Washington Post 2001 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2001 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

THE WASHINGTON POST COMPANY

Had the fair values of options granted after 1995 been recognized

as compensation expense, net income would have been reduced by

$3.6 million ($0.38 per share, basic and diluted), $3.8 million ($0.40

per share, basic and diluted), and $1.9 million ($0.19 per share, basic

and diluted) in 2001, 2000, and 1999, respectively.

The Company also maintains a stock option plan at its Kaplan sub-

sidiary that provides for the issuance of stock options representing

10.6 percent of Kaplan, Inc. common stock to certain members of

Kaplan’s management. Under the provisions of this plan, options are

issued with an exercise price equal to the estimated fair value of

Kaplan’s common stock. Options vest ratably over five years from

issuance, and upon exercise, an option holder has the right to require

the Company to repurchase the Kaplan stock at the stock’s then fair

value. The fair value of Kaplan’s common stock is determined by the

Company’s compensation committee. At December 30, 2001,

options representing 10.0 percent of Kaplan’s common stock were

issued and outstanding. For 2001, 2000, and 1999, the Company

recorded expense of $25,302,000, $6,000,000, and $7,250,000,

respectively, related to this plan. In 2001, payouts from option exer-

cises totaled $2.1 million. At December 30, 2001, the Company’s

stock-based compensation accrual balance totaled $41.4 million.

Average Number of Shares Outstanding. Basic earnings per share are

based on the weighted average number of shares of common stock

outstanding during each year. Diluted earnings per common share are

based upon the weighted average number of shares of common stock

outstanding each year, adjusted for the dilutive effect of shares

issuable under outstanding stock options. Basic and diluted weighted

average share information for 2001, 2000, and 1999 is as follows:

Basic Dilutive Diluted

Weighted Effect of Weighted

Average Stock Average

Shares Options Shares

2001........................ 9,486,386 13,173 9,499,559

2000........................ 9,445,466 14,362 9,459,828

1999........................ 10,060,578 21,206 10,081,784

HPENSIONS AND OTHER POSTRETIREMENT PLANS

The Company maintains various pension and incentive savings

plans and contributes to several multi-employer plans on behalf of

certain union-represented employee groups. Substantially all of the

Company’s employees are covered by these plans.

The Company also provides healthcare and life insurance benefits

to certain retired employees. These employees become eligible for

benefits after meeting age and service requirements.

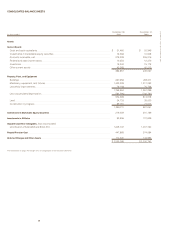

The following table sets forth obligation, asset, and funding infor-

mation for the Company’s defined benefit pension and postretire-

ment plans at December 30, 2001 and December 31, 2000:

Pension Plans Postretirement Plans

(in thousands) 2001 2000 2001 2000

Change in benefit obligation

Benefit obligation at

beginning of year $ 391,166 $ 344,611 $ 93,243 $ 86,938

Service cost 15,393 14,566 3,707 3,496

Interest cost 27,526 24,962 6,811 6,338

Amendments 5,182 29,442 — 1,968

Actuarial loss (gain) 22,334 (5,091) 6,519 (1,199)

Benefits paid (30,584) (17,324) (4,888) (4,298)

Benefit obligation at end

of year $ 431,017 $ 391,166 $ 105,392 $ 93,243

Change in plan assets

Fair value of assets at

beginning of year $1,314,885 $ 1,119,916 — —

Actual return on plan

assets 143,253 212,293 — —

Employer contributions — — $ 4,888 $ 4,298

Benefits paid (30,584) (17,324) (4,888) (4,298)

Fair value of assets at

end of year $1,427,554 $1,314,885 $ — $ —

Funded status $ 996,537 $ 923,719 $ (105,392) $ (93,243)

Unrecognized transition

asset (8,852) (15,354) — —

Unrecognized prior

service cost 16,949 17,230 (501) (663)

Unrecognized actuarial gain (556,946) (551,511) (24,931) (34,858)

Net prepaid (accrued) cost $ 447,688 $ 374,084 $(130,824) $ (128,764)

The total (income) cost arising from the Company’s defined benefit

pension and postretirement plans for the years ended December 30,

2001, December 31, 2000, and January 2, 2000 consists of the fol-

lowing components:

Pension Plans Postretirement Plans

(in thousands) 2001 2000 1999 2001 2000 1999

Service cost $ 15,393 $ 14,566 $ 14,756 $ 3,707 $3,496 $ 3,585

Interest cost 27,526 24,962 23,584 6,811 6,338 6,039

Expected return

on assets (97,567) (85,522) (92,566) — — —

Amortization of

transition asset (6,502) (7,585) (7,665) — — —

Amortization of prior

service cost 2,122 2,091 2,110 (162) (162) (162)

Recognized

actuarial gain (17,917) (13,824) (24,635) (3,408) (2,870) (2,886)

Net periodic

(benefit) cost

for the year (76,945) (65,312) (84,416) 6,948 6,802 6,576

Early retirement

programs expense 3,344 29,049 2,733 — 1,968 —

Total (benefit) cost

for the year $ (73,601) $ (36,263) $(81,683) $ 6,948 $8,770 $6,576