XM Radio 2008 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.facility and in the future we may be limited in our ability to borrow under this facility. We are in discussions with

Space Systems/Loral regarding ways in which SIRIUS can realize the financial benefits it expected to receive under

the Loral Credit Agreement, including through deferred payments on SIRIUS’ satellite purchase agreements and

other concessions, perhaps without drawing under the Loral Credit Agreement.

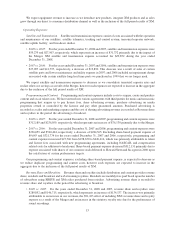

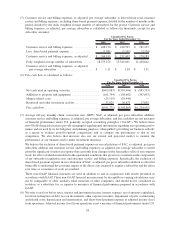

Operating Liquidity. Based upon our current plans, and other than our need to refinance our debt maturing in

2010, we believe that both SIRIUS and XM have sufficient cash, cash equivalents and marketable securities to cover

the estimated funding needs through cash flow breakeven, the point at which revenues are sufficient to fund

expected operating expenses, capital expenditures, working capital requirements, interest payments and taxes. The

ability to meet our debt and other obligations depends on our future operating performance and on economic,

financial, competitive and other factors. We continually review our operations for opportunities to adjust the timing

of expenditures to ensure that sufficient resources are maintained. We have the ability and intend to manage the

timing and related expenditures of certain of activities, including the launch of satellites, the deferral or payment of

bonuses with equity, the deferral of capital projects, as well as the deferral of other discretionary expenses. Our

financial projections are based on assumptions, which we believe are reasonable but contain significant uncer-

tainties. There can be no assurance that our plan will be successful.

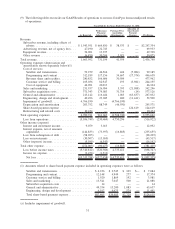

We are the sole stockholder of XM Holdings and its subsidiaries and its business is operated as an unrestricted

subsidiary under the agreements governing our existing indebtedness. Under certain circumstances, SIRIUS may be

unwilling or unable to contribute or loan XM capital to support its operations. Similarly, under certain circum-

stances, XM may be unwilling or unable to contribute or loan SIRIUS capital to support its operations. To the extent

XM’s funds are insufficient to support its business, XM may be required to seek additional financing, which may not

be available on favorable terms, or at all. If XM is unable to secure additional financing, its business and results of

operations may be adversely affected.

Tightening credit policies could also adversely impact our operational liquidity by making it more difficult or

costly for our subscribers to access credit, and could have an adverse impact on our operational liquidity as a result

of possible changes to our payment arrangements that credit card companies and other credit providers could

unilaterally make.

We regularly evaluate our plans and strategy. These evaluations often result in changes to our plans and

strategy, some of which may be material and significantly change our cash requirements or cause us to achieve cash

flow breakeven at a later date. These changes in our plans or strategy may include: the acquisition of unique or

compelling programming; the introduction of new features or services; significant new or enhanced distribution

arrangements; investments in infrastructure, such as satellites, equipment or radio spectrum; and acquisitions of

third parties that own programming, distribution, infrastructure, assets, or any combination of the foregoing. In

addition, our operations will also be affected by the FCC order approving the Merger which imposed certain

conditions upon, among other things, our program offerings and our ability to increase prices. Our future liquidity

also may be adversely affected by, among other things, the nature and extent of the benefits achieved by operating

XM as a wholly-owned unrestricted subsidiary under our existing indebtedness.

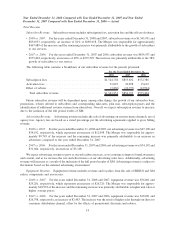

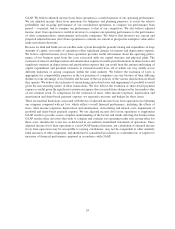

Off-Balance Sheet Arrangements

We are required under the terms of certain agreements to provide letters of credit and deposit monies in escrow,

which place restrictions on cash and cash equivalents. As of December 31, 2008 and 2007, $141,250 and $53,000,

respectively, was classified as restricted investments as a result of obligations under these letters of credit and

escrow deposits. In 2009, we released to Major League Baseball and NASCAR an aggregate of $140,000 held in

escrow in satisfaction of future obligations under our agreements with them.

We have not entered into any other material off-balance sheet arrangements or transactions.

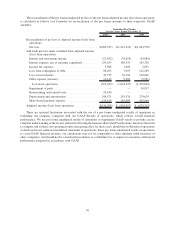

2003 Long-Term Stock Incentive Plan

SIRIUS maintains the Sirius Satellite Radio 2003 Long-Term Stock Incentive Plan (the “2003 Plan”).

Employees, consultants and members of our board of directors are eligible to receive awards under the 2003

Plan. The 2003 Plan provides for the grant of stock options, restricted stock, restricted stock units and other stock-

22