XM Radio 2008 Annual Report Download - page 66

Download and view the complete annual report

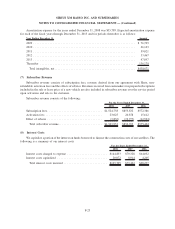

Please find page 66 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investments are periodically reviewed for impairment and a write down is recorded whenever declines in fair

value below carrying value are determined to be other than temporary. In making this determination, we consider,

among other factors, the severity and duration of the decline as well as the likelihood of a recovery within a

reasonable timeframe.

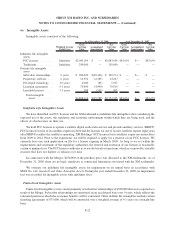

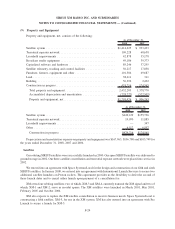

Property and Equipment

Property and equipment is stated at cost less accumulated depreciation and amortization. Equipment under

capital leases is stated at the present value of minimum lease payments. Depreciation and amortization are

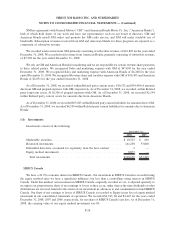

calculated using the straight-line method over the following estimated useful lives:

Satellite system ......................................... 2-15 years

Terrestrial repeater network................................. 3-15 years

Broadcast studio equipment ................................ 3-15 years

Capitalized software and hardware ........................... 3-7years

Satellite telemetry, tracking and control facilities ................. 3-17.5 years

Furniture, fixtures, equipment and other ....................... 2-7years

Building ............................................... 20or30years

Leasehold improvements................................... Lesser of useful

life or remaining lease term

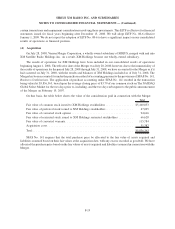

We operate three in-orbit satellites in our SIRIUS system and have one ground spare satellite. The three

in-orbit SIRIUS satellites were launched in 2000 and the spare satellite was delivered to ground storage in 2002. The

three-satellite constellation and terrestrial repeater network were placed into service in 2002. SIRIUS has an

agreement with Space Systems/Loral for the design and construction of an additional two satellites. In January

2008, SIRIUS entered into an agreement with International Launch Services to secure two satellite launches on

Proton rockets. This agreement with International Launch Services allows SIRIUS the flexibility to defer the second

of these launch dates and to cancel either launch upon payment of a cancellation fee.

We operate four in-orbit satellites in our XM system, two of which function as in-orbit spares. The two in-orbit

spare satellites were launched in 2001 while the other two satellites were launched and placed into service in 2005

and 2006, respectively. XM is constructing an additional satellite.

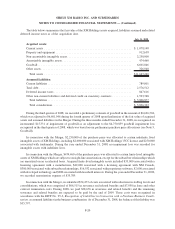

In accordance with SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets, long-

lived assets, such as property and equipment, and purchased intangibles subject to amortization, are reviewed for

impairment whenever events or changes in circumstances indicate the carrying amount may not be recoverable.

Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to

estimated undiscounted future cash flows expected to be generated by the asset. If the carrying amount of an asset

exceeds the estimated future cash flows, an impairment charge is recognized for the amount by which the carrying

amount exceeds the fair value of the asset.

Goodwill and Other Intangible Assets

Goodwill represents the purchase price in excess of the net amount assigned to identifiable assets acquired and

liabilities assumed in the Merger. We perform an impairment test at least annually or more frequently if indicators of

impairment exist. We are required to perform a two-step impairment test of goodwill under the provisions of

SFAS No. 142, Goodwill and Other Intangible Assets. The fair value of the entity is compared to its carrying value

and if the fair value exceeds its carrying value, goodwill is not impaired. If the carrying value exceeds the fair value,

the implied fair value of goodwill is compared to the carrying value of goodwill. If the implied fair value exceeds the

carrying value then goodwill is not impaired; otherwise, an impairment loss will be recorded by the amount the

carrying value exceeds the implied fair value.

F-16

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)