Washington Post 2001 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2001 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

Education Division. Excluding the operating results of the career fair

and HireSystems businesses from 1999 (these businesses were

contributed to BrassRing at the end of the third quarter of 1999),

2000 education division operating results compared with 1999 are

as follows:

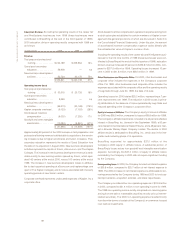

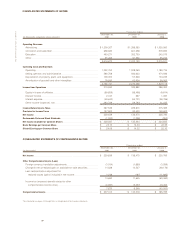

(in thousands) 2000 1999 % Change

Revenue

Test prep and professional

training................... $ 244,189 $ 209,964 16%

Quest post-secondary

education ................. 56,908 — n/a

New business development

activities .................. 52,724 30,175 75%

......................................... $ 353,821 $ 240,139 47%

Operating income (loss)

Test prep and professional

training................... $ 30,315 $ 25,733 18%

Quest post-secondary

education ................. 8,359 — n/a

New business development

activities .................. (55,313) (20,128) (175%)

Kaplan corporate overhead.. (9,123) (7,153) (28%)

Stock-based incentive

compensation ............ (6,000) (7,250) 17%

Goodwill and other intangible

amortization .............. (10,084) (6,861) (47%)

......................................... $ (41,846) $ (15,659) (167%)

Approximately 50 percent of the 2000 increase in test preparation and

professional training revenue is attributable to acquisitions; the remain-

ing increase is due to higher enrollments and tuition increases. Post-

secondary education represents the results of Quest Education from

the date of its acquisition in August 2000. New business development

activities represent the results of Score!, eScore.com, and The Kaplan

Colleges. The increase in new business development revenue is attrib-

utable mostly to new learning centers opened by Score!, which oper-

ated 142 centers at the end of 2000, versus 100 centers at the end of

1999. The increase in new business development losses is attributa-

ble to start-up period spending at eScore.com and kaplancollege.com

(part of The Kaplan Colleges) and to losses associated with the early

operating periods of new Score! centers.

Corporate overhead represents unallocated expenses of Kaplan, Inc.’s

corporate office.

Stock-based incentive compensation represents expense arising from

a stock option plan established for certain members of Kaplan’s man-

agement (the general provisions of which are discussed in Note G to

the Consolidated Financial Statements). Under this plan, the amount

of stock-based incentive compensation expense varies directly with

the estimated fair value of Kaplan’s common stock.

Including the operating results of the career fair and HireSystems busi-

nesses for the first nine months of 1999 (these businesses were con-

tributed to BrassRing at the end of the third quarter of 1999), education

division revenue increased 37 percent to $353.8 million for 2000, com-

pared to $257.5 million for 1999. Operating losses increased 10 per-

cent in 2000 to $41.8 million, from $38.0 million in 1999.

Other Businesses and Corporate Office. For 2000, other businesses and

corporate office includes the expenses of the Company’s corporate

office. For 1999, other businesses and corporate office includes the

expenses associated with the corporate office and the operating results

of Legi-Slate through June 30, 1999, the date of its sale.

Operating losses for 2000 totaled $25.2 million, representing a 7 per-

cent improvement over 1999. The reduction in 2000 losses is prima-

rily attributable to the absence of losses generated by Legi-Slate and

reduced spending at the Company’s corporate office.

Equity in Losses of Affiliates. The Company’s equity in losses of affiliates

for 2000 was $36.5 million, compared to losses of $8.8 million for 1999.

The Company’s affiliate investments consisted of a 42 percent effective

interest in BrassRing, Inc. (formed in late September 1999), a 50 per-

cent interest in the International Herald Tribune, and a 49 percent inter-

est in Bowater Mersey Paper Company Limited. The decline in 2000

affiliate results is attributable to BrassRing, Inc., which was in the inte-

gration and marketing phase of its operations.

BrassRing accounted for approximately $37.0 million of the

Company’s 2000 equity in affiliate losses. A substantial portion of

BrassRing’s losses arises from goodwill and intangible amortization

expense. Accordingly, the $37.0 million of equity in affiliate losses

recorded by the Company in 2000 did not require significant funding

by the Company.

Non-operating Items. In 2000, the Company incurred net interest expense

of $53.8 million, compared to $25.7 million of net interest expense in

1999. The 2000 increase in net interest expense is attributable to bor-

rowings executed by the Company during 1999 and 2000 to fund cap-

ital improvements, acquisition activities, and share repurchases.

The Company recorded other non-operating expense of $19.8 million

in 2000, compared to $21.4 million in non-operating income for 1999.

The 1999 non-operating income mostly comprised non-recurring gains

arising from the sale of marketable securities (mostly various Internet-

related securities). The 2000 non-operating expense resulted mostly

from the write-downs of certain of the Company’s e-commerce focused

cost method investments.

THE WASHINGTON POST COMPANY