XM Radio 2008 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

minimum bid requirement until July 19, 2009, we believe that it is in the best interests of the company and

our stockholders to give the board the flexibility to meet these requirements if and when Nasdaq resumes

enforcement. September 19, 2008 is the last day our common stock traded above $1.00 per share. If the price

of our common stock closes below the minimum $1.00 per share required for continued listing by Nasdaq for

thirty consecutive business days following the end of the temporary suspension, Nasdaq will notify us and

provide us an initial period of 180 calendar days to regain compliance. Currently, we meet all of the Nasdaq

Global Select Market’s continued listing criteria, other than the minimum trading price requirement. We

believe that approval of this proposal would significantly reduce our risk of not meeting this continued listing

standard in the future.

The purpose of the reverse stock split is to increase the per share trading value of our common stock. Our

board of directors intends to effect the proposed reverse stock split only if it believes that a decrease in the

number of shares outstanding is likely to improve the trading price for our common stock, and only if the

implementation of a reverse stock split is determined by the board of directors to be in the best interests of the

company and its stockholders. Our board of directors may exercise its discretion not to implement a reverse

stock split.

Impact of the Reverse Stock Split Amendment if Implemented

If approved and effected, the reverse stock split will be realized simultaneously and in the same ratio for

all of our common stock. The reverse stock split will affect all holders of our common stock uniformly and

will not affect any stockholder’s percentage ownership interest in the company. As described below, holders of

common stock otherwise entitled to a fractional share as a result of the reverse stock split will receive a cash

payment in lieu of such fractional share. These cash payments will reduce the number of post-reverse stock

split holders of our common stock to the extent there are concurrently stockholders who would otherwise

receive less than one share of common stock after the reverse stock split. In addition, the reverse stock split

will not affect any stockholder’s proportionate voting power (subject to the treatment of fractional shares).

The principal effects of the Reverse Stock Split Amendment will be that:

• depending on the ratio for the reverse stock split selected by our board of directors, each ten or fifty

shares of common stock owned by a stockholder, or any whole number of shares of common stock

between ten and fifty as determined by the board of directors, will be combined into one new share of

common stock;

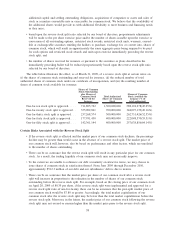

• the number of shares of common stock issued and outstanding (including the shares issuable upon

conversion of our preferred stock) will be reduced from approximately 6.5 billion shares to a range of

approximately 646 million shares to 129 million shares, depending upon the reverse stock split ratio

selected by the board of directors;

• the number of authorized shares of common stock will be reduced from 8 billion (or, if the proposal to

increase the number of authorized shares of common stock set forth in Item 2 is approved, 9 billion) to

a range of approximately 1.3 billion to 400 million dependent on the reverse stock split ratio chosen by

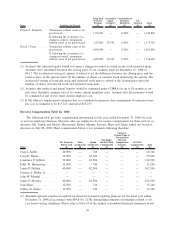

the board of directors. The table below illustrates the number of authorized shares of common stock

that will correspond to each range of reverse stock split ratios:

Range of Reverse Stock Split Ratios

Total Authorized Shares of Common Stock

after Reverse Stock Split

One-for-ten to one-for-nineteen ....................... 1,300,000,000

One-for-twenty to one-for-twenty-nine .................. 700,000,000

One-for-thirty to one-for-thirty-nine .................... 500,000,000

One-for-forty to one-for-fifty ......................... 400,000,000

• because the number of issued and outstanding shares of common stock will decrease as result of the

reverse stock split, the number of authorized but unissued shares of common stock may increase on a

relative basis. These additional shares of authorized common stock would be available for issuance at

the discretion of our board of directors from time to time for corporate purposes such as raising

37