Xcel Energy 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

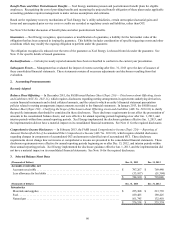

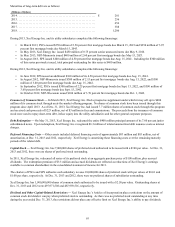

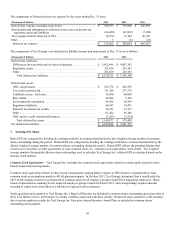

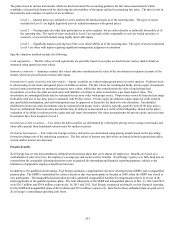

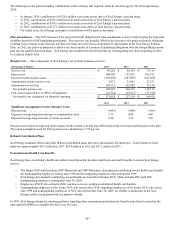

The components of deferred income tax expense for the years ending Dec. 31 were:

(Thousands of Dollars) 2013 2012 2011

Deferred tax expense excluding items below . . . . . . . . . . . . . . . . . . . . . . . $ 588,053 $ 559,860 $ 446,893

Amortization and adjustments to deferred income taxes on income tax

regulatory assets and liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (64,420)(63,862)(7,108)

Tax (expense) benefit allocated to OCI. . . . . . . . . . . . . . . . . . . . . . . . . . . . (8,572) 12,102 26,798

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 (6)(16)

Deferred tax expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 515,062 $ 508,094 $ 466,567

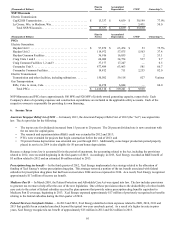

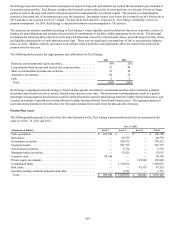

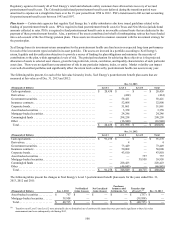

The components of Xcel Energy’s net deferred tax liability (current and noncurrent) at Dec. 31 were as follows:

(Thousands of Dollars) 2013 2012

Deferred tax liabilities:

Differences between book and tax bases of property . . . . . . . . . . . . . . . . $ 5,562,446 $ 4,867,142

Regulatory assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 321,636 293,367

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 254,639 220,781

Total deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,138,721 $ 5,381,290

Deferred tax assets:

NOL carryforward. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 532,774 $ 430,765

Tax credit carryforward. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 311,388 273,776

Unbilled revenue - fuel costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58,908 60,068

Rate refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49,804 8,109

Environmental remediation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42,886 44,549

Regulatory liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40,947 34,471

Deferred investment tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34,231 35,767

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81,202 95,308

NOL and tax credit valuation allowances. . . . . . . . . . . . . . . . . . . . . . . . . (3,263)(3,314)

Total deferred tax assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,148,877 $ 979,499

Net deferred tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,989,844 $ 4,401,791

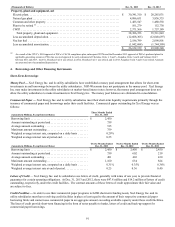

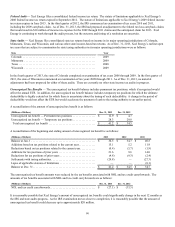

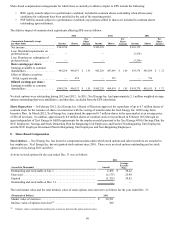

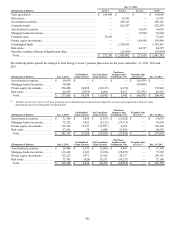

7. Earnings Per Share

Basic EPS was computed by dividing the earnings available to common shareholders by the weighted average number of common

shares outstanding during the period. Diluted EPS was computed by dividing the earnings available to common shareholders by the

diluted weighted average number of common shares outstanding during the period. Diluted EPS reflects the potential dilution that

could occur if securities or other agreements to issue common stock (i.e., common stock equivalents), were settled. The weighted

average number of potentially dilutive shares outstanding used to calculate Xcel Energy Inc.’s diluted EPS is calculated based on the

treasury stock method.

Common Stock Equivalents — Xcel Energy Inc. currently has common stock equivalents related to certain equity awards in share-

based compensation arrangements.

Common stock equivalents related to share-based compensation causing dilutive impact to EPS relates to commitments to issue

common stock as an employer match to 401(k) plan participants. In October 2013, Xcel Energy determined that it would settle the

2013 401(k) employer match in cash instead of common stock for all employee groups except PSCo bargaining employees. Share-

based compensation accounting for the impacted employee groups ceased in October 2013, and corresponding expense amounts

recorded to equity were reclassified to a liability for expected cash settlements.

Stock equivalent units granted to Xcel Energy Inc.’s Board of Directors are included in common shares outstanding upon grant date as

there is no further service, performance or market condition associated with these awards. Restricted stock, granted to settle amounts

due to certain employees under the Xcel Energy Inc. Executive Annual Incentive Award Plan, is included in common shares

outstanding when granted.