XM Radio 2008 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

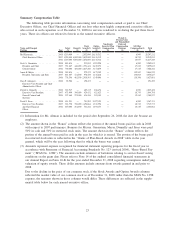

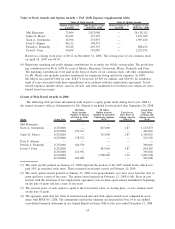

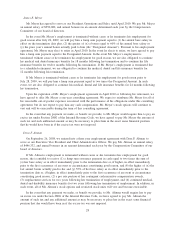

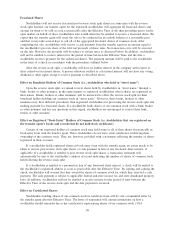

Name Conditions for Payouts

Lump Sum

Severance

Payment

($)

Accelerated

Equity

Vesting(1)

($)

Continuation of

Insurance

Benefits(2)

($)

Tax

Gross-Up

($)

Total

($)

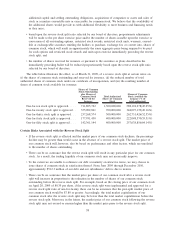

Patrick L. Donnelly . . . Termination without cause or for

good reason 1,125,000 — 15,806 — 1,140,806

If following the occurrence of a

change-in-control, termination

without cause or for good reason 1,125,000 34,544 15,806 — 1,175,350

David J. Frear . . . . . . . Termination without cause or for

good reason 1,450,000 — 15,806 — 1,465,806

If following the occurrence of a

change-in-control, termination

without cause or for good reason 1,450,000 50,634 15,806 — 1,516,440

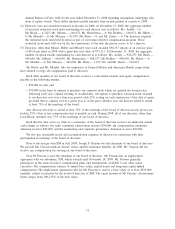

(1) Assumes that unvested equity would vest upon a change-in-control as stated in our stock incentive plans.

Amounts were calculated based on the closing price of our common stock on December 31, 2008 of

$0.12. The accelerated vesting of options is valued at (a) the difference between the closing price and the

exercise price of the options times (b) the number of shares of common stock underlying the options. The

accelerated vesting of restricted stock and restricted stock units is valued at the closing price times the

number of shares of restricted stock and restricted stock units.

(2) Assumes that medical and dental benefits would be continued under COBRA for up to 18 months at cur-

rent rates; thereafter assumes rate of two times current employer costs. Assumes that life insurance would

be continued at rate of two times current employer cost.

(3) If Mr. Meyer’s employment terminates due to a scheduled retirement, then continuation of insurance bene-

fits cost is estimated to be $17,225, instead of $25,237.

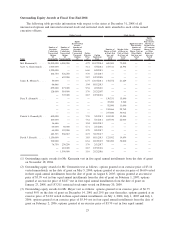

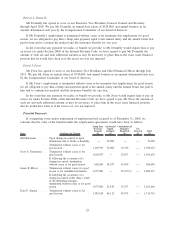

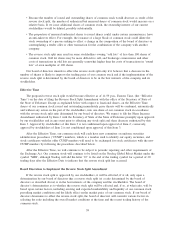

Director Compensation Table for 2008

The following table provides compensation information for the year ended December 31, 2008 for each

of our non-employee directors. Directors who are employees do not receive compensation for their services as

directors. Ms. Amble and Messrs. Hartenstein, Huber, Mendel, Parsons, Shaw and Zients joined our board of

directors on July 28, 2008. Their compensation below is for payments following that date:

Name

Fee Earned or

Paid in Cash

($)

Stock

Awards(1)(2)

($)

Option

Awards(1)(3)

($)

Non-Equity

Incentive Plan

Compensation

($)

Change in

Pension Value of

Non-Qualified

Deferred

Compensation

Earnings

($)

All Other

Compensation

($)

Total

($)

Joan L Amble ............ 20,000 — 746 — — — 20,746

Leon D. Black ............ 12,500 — 42,506 — — — 55,006

Lawrence F. Gilberti ....... 70,000 — 42,506 — — — 112,506

Eddy W. Hartenstein ....... 12,500 — 746 — — — 13,246

James P. Holden .......... 60,000 — 42,506 — — — 102,506

Chester A. Huber, Jr. ...... — — — — — — —

John W. Mendel .......... — — — — — — —

James F. Mooney .......... 80,000 — 42,506 — — — 122,506

Jack Shaw ............... 12,500 — 746 — — — 13,246

Jeffrey D. Zients .......... 12,500 — 746 — — — 13,246

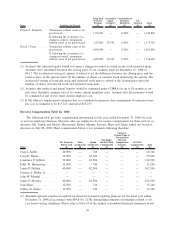

(1) Amounts represent expense recognized for financial statement reporting purposes for the fiscal year ended

December 31, 2008 in accordance with SFAS No. 123R, disregarding estimates of forfeitures related to ser-

vice-based vesting conditions. Please refer to Note 14 of the audited consolidated financial statements in our

30