Xcel Energy 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30

NSP-Wisconsin purchased firm natural gas supply utilizing long-term and short-term agreements from approximately 13 domestic and

Canadian suppliers. This diversity of suppliers and contract lengths allows NSP-Wisconsin to maintain competition from suppliers

and minimize supply costs.

See Items 1A and 7 for further discussion of natural gas supply and costs.

PSCo

Public Utility Regulation

Summary of Regulatory Agencies and Areas of Jurisdiction — PSCo is regulated by the CPUC with respect to its facilities, rates,

accounts, services and issuance of securities. PSCo holds a FERC certificate that allows it to transport natural gas in interstate

commerce without PSCo becoming subject to full FERC jurisdiction under the Federal Natural Gas Act. PSCo is subject to the DOT

and the CPUC with regards to pipeline safety compliance.

Purchased Natural Gas and Conservation Cost-Recovery Mechanisms — PSCo has retail adjustment clauses that recover purchased

natural gas and other resource costs:

• GCA — The GCA recovers the actual costs of purchased natural gas and transportation to meet the requirements of its

customers and is revised quarterly to allow for changes in natural gas rates.

• DSMCA — The DSMCA is a low-income energy assistance program. The costs of this energy conservation and weatherization

program are recovered through the gas DSMCA.

• PSIA — Effective Jan. 1, 2012, the PSIA began to recover costs associated with transmission and distribution pipeline integrity

management programs and two projects to replace large transmission pipelines. Although PSCo had proposed to include the

PSIA in base rates, instead the rider was extended through Dec. 31, 2015.

QSP Requirements — The CPUC established a natural gas QSP that provides for bill credits to customers if PSCo does not achieve

certain performance targets relating to natural gas leak repair time and customer service. The CPUC conducts proceedings to review

and approve the rate adjustment annually. In 2013, the CPUC extended the terms of the current QSP through the end of 2015.

Capability and Demand

PSCo projects peak day natural gas supply requirements for firm sales and backup transportation to be 1,952,939 MMBtu. In

addition, firm transportation customers hold 797,329 MMBtu of capacity for PSCo without supply backup. Total firm delivery

obligation for PSCo is 2,750,268 MMBtu per day. The maximum daily deliveries for PSCo for firm and interruptible services were

1,865,207 MMBtu on Dec. 5, 2013 and 1,539,864 MMBtu on Dec. 19, 2012.

PSCo purchases natural gas from independent suppliers, generally based on market indices that reflect current prices. The natural gas

is delivered under transportation agreements with interstate pipelines. These agreements provide for firm deliverable pipeline capacity

of approximately 1,822,939 MMBtu per day, which includes 859,514 MMBtu of natural gas held under third-party underground

storage agreements. In addition, PSCo operates three company-owned underground storage facilities, which provide approximately

22,400 MMBtu of natural gas supplies on a peak day. The balance of the quantities required to meet firm peak day sales obligations

are primarily purchased at PSCo’s city gate meter stations.

PSCo is required by CPUC regulations to file a natural gas purchase plan each year projecting and describing the quantities of natural

gas supplies, upstream services and the costs of those supplies and services for the 12-month period of the following year. PSCo is

also required to file a natural gas purchase report by October of each year reporting actual quantities and costs incurred for natural gas

supplies and upstream services for the previous 12-month period.

Natural Gas Supply and Costs

PSCo actively seeks natural gas supply, transportation and storage alternatives to yield a diversified portfolio that provides increased

flexibility, decreased interruption and financial risk and economical rates. In addition, PSCo conducts natural gas price hedging

activities that have been approved by the CPUC.

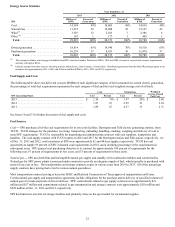

The following table summarizes the average delivered cost per MMBtu of natural gas purchased for resale by PSCo’s regulated retail

natural gas distribution business:

2013. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4.20

2012. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.28

2011. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.99