XM Radio 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The loans under the Second-Lien Credit Agreement are guaranteed by XM Holdings and each of the subsidiary

guarantors named therein. The loan is secured by a second lien on substantially all the assets of XM Holdings, XM

and certain subsidiaries named therein. The affirmative covenants, negative covenants and event of default

provisions contained in the Second-Lien Credit Agreement are substantially similar to those contained in the

First-Lien Credit Agreement (as defined below).

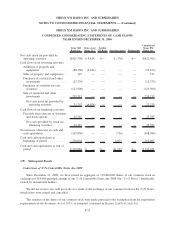

Amendment and Restatement of Existing XM Bank Facilities. On March 6, 2009, XM amended and restated

(i) the $100,000 Credit Agreement, dated as of June 26, 2008, among XM, XM Holdings, the lenders named therein

and UBS AG, as administrative agent (the “UBS Term Loan”) and (ii) the $250,000 Credit Agreement, dated as of

May 5, 2006, among XM, XM Holdings, the lenders named therein and JPMorgan Chase Bank, N.A., as

administrative agent (the “JPM Revolver” and, together with the UBS Term Loan, the “Previous Facilities”).

The Previous Facilities have been combined as term loans into the Amended and Restated Credit Agreement, dated

as of March 6, 2009, among XM, XM Holdings, the lenders named therein and JPMorgan Chase Bank, N.A., as

administrative agent (the “First-Lien Credit Agreement”), and Liberty Media LLC (the “Purchaser”) has purchased

$100,000 aggregate principal amount of such loans from the lenders. XM paid a restructuring fee of 2% to the

existing lenders under the Previous Facilities.

Loans under the First-Lien Credit Agreement held by existing lenders (the “Tranche A” and the “Tranche B”

term loans) will mature on May 5, 2010 and the remaining loans purchased by Liberty (the “Tranche C” term loans)

will mature on May 5, 2011. The Tranche A and the Tranche B term loans are subject to scheduled quarterly

amortization payments of $25,000 starting on March 31, 2009. The Tranche C term loans are subject to a partial

amortization of $25,000 on March 31, 2010, with all remaining amounts due on the final maturity date. Pursuant to

these maturities and the scheduled amortization payments, of the outstanding principal amount, $100,000 of the

$350,000 is due in 2009; $175,000 is due in 2010; and $75,000 is due in 2011. The loans will bear interest at rates

ranging from prime plus 11% to LIBOR (subject to a 3% floor) plus 12%.

The loans under the First-Lien Credit Agreement are guaranteed by XM Holdings and each of the subsidiary

guarantors named therein. The loans are secured by a first lien on substantially all of the assets of XM Holdings, XM

and certain subsidiaries named therein. The affirmative covenants, negative covenants and event of default

provisions contained in the First-Lien Credit Agreement are substantially similar to those contained in the Previous

Facilities, except that: (i) XM must maintain cash reserves of $75 million (without taking into account any proceeds

from the Second-Lien Credit Agreement (as defined above)), (ii) we must maintain cash reserves of $35 million,

(iii) XM Holdings and XM must maintain certain EBITDA levels set forth therein and (iv) an event of default shall

occur upon the acceleration of any our material indebtedness or in the event of our voluntary or involuntary

bankruptcy.

Issuance of the Preferred Stock. On March 6, 2009, we issued 12,500,000 shares of our preferred stock in

consideration for the investments described herein. The rights, preferences and privileges of the preferred stock are

described in the applicable Certificate of Designations. A summary of the terms of each Certificate of Designations

is described above. The foregoing description of the Certificates of Designations does not purport to be a complete

description of all of the terms of such Certificate of Designations and is qualified in its entirety by reference to the

Certificate of Designations for the preferred, copies of which are filed as Exhibits 3.1 and 3.2 to the Current Report

on Form 8-K dated March 6, 2009 filed with the Securities and Exchange Commission, and each Certificate of

Designations is incorporated herein by reference.

9.75% Senior Supplemental Indenture

On March 6, 2009, XM executed and delivered a Third Supplemental Indenture (the “XM 9.75% Notes

Supplemental Indenture”), dated as of March 6, 2009, by and among XM, XM Holdings, XM Equipment Leasing

LLC, XM Radio Inc. and The Bank of New York Mellon, as trustee, which supplements the indenture, dated as of

May 1, 2006, among XM, XM Holdings, XM Equipment Leasing LLC and the trustee with respect to XM’s

9.75% Senior Notes due 2014 (the “9.75% Notes”).

F-56

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)