XM Radio 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

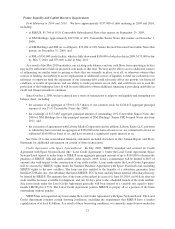

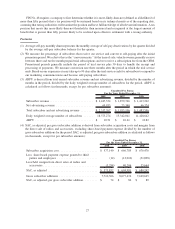

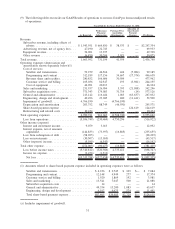

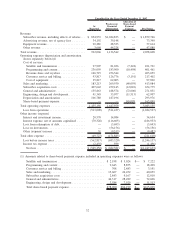

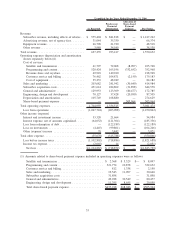

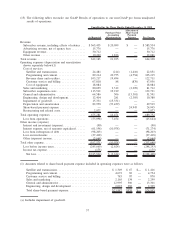

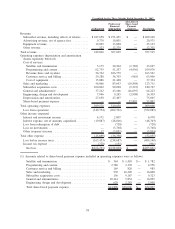

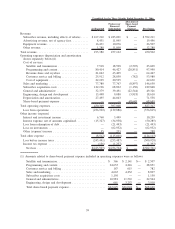

(9) The following tables reconcile our GAAP Results of operations to our non-GAAP pro forma unadjusted results

of operations:

As Reported

Predecessor

Financial

Information

Purchase Price

Accounting

Adjustments(a)

Allocation of

Share-based

Payment

Expense Pro Forma

Unaudited for the Years Ended December 31, 2008

Revenue:

Subscriber revenue, including effects of

rebates . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,543,951 $ 664,850 $ 38,533 $ — $2,247,334

Advertising revenue, net of agency fees . . . 47,190 22,743 — — 69,933

Equipment revenue . . . . . . . . . . . . . . . . . . 56,001 13,397 — — 69,398

Other revenue . . . . . . . . . . . . . . . . . . . . . . 16,850 30,204 3,021 — 50,075

Total revenue . . . . . . . . . . . . . . . . . . . . . . . . 1,663,992 731,194 41,554 — 2,436,740

Operating expenses (depreciation and

amortization shown separately below)(1)

Cost of services:

Satellite and transmission. . . . . . . . . . . . 59,279 46,566 424 (7,084) 99,185

Programming and content . . . . . . . . . . . 312,189 117,156 34,667 (17,374) 446,638

Revenue share and royalties . . . . . . . . . . 280,852 166,606 30,504 — 477,962

Customer service and billing . . . . . . . . . 165,036 82,947 193 (3,981) 244,195

Cost of equipment . . . . . . . . . . . . . . . . . 46,091 20,013 — — 66,104

Sales and marketing . . . . . . . . . . . . . . . . . 231,937 126,054 5,393 (21,088) 342,296

Subscriber acquisition costs . . . . . . . . . . . . 371,343 174,083 31,714 (14) 577,126

General and administrative . . . . . . . . . . . . 213,142 116,444 1,083 (63,637) 267,032

Engineering, design and development. . . . . 40,496 23,045 400 (11,441) 52,500

Impairment of goodwill . . . . . . . . . . . . . . . 4,766,190 — (4,766,190) — —

Depreciation and amortization . . . . . . . . . . 203,752 88,749 (46,930) — 245,571

Share-based payment expense . . . . . . . . . . — — — 124,619 124,619

Restructuring and related costs . . . . . . . . . 10,434 — — — 10,434

Total operating expenses . . . . . . . . . . . . . . . . 6,700,741 961,663 (4,708,742) — 2,953,662

Loss from operations . . . . . . . . . . . . . . . . . (5,036,749) (230,469) 4,750,296 — (516,922)

Other income (expense)

Interest and investment income . . . . . . . . . 9,079 3,013 — — 12,092

Interest expense, net of amounts

capitalized . . . . . . . . . . . . . . . . . . . . . . . (144,833) (73,937) (16,885) — (235,655)

Loss from redemption of debt . . . . . . . . . . (98,203) — — — (98,203)

Loss on investments . . . . . . . . . . . . . . . . . (30,507) (13,010) — — (43,517)

Other (expense) income . . . . . . . . . . . . . . . (9,599) (6,543) — — (16,142)

Total other expense . . . . . . . . . . . . . . . . . . . . (274,063) (90,477) (16,885) — (381,425)

Loss before income taxes . . . . . . . . . . . . . (5,310,812) (320,946) 4,733,411 — (898,347)

Income tax expense . . . . . . . . . . . . . . . . . . (2,476) (1,512) — — (3,988)

Net loss . . . . . . . . . . . . . . . . . . . . . . . . $(5,313,288) $(322,458) $ 4,733,411 $ — $ (902,335)

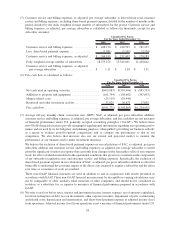

(1) Amounts related to share-based payment expense included in operating expenses were as follows:

Satellite and transmission . . . . . . . . . . . . . . . . . . . . . . $ 4,236 $ 2,745 $ 103 $— $ 7,084

Programming and content . . . . . . . . . . . . . . . . . . . . . . 12,148 4,949 277 — 17,374

Customer service and billing . . . . . . . . . . . . . . . . . . . 1,920 1,869 192 — 3,981

Sales and marketing . . . . . . . . . . . . . . . . . . . . . . . . . . 13,541 7,047 500 — 21,088

Subscriber acquisition costs . . . . . . . . . . . . . . . . . . . . 14 — — — 14

General and administrative . . . . . . . . . . . . . . . . . . . . . 49,354 13,200 1,083 — 63,637

Engineering, design and development . . . . . . . . . . . . . 6,192 4,675 574 — 11,441

Total share-based payment expense . . . . . . . . . . . . . . . $87,405 $34,485 $2,729 $— $124,619

(a) Includes impairment of goodwill.

31