Washington Post 2001 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2001 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

THE WASHINGTON POST COMPANY

On September 29, 1999, the Company merged its career fair and

HireSystems businesses together and renamed the combined oper-

ations BrassRing, Inc. On the same date, BrassRing issued stock

representing a 46 percent equity interest to two parties under two

separate transactions for cash and businesses with an aggregate fair

value of $87,000,000. As a result of this transaction, the Company’s

ownership of BrassRing was reduced to 54 percent, and the minor-

ity investors were granted certain participatory rights. As such, the

Company de-consolidated BrassRing on September 29, 1999 and

recorded its investment under the equity method of accounting. The

1999 increase in the basis of the Company’s investment in

BrassRing resulting from this transaction of $34,571,000, net of

taxes, was recorded as contributed capital.

During 2000, BrassRing issued stock to various parties in connec-

tion with its acquisitions of various career fair and recruiting serv-

ices companies. The effect of these transactions reduced the

Company’s investment interest in BrassRing to 42 percent, from 54

percent, at January 2, 2000, and increased the Company’s invest-

ment basis in BrassRing by $13,332,000, net of taxes. The increase

in investment basis was recorded as contributed capital.

BrassRing accounted for approximately $75.1 million of the 2001

equity in losses of affiliates compared to $37.0 million in 2000. The

increase in 2001 equity in affiliate losses from BrassRing is largely

due to a one-time non-cash goodwill and other intangibles impair-

ment charge that BrassRing recorded in 2001 primarily to reduce the

carrying value of its career fair business. As a substantial portion of

BrassRing’s losses arose from goodwill and intangible amortization

expense for both 2001 and 2000, the $75.1 million and $37.0 mil-

lion of equity in affiliate losses recorded by the Company in 2001 and

2000 did not require significant funding by the Company.

In December 2001, BrassRing, Inc. was restructured, and the

Company’s interest in BrassRing, Inc. was converted into an inter-

est in the newly-formed BrassRing LLC. At December 30, 2001, the

Company held a 39.7 percent interest in the BrassRing LLC com-

mon equity and a $14.9 million Subordinated Convertible Promissory

Note from BrassRing LLC.

Cost Method Investments. The Company’s cost method investments

consist of minority investments in non-public companies where the

Company does not have significant influence over the investees’

operating and management decisions. Most of the companies rep-

resented by these cost method investments have concentrations in

Internet-related business activities. At December 30, 2001 and

December 31, 2000, the carrying value of the Company’s cost

method investments was $29,595,000 and $48,617,000, respec-

tively. Cost method investments are included in “Deferred Charges

and Other Assets” in the Consolidated Balance Sheets.

During 2001, 2000, and 1999, the Company invested $11,675,000,

$42,459,000 and $33,549,000, respectively, in companies constitut-

ing cost method investments and recorded charges of $32,415,000,

$23,097,000, and $13,555,000, respectively, to write-down cost

method investments to estimated fair value. Charges recorded to write-

down cost method investments are included in “Other income

(expense), net” in the Consolidated Statements of Income.

During 2001 and 2000, proceeds from sales of cost method invest-

ments were $451,000 and $7,070,000, and gross realized (losses)

gains on such sales were ($157,000) and $6,570,000, respectively.

There were no sales of cost method investments in 1999. Gross real-

ized gains or losses upon the sale of cost method investments are

included in “Other income (expense), net” in the Consolidated

Statements of Income.

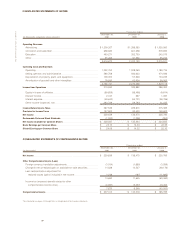

DINCOME TAXES

The provision for income taxes consists of the following:

(in thousands) Current Deferred

2001

U.S. Federal............................... $ 48,253 $ 86,384

Foreign .................................... 1,270 714

State and local ............................ 11,075 10,204

$ 60,598 $ 97,302

2000

U.S. Federal............................... $ 77,517 $ 4,854

Foreign .................................... 1,033 75

State and local ............................ 22,593 (12,672)

$101,143 $ (7,743)

1999

U.S. Federal............................... $ 94,609 $ 30,346

Foreign .................................... 1,306 (22)

State and local ............................ 23,697 (336)

$119,612 $ 29,988