XM Radio 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

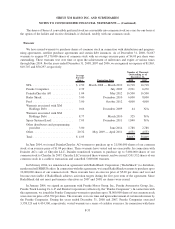

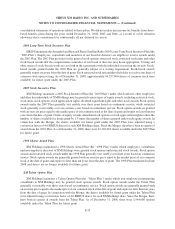

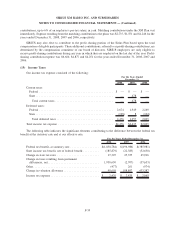

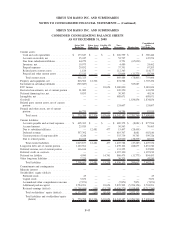

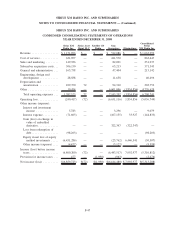

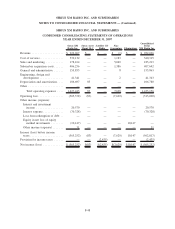

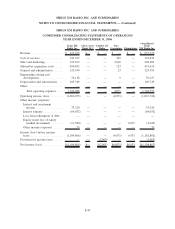

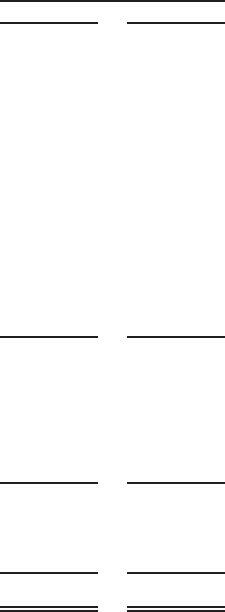

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and

deferred tax liabilities are presented below:

2008 2007

December 31,

Deferred tax assets:

Net operating loss carryforwards ........................... $2,608,038 $ 1,367,744

GM payments and liabilities............................... 506,106 —

Deferred revenue ....................................... 240,849 18,717

Severance accrual ...................................... 17,237 —

Accrued bonus......................................... 24,537 5,753

Expensed costs capitalized for tax .......................... 75,998 —

Loan financing costs .................................... 27,890 —

Investments ........................................... 63,786 —

Stock based compensation ................................ 138,840 126,679

Other ............................................... 100,205 64,637

Total deferred tax assets ................................ 3,803,486 1,583,530

Deferred tax liabilities:

Depreciation of property and equipment ...................... (158,012) (157,438)

FCC license........................................... (766,935) (12,771)

Other Intangible assets ................................... (265,138) —

Net deferred tax liabilities .............................. (1,190,085) (170,209)

Net deferred tax assets before valuation allowance ................ 2,613,401 1,413,321

Valuation allowance....................................... (3,476,583) (1,426,092)

Net deferred tax liability ............................... $ (863,182) $ (12,771)

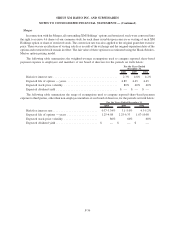

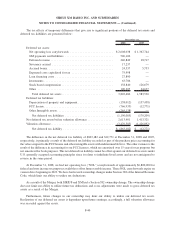

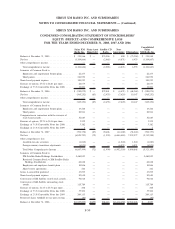

The difference in the net deferred tax liability of $863,182 and $12,771 at December 31, 2008 and 2007,

respectively, is primarily a result of the deferred tax liability recorded as part of the purchase price accounting for

the value assigned to the FCC license and other intangible assets with indeterminable lives. The other variance is the

result of the difference in accounting for our FCC licenses, which are amortized over 15 years for tax purposes but

not amortized for book purposes. This net deferred tax liability cannot be offset against our deferred tax assets under

U.S. generally accepted accounting principles since it relates to indefinite-lived assets and are not anticipated to

reverse in the same period.

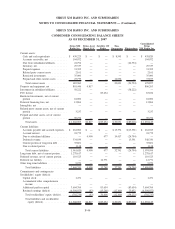

At December 31, 2008, we had net operating loss (“NOL”) carryforwards of approximately $6,800,000 for

federal and state income tax purposes available to offset future taxable income. These NOL carryforwards expire on

various dates beginning in 2023. We have had several ownership changes under Section 382 of the Internal Revenue

Code, which limit our ability to utilize tax deductions.

As a result of the Merger, both SIRIUS and XM had a Section 382 ownership change. The ownership change

does not limit our ability to utilize future tax deductions and so no adjustments were made to gross deferred tax

assets as a result of the Merger.

Furthermore, future changes in our ownership may limit our ability to utilize our deferred tax assets.

Realization of our deferred tax assets is dependent upon future earnings; accordingly, a full valuation allowance

was recorded against the assets.

F-40

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)