Washington Post 2001 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2001 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

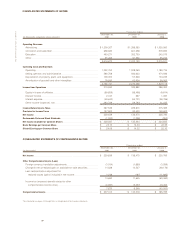

THE WASHINGTON POST COMPANY

The provision for income taxes exceeds the amount of income tax

determined by applying the U.S. Federal statutory rate of 35 percent

to income before taxes as a result of the following:

(in thousands) 2001 2000 1999

U.S. Federal statutory taxes $ 135,639 $ 80,455 $ 131,385

State and local taxes,

net of U.S. Federal

income tax benefit ....... 13,832 6,449 15,185

Amortization of goodwill

not deductible for

income tax purposes..... 6,988 5,011 4,178

Other, net ................... 1,441 1,485 (1,148)

Provision for income taxes... $ 157,900 $ 93,400 $ 149,600

Deferred income taxes at December 30, 2001 and December 31, 2000

consist of the following:

(in thousands) 2001 2000

Accrued postretirement benefits........... $ 56,955 $ 55,280

Other benefit obligations .................. 73,080 60,676

Accounts receivable ....................... 15,949 17,296

State income tax loss carryforwards ...... 17,218 12,013

Other ...................................... 14,886 20,693

Deferred tax asset......................... 178,088 165,958

Property, plant, and equipment............ 110,763 84,164

Prepaid pension cost ...................... 181,434 152,609

Affiliate operations......................... (1,195) 18,365

Unrealized gain on available-

for-sale securities ....................... 15,475 8,476

Goodwill and other intangibles ............ 93,286 18,277

Other ...................................... 274 1,798

Deferred tax liability ....................... 400,037 283,689

Deferred income taxes .................... $221,949 $ 117,731

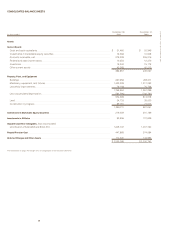

EDEBT

At December 30, 2001, the Company had $933,078,000 in total debt

outstanding, which comprised $533,896,000 of commercial paper

borrowings, $398,142,000 of 5.5 percent unsecured notes due

February 15, 2009, and $1,040,000 in other debt. At December 30,

2001, the Company has classified $483,896,000 of its commercial

paper borrowings as “Long-Term Debt” in its Consolidated Balance

Sheets as the Company has the ability and intent to finance such

borrowings on a long-term basis under its credit agreements.

Interest on the 5.5 percent unsecured notes is payable semi-annu-

ally on February 15 and August 15.

At December 30, 2001 and December 31, 2000, the average inter-

est rate on the Company’s outstanding commercial paper borrow-

ings was 2.0 percent and 6.6 percent, respectively. The Company’s

commercial paper borrowings are supported by a five-year

$500,000,000 revolving credit facility and a one-year $250,000,000

revolving credit facility, which expire in March 2003 and September

2002, respectively.

Under the terms of the $500,000,000 revolving credit facility, inter-

est on borrowings is at floating rates, and the Company is required

to pay an annual facility fee of 0.055 percent and 0.15 percent on

the unused and used portions of the facility, respectively. Under the

terms of the $250,000,000 revolving credit facility, interest on bor-

rowings is at floating rates, and the Company is required to pay a

variable facility fee of 0.05 percent and 0.20 percent per annum on

the unused and used portions of the facility, respectively. Both revolv-

ing credit facilities contain certain covenants, including a financial

covenant that the Company maintain at least $850,000,000 of con-

solidated shareholders’ equity.

The Company incurred interest costs on its borrowing of $47,473,000

and $53,764,000 during 2001 and 2000, respectively. No interest

expense was capitalized in 2001 or 2000.

At December 30, 2001 and December 31, 2000, the fair value of

the Company’s 5.5 percent unsecured notes, based on quoted

market prices, totaled $387,720,000 and $376,200,000, respec-

tively, compared with the carrying amount of $398,142,000 and

$397,881,000, respectively.

The carrying value of the Company’s commercial paper borrowings

at December 30, 2001 and December 31, 2000 approximates fair

value.

F REDEEMABLE PREFERRED STOCK

In connection with the acquisition of a cable television system in

1996, the Company issued 11,947 shares of its Series A Preferred

Stock. On February 23, 2000, the Company issued an additional

1,275 shares related to this transaction. From 1998 to 2001, 90

shares of Series A Preferred Stock were redeemed at the request

of a Series A Preferred Stockholder.

The Series APreferred Stock has a par value of $1.00 per share and

a liquidation preference of $1,000 per share; it is redeemable by the

Company at any time on or after October 1, 2015 at a redemption

price of $1,000 per share. In addition, the holders of such stock have

a right to require the Company to purchase their shares at the

redemption price during an annual 60-day election period; the first

such period began on February 23, 2001. Dividends on the Series

A Preferred Stock are payable four times a year at the annual rate

of $80.00 per share and in preference to any dividends on the

Company’s common stock. The Series A Preferred Stock is not con-

vertible into any other security of the Company, and the holders