XM Radio 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

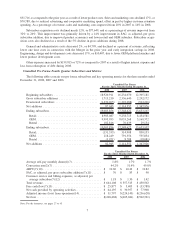

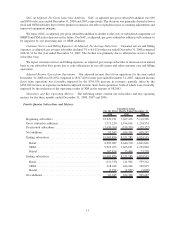

SAC, As Adjusted, Per Gross Subscriber Addition. SAC, as adjusted, per gross subscriber addition improved

by 14% to $74 from $86 for the years ended December 31, 2008 and 2007, respectively. The decrease was primarily

driven by lower retail and OEM subsidies due to better product economics and improved equipment margin.

Customer Service and Billing Expenses, As Adjusted, Per Average Subscriber. Customer service and billing

expenses, as adjusted, per average subscriber improved 6% to $1.11 for the year ended December 31, 2008

compared with $1.18 for the year ended December 31, 2007. The decline was primarily due to efficiencies across a

larger subscriber base.

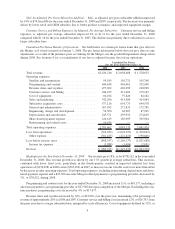

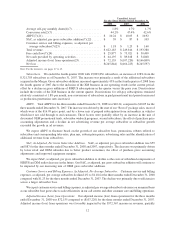

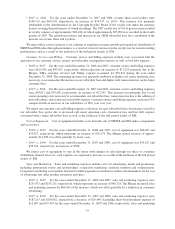

Unaudited Pro Forma Results of Operations. Set forth below are certain pro forma items that give effect to

the Merger as if it had occurred on January 1, 2006. The pro forma information below does not give effect to any

adjustments as a result of the purchase price accounting for the Merger, nor the goodwill impairment charge taken

during 2008. See footnote 8 for a reconciliation of net loss to adjusted income (loss) from operations.

2008 2007 2006

Unaudited Pro Forma

For the Years Ended December 31,

Total revenue................................. $2,436,740 $ 2,058,608 $ 1,570,652

Operating expenses:

Satellite and transmission ...................... 99,185 101,721 105,768

Programming and content...................... 446,638 401,461 352,968

Revenue share and royalties .................... 477,962 403,059 218,928

Customer service and billing ................... 244,195 217,402 179,183

Cost of equipment ........................... 66,104 97,820 84,182

Sales and marketing .......................... 342,296 413,084 414,984

Subscriber acquisition costs .................... 577,126 654,775 644,578

General and administrative ..................... 267,032 271,831 172,785

Engineering, design and development ............. 52,500 62,907 87,505

Depreciation and amortization .................. 245,571 293,976 274,629

Share-based payment expense................... 124,619 165,099 505,964

Restructuring and related costs .................. 10,434 — —

Total operating expenses ........................ 2,953,662 3,083,135 3,041,474

Loss from operations ........................... (516,922) (1,024,527) (1,470,822)

Other expense .............................. (381,425) (221,610) (350,866)

Loss before income taxes........................ (898,347) (1,246,137) (1,821,688)

Income tax expense .......................... (3,988) (1,496) (2,051)

Net loss. . . .................................. $(902,335) $(1,247,633) $(1,823,739)

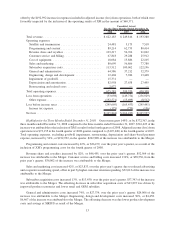

Highlights for the Year Ended December 31, 2008. Our revenue grew 18%, or by $378,132, in the year ended

December 31, 2008. This revenue growth was driven by our 17% growth in average subscribers. This increase,

combined with lower fixed costs, particularly in the fourth quarter, resulted in improved adjusted loss from

operations of ($136,298) in 2008 versus ($565,452) in 2007, as increases in our variable costs were more than offset

by decreases in other operating expenses. Total operating expenses, excluding restructuring, depreciation and share-

based payment expense and a $27,500 one-time Merger related payment to a programming provider, decreased by

3%, or $78,522, during 2008.

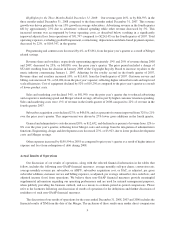

Programming and content costs for the year ended December 31, 2008 increased 11%, or $45,177, including a

one-time payment to a programming provider of $27,500 due upon completion of the Merger. Excluding this one-

time payment, programming costs increased by 4% or $17,677.

Revenue share and royalties increased by 19%, or $74,903, over the prior year, maintaining a flat percentage of

revenue of approximately 20% in 2008 and 2007. Customer service and billing costs increased 12%, or $26,793, from

the prior year due to a larger subscriber base, mitigated by scale efficiencies. Cost of equipment declined by 32%, or

6