Xcel Energy 2013 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

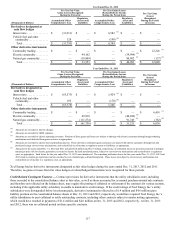

117

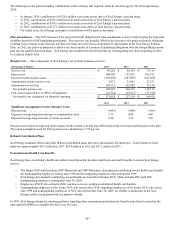

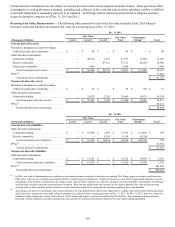

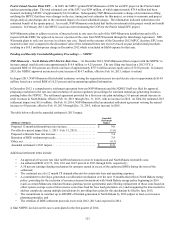

Year Ended Dec. 31, 2012

Pre-Tax Fair Value

Gains (Losses) Recognized

During the Period in:

Pre-Tax (Gains) Losses

Reclassified into Income

During the Period from: Pre-Tax Gains

(Losses)

Recognized

During the Period

in Income(Thousands of Dollars) Accumulated Other

Comprehensive Loss

Regulatory

(Assets) and

Liabilities Accumulated Other

Comprehensive Loss

Regulatory

Assets and

(Liabilities)

Derivatives designated as

cash flow hedges

Interest rate . . . . . . . . . . . . . . . $ (31,913) $ — $ 6,582 (a) $ — $ —

Vehicle fuel and other

commodity. . . . . . . . . . . . . . 120 — (198)(b) — —

Total . . . . . . . . . . . . . . . . . . $ (31,793) $ — $ 6,384 $ — $ —

Other derivative instruments

Commodity trading . . . . . . . . . $ — $ — $ — $ — $ 12,226 (c)

Electric commodity. . . . . . . . . — 44,162 — (39,999)(d) —

Natural gas commodity. . . . . . — (10,809) — 80,902 (e) (137) (d)

Total . . . . . . . . . . . . . . . . . . $ — $ 33,353 $ — $ 40,903 $ 12,089

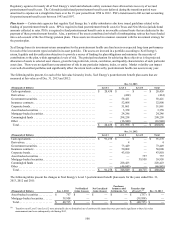

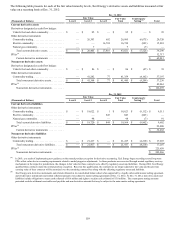

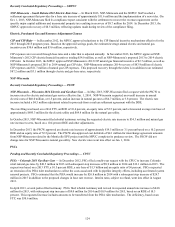

Year Ended Dec. 31, 2011

Pre-Tax Fair Value

Gains (Losses) Recognized

During the Period in:

Pre-Tax (Gains) Losses

Reclassified into Income

During the Period from: Pre-Tax Gains

(Losses)

Recognized

During the Period

in Income(Thousands of Dollars) Accumulated Other

Comprehensive Loss

Regulatory

(Assets) and

Liabilities Accumulated Other

Comprehensive Loss

Regulatory

Assets and

(Liabilities)

Derivatives designated as

cash flow hedges

Interest rate . . . . . . . . . . . . . . . $ (63,573) $ — $ 1,424 (a) $ — $ —

Vehicle fuel and other

commodity. . . . . . . . . . . . . . 195 — (178)(b) — —

Total . . . . . . . . . . . . . . . . . . $ (63,378) $ — $ 1,246 $ — $ —

Other derivative instruments

Commodity trading . . . . . . . . . $ — $ — $ — $ — $ 6,418 (c)

Electric commodity. . . . . . . . . — 49,818 — (40,492)(d) —

Natural gas commodity. . . . . . — (111,574) — 91,743 (e) (382) (d)

Total . . . . . . . . . . . . . . . . . . $ — $ (61,756) $ — $ 51,251 $ 6,036

(a) Amounts are recorded to interest charges.

(b) Amounts are recorded to O&M expenses.

(c) Amounts are recorded to electric operating revenues. Portions of these gains and losses are subject to sharing with electric customers through margin-sharing

mechanisms and deducted from gross revenue, as appropriate.

(d) Amounts are recorded to electric fuel and purchased power. These derivative settlement gains and losses are shared with electric customers through fuel and

purchased energy cost-recovery mechanisms, and reclassified out of income as regulatory assets or liabilities, as appropriate.

(e) Amounts for the years ended Dec. 31, 2012 and 2011 included $5.0 million and $12.7 million, respectively, of settlement losses on derivatives entered to mitigate

natural gas price risk for electric generation, recorded to electric fuel and purchased power, subject to cost-recovery mechanisms and reclassified to a regulatory

asset, as appropriate. Such losses for the year ended Dec. 31, 2013 were immaterial. The remaining settlement losses for the years ended Dec. 31, 2013, 2012 and

2011 relate to natural gas operations and are recorded to cost of natural gas sold and transported. These losses are subject to cost-recovery mechanisms and

reclassified out of income to a regulatory asset, as appropriate.

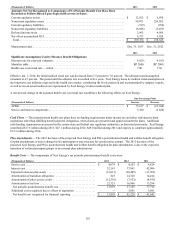

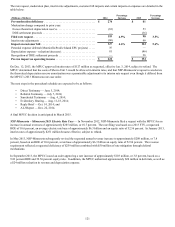

Xcel Energy had no derivative instruments designated as fair value hedges during the years ended Dec. 31, 2013, 2012 and 2011.

Therefore, no gains or losses from fair value hedges or related hedged transactions were recognized for these periods.

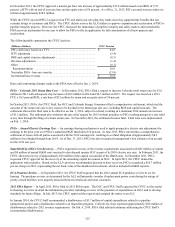

Credit Related Contingent Features — Contract provisions for derivative instruments that the utility subsidiaries enter, including

those recorded to the consolidated balance sheet at fair value, as well as those accounted for as normal purchase-normal sale contracts

and therefore not reflected on the balance sheet, may require the posting of collateral or settlement of the contracts for various reasons,

including if the applicable utility subsidiary is unable to maintain its credit ratings. If the credit ratings of Xcel Energy Inc.’s utility

subsidiaries were downgraded below investment grade, derivative instruments reflected in a $1.4 million and $4.6 million gross

liability position on the consolidated balance sheets at Dec. 31, 2013 and 2012, respectively, would have required Xcel Energy Inc.’s

utility subsidiaries to post collateral or settle outstanding contracts, including other contracts subject to master netting agreements,

which would have resulted in payments of $1.4 million and $4.6 million at Dec. 31, 2013 and 2012, respectively. At Dec. 31, 2013

and 2012, there was no collateral posted on these specific contracts.