Xcel Energy 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

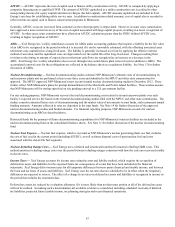

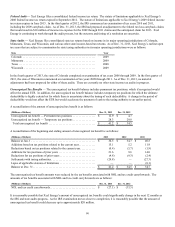

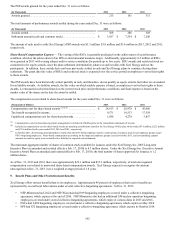

The payable for interest related to unrecognized tax benefits is partially offset by the interest benefit associated with NOL and tax

credit carryforwards. The payables for interest related to unrecognized tax benefits at Dec. 31, 2013, 2012 and 2011 were not

material. No amounts were accrued for penalties related to unrecognized tax benefits as of Dec. 31, 2013, 2012 or 2011.

Tangible Property Regulations — In September 2013, the U.S. Treasury issued final regulations addressing the tax consequences

associated with the acquisition, production and improvement of tangible property. As Xcel Energy had adopted certain utility-specific

guidance previously issued by the IRS, the issuance is not expected to have a material impact on its consolidated financial statements.

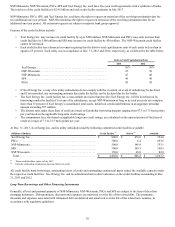

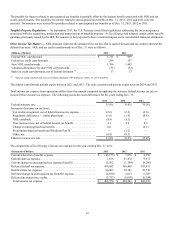

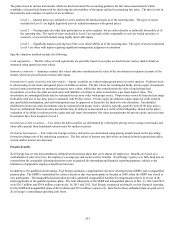

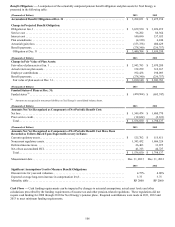

Other Income Tax Matters — NOL amounts represent the amount of the tax loss that is carried forward and tax credits represent the

deferred tax asset. NOL and tax credit carryforwards as of Dec. 31 were as follows:

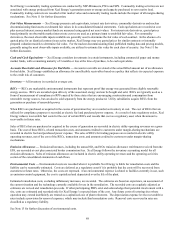

(Millions of Dollars) 2013 2012

Federal NOL carryforward . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,311 $ 969

Federal tax credit carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 294 257

State NOL carryforwards. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,706 1,465

Valuation allowances for state NOL carryforwards. . . . . . . . . . . . . . . . . . . (51)(52)

State tax credit carryforwards, net of federal detriment (a) . . . . . . . . . . . . . 17 17

(a) State tax credit carryforwards are net of federal detriment of $9 million as of Dec. 31, 2013 and 2012.

The federal carryforward periods expire between 2021 and 2033. The state carryforward periods expire between 2014 and 2033.

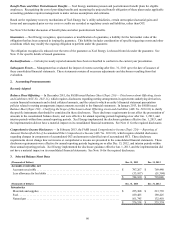

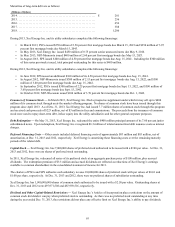

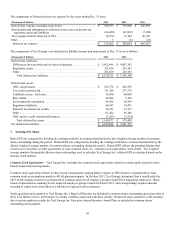

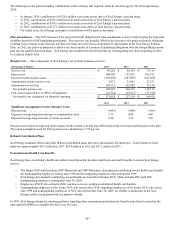

Total income tax expense from operations differs from the amount computed by applying the statutory federal income tax rate to

income before income tax expense. The following reconciles such differences for the years ending Dec. 31:

2013 2012 2011

Federal statutory rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.0% 35.0% 35.0%

Increases (decreases) in tax from:

Tax credits recognized, net of federal income tax expense. . . . . . . . . . . . (2.6)(2.2)(2.6)

Regulatory differences — utility plant items . . . . . . . . . . . . . . . . . . . . . . (1.6)(1.0)(0.8)

NOL carryback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.8)(1.1) —

State income taxes, net of federal income tax benefit. . . . . . . . . . . . . . . . 4.1 4.0 4.3

Change in unrecognized tax benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.6 — (0.1)

Prescription drug tax benefit and Medicare Part D. . . . . . . . . . . . . . . . . . — (1.2) —

Other, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.9)(0.3) —

Effective income tax rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33.8% 33.2% 35.8%

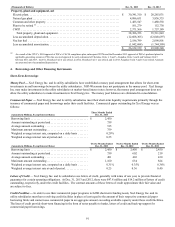

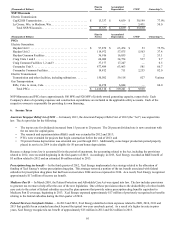

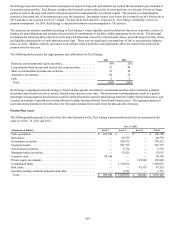

The components of Xcel Energy’s income tax expense for the years ending Dec. 31 were:

(Thousands of Dollars) 2013 2012 2011

Current federal tax (benefit) expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (46,173) $ 7,876 $ 3,399

Current state tax expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,678 31,478 9,971

Current change in unrecognized tax expense (benefit) . . . . . . . . . . . . . . . . 13,162 (1,704)(8,266)

Deferred federal tax expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 439,085 366,409 383,931

Deferred state tax expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80,907 50,741 78,770

Deferred change in unrecognized tax (benefit) expense . . . . . . . . . . . . . . . (4,930) 2,013 6,705

Deferred investment tax credits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,753)(6,610)(6,194)

Total income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 483,976 $ 450,203 $ 468,316