Xcel Energy 2013 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2013 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

In December 2013, the CPUC approved a natural gas base rate increase of approximately $15.8 million based on an ROE of 9.72

percent, a HTY with an end of year rate base and an equity ratio of 56 percent. As of Dec. 31, 2013, PSCo accrued revenue subject to

refund of approximately $20.9 million.

While the CPUC rejected PSCo’s request of an FTY and multi-year rate plan, they made clear they supported the benefits that rate

certainty brings to customers and PSCo. The CPUC did not reverse the ALJ’s failure to approve expansion and acceleration of PSCo’s

pipeline integrity projects. However, the CPUC discussed the importance of pipeline integrity and safety matters and extended the

PSIA recovery mechanism for one year to allow for PSCo to file an application for full consideration of all new projects and

acceleration.

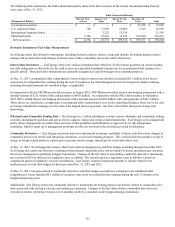

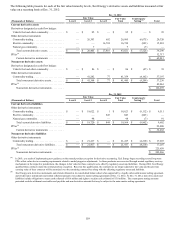

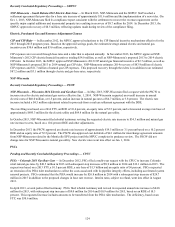

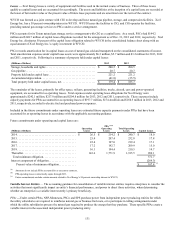

The following table summarizes the CPUC decision:

(Millions of Dollars) CPUC Decision

PSCo deficiency based on a FTY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 44.8

HTY adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5.4)

ROE and capital structure adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8.3)

Revenue adjustments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1.4)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.1)

Recommendation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29.6

Neutralize PSIA - base rate transfer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (13.8)

Incremental base revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 15.8

Rates and conforming changes made to the PSIA were effective Jan. 1, 2014.

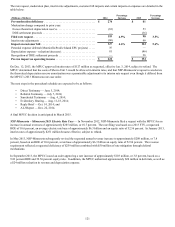

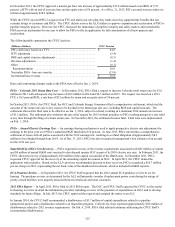

PSCo – Colorado 2013 Steam Rate Case — In December 2012, PSCo filed a request to increase Colorado retail steam rates by $1.6

million in 2013 with subsequent step increases of $0.9 million in 2014 and $2.3 million in 2015. The request was based on a 2013

FTY, a 10.5 percent ROE, a rate base of $21 million for steam and an equity ratio of 56 percent.

In October 2013, PSCo, the CPUC Staff, the OCC and Colorado Energy Consumers filed a comprehensive settlement, which tied the

outcome of the steam rate case to key issues to be decided in the natural gas rate case, including ROE and capital structure. The

settlement allowed the filed rates to be effective on Jan. 1, 2014, subject to refund, resulting in a minimum 2014 annual rate increase

of $1.2 million. The settlement also withdrew the rate relief request for 2015 without prejudice to PSCo seeking prospective rate relief

at any time through the filing of a future steam case. In November 2013, the settlement became final. Final rates were implemented

on Feb. 1, 2014.

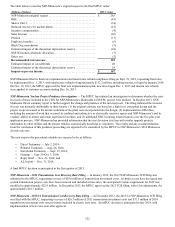

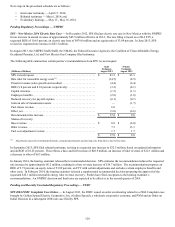

PSCo – Annual Electric Earnings Test — An earnings sharing mechanism is used to apply prospective electric rate adjustments for

earnings in the prior year over PSCo’s authorized ROE threshold of 10 percent. In June 2013, PSCo entered into a comprehensive

settlement of issues with all parties associated with the 2012 earnings test, resulting in a refund obligation of approximately $8.2

million to be refunded through June 2014. As of Dec. 31, 2013, PSCo has also recognized management’s best estimate of an accrual

for the 2013 test year.

SmartGridCity (SGC) Cost Recovery — PSCo requested recovery of the revenue requirements associated with $45 million of capital

and $4 million of annual O&M costs incurred to develop and operate SGC as part of its 2010 electric rate case. In February 2011, the

CPUC allowed recovery of approximately $28 million of the capital cost and all of the O&M costs. In December 2011, PSCo

requested CPUC approval for the recovery of the remaining capital investment in SGC. In April 2013, the CPUC denied the

application with prejudice. Based on the ALJ’s previous recommended decision to deny recovery, PSCo recognized a $10.7 million

pre-tax charge in 2012, representing the net book value of the disallowed investment, which is included in O&M expense.

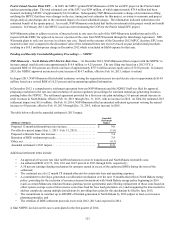

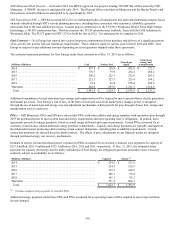

ECA Prudence Review — In September 2013, the CPUC Staff requested that the 2012 annual ECA prudence review be set for

hearing. The prudence review, as determined by the ALJ, will primarily consider if replacement power costs during the outage of

jointly owned facilities were properly allocated between wholesale and retail customers.

2012 PSIA Report — In April 2013, PSCo filed its 2012 PSIA report. The OCC and CPUC Staff requested the CPUC set the matter

for hearing to review in detail the information provided, including a review of the prudence of expenditures in 2012, and to develop

standards for future filings. In July 2013, the CPUC approved the request and assigned the matter to an ALJ.

In January 2014, the CPUC Staff recommended a disallowance of $3.7 million of capital expenditures related to a pipeline

replacement project and a disallowance related to an inspection program. Collectively, these represent approximately $0.6 million of

disallowances related to 2012 revenue requirements. On Feb. 6, 2014, PSCo filed rebuttal testimony addressing the CPUC Staff’s

recommended disallowances.