability. Given this regulatory treatment and the limited magnitude of FTRs relative to the electric utility operations of NSP-

Minnesota and SPS, the numerous unobservable quantitative inputs to the complex model used for valuation of FTRs are insignificant

to the consolidated financial statements of Xcel Energy.

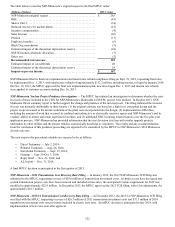

Non-Derivative Instruments Fair Value Measurements

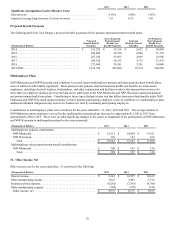

The NRC requires NSP-Minnesota to maintain a portfolio of investments to fund the costs of decommissioning its nuclear generating

plants. Together with all accumulated earnings or losses, the assets of the nuclear decommissioning fund are legally restricted for the

purpose of decommissioning the Monticello and Prairie Island nuclear generating plants. The fund contains cash equivalents, debt

securities, equity securities and other investments – all classified as available-for-sale. NSP-Minnesota plans to reinvest matured

securities until decommissioning begins. NSP-Minnesota uses the MPUC approved asset allocation for the escrow and investment

targets by asset class for both the escrow and qualified trust.

NSP-Minnesota recognizes the costs of funding the decommissioning of its nuclear generating plants over the lives of the plants,

assuming rate recovery of all costs. Given the purpose and legal restrictions on the use of nuclear decommissioning fund assets,

realized and unrealized gains on fund investments over the life of the fund are deferred as an offset of NSP-Minnesota’s regulatory

asset for nuclear decommissioning costs. Consequently, any realized and unrealized gains and losses on securities in the nuclear

decommissioning fund, including any other-than-temporary impairments, are deferred as a component of the regulatory asset for

nuclear decommissioning.

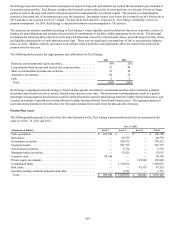

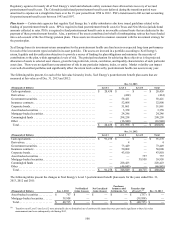

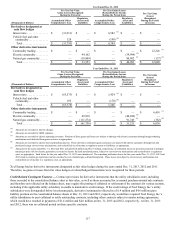

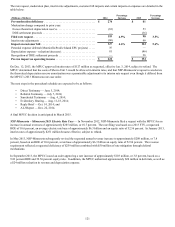

Unrealized gains for the nuclear decommissioning fund were $240.3 million and $135.8 million at Dec. 31, 2013 and 2012,

respectively, and unrealized losses and amounts recorded as other-than-temporary impairments were $58.5 million and $46.4 million

at Dec. 31, 2013 and 2012, respectively.

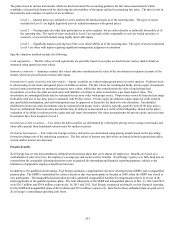

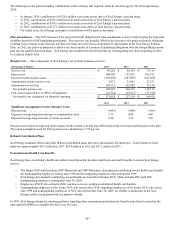

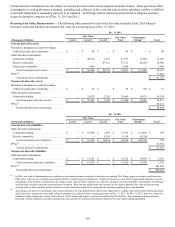

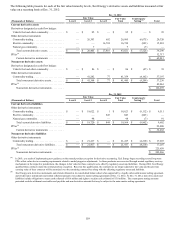

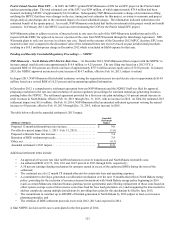

The following tables present the cost and fair value of Xcel Energy’s non-derivative instruments with recurring fair value

measurements in the nuclear decommissioning fund at Dec. 31, 2013 and 2012:

Dec. 31, 2013

Fair Value

(Thousands of Dollars) Cost Level 1 Level 2 Level 3 Total

Nuclear decommissioning fund (a)

Cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 33,281 $ 33,281 $ — $ — $ 33,281

Commingled funds . . . . . . . . . . . . . . . . . . . . . . . . . . 457,986 — 452,227 — 452,227

International equity funds . . . . . . . . . . . . . . . . . . . . . 78,812 — 81,671 — 81,671

Private equity investments . . . . . . . . . . . . . . . . . . . . 52,143 — — 62,696 62,696

Real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45,564 — — 57,368 57,368

Debt securities:

Government securities . . . . . . . . . . . . . . . . . . . . . 34,304 — 27,628 — 27,628

U.S. corporate bonds . . . . . . . . . . . . . . . . . . . . . . 80,275 — 83,538 — 83,538

International corporate bonds. . . . . . . . . . . . . . . . 15,025 — 15,358 — 15,358

Municipal bonds. . . . . . . . . . . . . . . . . . . . . . . . . . 241,112 — 232,016 — 232,016

Equity securities:

Common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . 406,695 581,243 — — 581,243

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,445,197 $ 614,524 $ 892,438 $ 120,064 $ 1,627,026

(a) Reported in nuclear decommissioning fund and other investments on the consolidated balance sheet, which also includes $87.1 million of equity investments in

unconsolidated subsidiaries and $41.9 million of miscellaneous investments.