Washington Post 2001 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2001 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

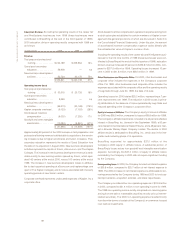

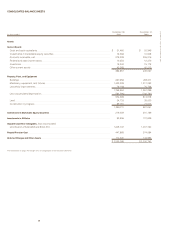

41

Cumulative Unrealized

Foreign Gain on

Class A Class B Capital in Currency Available-

Common Common Excess of Retained Translation for-Sale Treasury

Stock Stock Par Value Earnings Adjustment Securities Stock

Balance, January 3, 1999 .......................... $1,739 $ 18,261 $ 46,199 $ 2,597,217 $ (1,600) $ 41,980 $(1,115,693)

Net income for the year ........................ 225,785

Dividends paid on common stock—

$5.20 per share ............................. (52,376)

Dividends paid on redeemable preferred stock .. (950)

Repurchase of 744,095 shares of

Class B common stock...................... (425,865)

Issuance of 90,247 shares of Class B

common stock, net of restricted stock

award forfeitures ............................ 16,023 10,425

Change in foreign currency translation

adjustment (net of taxes) .................... (3,289)

Change in unrealized gain on

available-for-sale securities (net of taxes) .... (36,711)

Issuance of subsidiary stock (net of taxes) ..... 34,571

Tax benefits arising from employee stock plans.. 12,074

Balance, January 2, 2000........................... $1,739 $18,261 $108,867 $2,769,676 $(4,889) $5,269 $(1,531,133)

Net income for the year ........................ 136,470

Dividends paid on common stock—

$5.40 per share ............................. (50,998)

Dividends paid on redeemable preferred stock.. (1,026)

Repurchase of 200 shares of

Class B common stock...................... (96)

Issuance of 21,279 shares of Class B

common stock, net of restricted stock

award forfeitures ............................ 4,433 3,027

Change in foreign currency translation

adjustment (net of taxes) .................... (1,685)

Change in unrealized gain on

available-for-sale securities (net of taxes) ... 8,233

Issuance of subsidiary stock (net of taxes)..... 13,332

Tax benefits arising from employee stock plans.. 1,527

Balance, December 31, 2000........................ $1,739 $18,261 $128,159 $2,854,122 $(6,574) $13,502 $(1,528,202)

Net income for the year ........................ 229,639

Dividends paid on common stock—

$5.60 per share ............................. (53,114)

Dividends paid on redeemable preferred stock.. (1,052)

Repurchase of 714 shares of

Class B common stock...................... (445)

Issuance of 35,105 shares of Class B

common stock, net of restricted stock

award forfeitures ............................ 10,639 5,120

Change in foreign currency translation

adjustment (net of taxes) .................... (3,104)

Change in unrealized gain on

available-for-sale securities (net of taxes) ... 10,779

Conversion of Class A common stock

to Class B common stock ................... (17) 17

Tax benefits arising from employee stock plans.. 4,016

Balance, December 30, 2001........................ $ 1,722 $ 18,278 $ 142,814 $ 3,029,595 $ (9,678) $ 24,281 $ (1,523,527)

The information on pages 42 through 54 is an integral part of the financial statements.

THE WASHINGTON POST COMPANY

CONSOLIDATED STATEMENTS OF CHANGES IN COMMON SHAREHOLDERS’ EQUITY

(in thousands)