Washington Post 2001 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2001 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

New business development activities represent the results of Score!

and The Kaplan Colleges (various distance-learning businesses). The

improvement in new business development revenue is primarily attrib-

utable to Score!, with both increased enrollment from new learning

centers opened (147 centers at the end of 2001, versus 142 centers

at the end of 2000) and rate increases implemented early in 2001. In

early 2002, Kaplan put all of its post-secondary schools (Quest and

The Kaplan Colleges) under a single higher education division.

Corporate overhead represents unallocated expenses of Kaplan, Inc.’s

corporate office, including expenses associated with the design and

development of educational software that, if successfully completed,

will benefit all of Kaplan’s business units. The increase in this expense

category in 2001 is principally due to increased spending for these

development initiatives.

Kaplan records accrued charges for stock-based incentive compen-

sation arising from a stock option plan established for certain mem-

bers of Kaplan’s management (the general provisions of which are

discussed in Note G to the Consolidated Financial Statements). Under

the stock-based incentive plan, the amount of compensation expense

varies directly with the estimated fair value of Kaplan’s common stock

and the number of options outstanding. The increase in stock-based

incentive compensation for 2001 is due to an increase in Kaplan’s

estimated value.

Equity in Losses of Affiliates. The Company’s equity in losses of affiliates

for 2001 was $68.7 million, compared to losses of $36.5 million for 2000.

The Company’s affiliate investments consist of a 39.7 percent common

equity interest in BrassRing LLC, a 50 percent interest in the International

Herald Tribune, and a 49 percent interest in Bowater Mersey Paper

Company Limited.

BrassRing accounted for approximately $75.1 million of the 2001

equity in losses of affiliates, compared to $37.0 million in 2000. The

increase in 2001 equity in affiliate losses from BrassRing is largely due

to a one-time non-cash goodwill and other intangibles impairment

charge that BrassRing recorded in 2001 primarily to reduce the car-

rying value of its career fair business. As a substantial portion of

BrassRing’s losses arose from goodwill and intangible amortization

expense for both 2001 and 2000, the $75.1 million and $37.0 million

of equity in affiliate losses recorded by the Company in 2001 and 2000,

respectively, did not require significant funding by the Company.

In December 2001, BrassRing, Inc. was restructured, and the

Company’s interest in BrassRing, Inc. was converted into an interest

in the newly-formed BrassRing LLC. At December 30, 2001, the

Company held a 39.7 percent interest in the BrassRing LLC common

equity and a $14.9 million Subordinated Convertible Promissory Note

(“Note”) from BrassRing LLC. In February 2002, the Note was con-

verted into Preferred Units, which are convertible at the Company’s

option to BrassRing LLC common equity. Assuming the conversion

of the Preferred Units, the Company’s common equity interest in

BrassRing LLC would be approximately 49.5 percent.

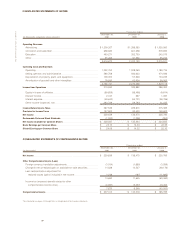

Non-operating Items. The Company recorded other non-operating

income of $283.7 million in 2001, compared to $19.8 million in non-

operating expense for 2000. The 2001 non-operating income mostly

comprises gains arising from the sale and exchange of certain cable

systems completed in January and March of 2001. Offsetting these

gains were losses from the write-downs of a non-operating parcel

of land and certain investments to their estimated fair value. For

income tax purposes, substantial components of the cable system

sale and exchange transactions qualify as like-kind exchanges, and

therefore, a large portion of these transactions does not result in a

current tax liability.

The Company incurred net interest expense of $47.5 million in 2001,

compared to $53.8 million in 2000. At December 30, 2001, the

Company had $933.1 million in borrowings outstanding at an aver-

age interest rate of 3.5 percent.

Income Taxes. The effective rate was 40.7 percent for 2001, com-

pared to 40.6 percent for 2000. Excluding the effect of the cable gain

transactions, the Company’s effective tax rate approximated 50.2

percent for 2001, with the increase in rate due mostly to the decline

in pre-tax income.

RESULTS OF OPERATIONS — 2000 COMPARED TO 1999

Net income for 2000 was $136.5 million, compared with net income of

$225.8 million for 1999. Diluted earnings per share totaled $14.32 in

2000, compared with $22.30 in 1999, with fewer average shares out-

standing in 2000. The decline in 2000 net income and diluted earnings

per share was primarily caused by increased costs associated with the

development of new businesses (impact of $28.9 million, or $3.47 per

diluted share), a charge arising from an early retirement program at The

Washington Post newspaper (impact of $16.5 million, or $1.74 per

diluted share), higher interest expense (impact of $16.6 million, or $1.85

per diluted share), and a reduced pension credit (impact of $11.7 mil-

lion, or $0.92 per diluted share). In addition, 1999 net income included

gains from the sale of marketable equity securities, which did not recur

in 2000 (impact of $18.6 million, or $1.81 per share). These factors were

offset in part by improved operating results at The Washington Post

newspaper and the television broadcasting division.

Revenue for 2000 totaled $2,412.2 million, an increase of 9 percent

from $2,215.6 million in 1999. Advertising revenue increased 5 per-

cent in 2000, and circulation and subscriber revenue increased 4 per-

cent. Education revenue increased 47 percent in 2000, and other

revenue decreased 6 percent. Increases in advertising revenue at the

newspaper and television broadcasting divisions accounted for most

of the increase in advertising revenue. The increase in circulation and

subscriber revenue is primarily due to a 6 percent increase in sub-

THE WASHINGTON POST COMPANY