Washington Post 2001 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2001 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION

THE WASHINGTON POST COMPANY

This analysis should be read in conjunction with the Consolidated

Financial Statements and the notes thereto.

RESULTS OF OPERATIONS — 2001 COMPARED TO 2000

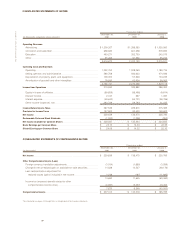

Net income for 2001 was $229.6 million, compared with net income of

$136.5 million for 2000. Diluted earnings per share totaled $24.06 in

2001, compared with $14.32 in 2000. The Company’s 2001 results

include after-tax gains of $196.5 million, or $20.69 per share, from the

sale and exchange of certain cable systems in the first quarter; a non-

cash goodwill and other intangibles impairment charge recorded by the

Company’s BrassRing affiliate (after-tax impact of $19.9 million, or

$2.10 per share); and losses from the write-down of a non-operating

parcel of land and certain cost method investments to their estimated

fair value (after-tax impact of $18.3 million, or $1.93 per share).

Excluding these non-operating and principally non-cash transactions

in 2001, net income totaled $71.3 million, or $7.40 per share. The

decline in 2001 operating earnings is largely due to a significant decline

in advertising revenue, increased depreciation and amortization

expenses, and higher stock-based compensation expense accruals at

the education division. These factors were offset in part by increased

operating income contributed by Quest Education (acquired in August

2000), higher profits from Kaplan’s test preparation and professional

training businesses, reduced operating losses at Kaplan’s new busi-

ness development activities, and an increased pension credit. In addi-

tion, 2000 earnings included a fourth quarter after-tax charge of $16.5

million, or $1.74 per share, arising from an early retirement program at

The Washington Post.

Revenue for 2001 totaled $2,416.7 million, or flat compared to revenue

of $2,412.2 million in 2000. Advertising revenue decreased 13 percent

in 2001, and circulation and subscriber revenue increased 10 percent.

Education revenue increased 40 percent in 2001, and other revenue

decreased 10 percent. The large decrease in advertising revenue is

due to declines at the newspaper, television, and magazine divisions.

The increase in circulation and subscriber revenue is due to a 20 per-

cent increase in Newsweek domestic circulation revenue and a 10 per-

cent increase in subscriber revenue at the cable division. Revenue

growth at Kaplan, Inc. (about two-thirds of which was from acquisi-

tions) accounted for the increase in education revenue.

Operating costs and expenses for the year increased 6 percent to

$2,196.7 million, from $2,072.3 million in 2000. The cost and expense

increase is primarily attributable to companies acquired in 2001 and

2000, higher depreciation and amortization expense, and higher stock-

based compensation expense accruals at the education division, off-

set by a higher pension credit and lower expenses at the newspaper

publishing, television broadcasting, and magazine publishing seg-

ments due to extensive cost control initiatives.

Operating income decreased 35 percent to $219.9 million in 2001,

from $339.9 million in 2000.

The Company’s 2001 operating income includes $76.9 million of net

pension credits, compared to $65.3 million in 2000. These amounts

exclude $3.3 million and $29.0 million in charges related to early retire-

ment programs in 2001 and 2000, respectively.

DIVISION RESULTS

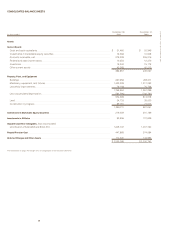

Newspaper Publishing Division. Newspaper publishing division revenue

in 2001 decreased 8 percent to $842.7 million, from $918.2 million in

2000. Division operating income for 2001 totaled $84.7 million, a

decrease of 26 percent from operating income of $114.4 million in 2000.

The decrease in operating income for 2001 is due to a significant

decline in print advertising, offset in part by a higher pension credit,

higher online advertising revenue, lower newsprint cost, cost control

initiatives employed throughout the division, and the $27.5 million

charge recorded in the fourth quarter of 2000 in connection with an

early retirement program completed at The Post.

Print advertising revenue at The Washington Post newspaper

decreased 14 percent to $574.3 million, from $664.1 million in 2000.

Volume declines of 41 percent in classified recruitment advertising for

2001 caused classified recruitment advertising revenue declines of 37

percent. The economic environment surrounding most of the other

advertising categories at The Post (i.e., retail, general, preprints) was

also sluggish for fiscal 2001 compared to the prior year. In these cat-

egories, rate increases only partially offset volume declines ranging

from 3 percent to 28 percent during 2001. The soft advertising climate

worsened late in the third quarter of 2001 as the Company experienced

further reductions in advertising revenue and volumes following the

events of September 11.

Daily and Sunday circulation at The Post declined 0.5 percent and 0.7

percent, respectively, in 2001. For the year ended December 30, 2001,

average daily circulation at The Post totaled 773,000, and average

Sunday circulation totaled 1,067,000. Newsprint expense at the news-

paper publishing division decreased 6 percent for 2001 due to reduced

consumption, offset by overall higher prices during the year.

Revenues generated by the Company’s online publishing activities,

primarily washingtonpost.com, increased 12 percent to $30.4 million

during the year.

Television Broadcasting Division. Revenue for the television broadcasting

division totaled $314.0 million for 2001, a 14 percent decline from 2000.

Excluding approximately $42 million in political and Olympics advertis-

ing in 2000, revenue in 2001 decreased 3 percent due to a general soft-

ness in advertising (particularly national advertising) and several days of

commercial-free coverage following the events of September 11.

Competitive market position remained strong for the Company’s

television stations. WJXT in Jacksonville and WDIV in Detroit were

ranked number one in the latest ratings period, sign-on to sign-off, in

their respective markets; KSAT in San Antonio ranked second; WPLG

was tied for second among English-language stations in the Miami