XM Radio 2008 Annual Report Download - page 139

Download and view the complete annual report

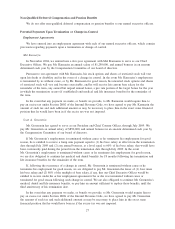

Please find page 139 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Non-Qualified Deferred Compensation and Pension Benefits

We do not offer non-qualified deferred compensation or pension benefits to our named executive officers.

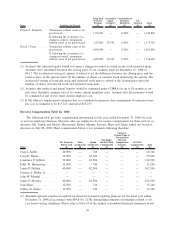

Potential Payments Upon Termination or Change-in-Control

Employment Agreements

We have entered into an employment agreement with each of our named executive officers, which contain

provisions regarding payments upon a termination or change of control.

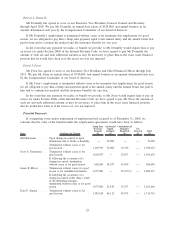

Mel Karmazin

In November 2004, we entered into a five-year agreement with Mel Karmazin to serve as our Chief

Executive Officer. We pay Mr. Karmazin an annual salary of $1,250,000, and annual bonuses in an amount

determined each year by the Compensation Committee of our board of directors.

Pursuant to our agreement with Mr. Karmazin, his stock options and shares of restricted stock will vest

upon his death or disability and in the event of a change in control. In the event Mr. Karmazin’s employment

is terminated by us without cause, or by Mr. Karmazin for good reason, his unvested stock options and shares

of restricted stock will vest and become exercisable, and he will receive his current base salary for the

remainder of the term, any earned but unpaid annual bonus, a pro rata portion of his target bonus for the year

in which the termination occurs (if established) and medical and life insurance benefits for the remainder of

the term.

In the event that any payment we make, or benefit we provide, to Mr. Karmazin would require him to

pay an excise tax under Section 280G of the Internal Revenue Code, we have agreed to pay Mr. Karmazin the

amount of such tax and such additional amount as may be necessary to place him in the exact same financial

position that he would have been in if the excise tax was not imposed.

Scott A. Greenstein

Mr. Greenstein has agreed to serve as our President and Chief Content Officer, through July 2009. We

pay Mr. Greenstein an annual salary of $850,000, and annual bonuses in an amount determined each year by

the Compensation Committee of our board of directors.

If Mr. Greenstein’s employment is terminated without cause or he terminates his employment for good

reason, he is entitled to receive a lump sum payment equal to (1) his base salary in effect from the termination

date through July 2009 and (2) any annual bonuses, at a level equal to 60% of his base salary, that would have

been customarily paid during the period from the termination date through July 2009. In the event

Mr. Greenstein’s employment is terminated without cause or he terminates his employment for good reason,

we are also obligated to continue his medical and dental benefits for 18 months following his termination and

life insurance benefits for the remainder of the term.

If, following the occurrence of a change in control, Mr. Greenstein is terminated without cause or he

terminates his employment for good reason, we are obligated to pay Mr. Greenstein the lesser of (1) four times

his base salary and (2) 80% of the multiple of base salary, if any, that our Chief Executive Officer would be

entitled to receive under his or her employment agreement if he or she was terminated without cause or

terminated for good reason following such change in control. We are also obligated to continue Mr. Greenstein’s

medical, dental and life insurance benefits, or pay him an amount sufficient to replace these benefits, until the

third anniversary of his termination date.

In the event that any payment we make, or benefit we provide, to Mr. Greenstein would require him to

pay an excise tax under Section 280G of the Internal Revenue Code, we have agreed to pay Mr. Greenstein

the amount of such tax and such additional amount as may be necessary to place him in the exact same

financial position that he would have been in if the excise tax was not imposed.

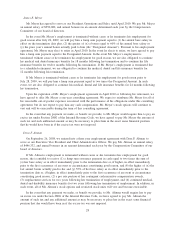

27