Washington Post 2001 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2001 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WASHINGTON POST COMPANY

thereof have no voting rights except with respect to any proposed

changes in the preferences and special rights of such stock.

GCAPITAL STOCK, STOCK AWARDS, AND STOCK OPTIONS

Capital Stock. Each share of Class A common stock and Class B com-

mon stock participates equally in dividends. The Class B stock has

limited voting rights and as a class has the right to elect 30 percent

of the Board of Directors; the Class A stock has unlimited voting

rights, including the right to elect a majority of the Board of Directors.

During 2001, 2000, and 1999, the Company purchased a total of 714,

200, and 744,095, shares, respectively, of its Class B common stock

at a cost of approximately $445,000, $96,000, and $425,865,000.

Stock Awards. In 1982, the Company adopted a long-term incentive

compensation plan, which, among other provisions, authorizes the

awarding of Class B common stock to key employees. Stock awards

made under this incentive compensation plan are subject to the gen-

eral restriction that stock awarded to a participant will be forfeited

and revert to Company ownership if the participant’s employment ter-

minates before the end of a specified period of service to the

Company. At December 30, 2001, there were 70,775 shares

reserved for issuance under the incentive compensation plan. Of this

number, 29,895 shares were subject to awards outstanding, and

40,880 shares were available for future awards. Activity related to

stock awards under the long-term incentive compensation plan for

the years ended December 30, 2001, December 31, 2000, and

January 2, 2000 was as follows:

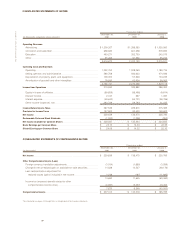

2001 2000 1999

Number Average Number Average Number Average

of Award of Award of Award

Shares Price Shares Price Shares Price

Awards Outstanding

Beginning of year.. 30,165 $413.28 31,360 $412.86 30,730 $405.40

Awarded....... 16,865 608.96 1,155 501.72 2,615 543.02

Vested......... (15,200) 364.13 (99) 330.75 (167) 349.00

Forfeited....... (1,935) 555.02 (2,251) 456.41 (1,818) 479.90

End of year....... 29,895 $539.25 30,165 $413.28 31,360 $412.86

In addition to stock awards granted under the long-term incentive

compensation plan, the Company also made stock awards of 3,300

shares in 2001, 1,950 shares in 2000, and 1,750 shares in 1999.

For the share awards outstanding at December 30, 2001, the

aforementioned restriction will lapse in 2002 for 1,446 shares, in

2003 for 15,799 shares, in 2004 for 2,450 shares, and in 2005 for

18,430 shares. Stock-based compensation costs resulting from

stock awards reduced net income by $2.6 million ($0.27 per share,

basic and diluted), $2.4 million ($0.25 per share, basic and diluted),

and $2.2 million ($0.22 per share, basic and diluted), in 2001, 2000,

and 1999, respectively.

Stock Options. The Company’s employee stock option plan, which

was adopted in 1971 and amended in 1993, reserves 1,900,000

shares of the Company’s Class B common stock for options to be

granted under the plan. The purchase price of the shares covered

by an option cannot be less than the fair value on the granting date.

At December 30, 2001, there were 486,700 shares reserved for

issuance under the stock option plan, of which 170,575 shares were

subject to options outstanding, and 316,125 shares were available

for future grants.

Changes in options outstanding for the years ended December 30,

2001, December 31, 2000, and January 2, 2000 were as follows:

2001 2000 1999

Number Average Number Average Number Average

of Option of Option of Option

Shares Price Shares Price Shares Price

Beginning of year.. 166,450 $465.55 156,497 $470.64 246,072 $404.48

Granted........ 24,000 522.75 89,500 544.90 3,750 516.36

Exercised...... (16,875) 276.79 (20,425) 345.46 (87,825) 288.43

Forfeited....... (3,000) 546.04 (59,122) 643.71 (5,500) 450.86

End of year...... 170,575 $490.86 166,450 $465.55 156,497 $470.64

Of the shares covered by options outstanding at the end of 2001,

89,388 are now exercisable, 30,313 will become exercisable in 2002,

25,562 will become exercisable in 2003, 19,312 will become exer-

cisable in 2004, and 6,000 will become exercisable in 2005.

Information related to stock options outstanding at December 30,

2001, is as follows:

Weighted

Average Weighted Weighted

Number Remaining Average Number Average

Range of Outstanding Contractual Exercise Exercisable Exercise

Exercise Prices at 12/30/01 Life (yrs.) Price at 12/30/01 Price

$ 222–299 13,500 2.7 251.11 13,500 251.11

344 11,500 5.0 343.94 11,500 343.94

472–484 30,825 6.6 473.93 25,950 472.57

500–596 114,750 8.7 538.34 38,438 535.66

All options were granted at an exercise price equal to or greater than

the fair market value of the Company’s common stock at the date of

grant. The weighted average fair value for options granted during

2001, 2000, and 1999 was $107.78, $161.15, and $157.77, respec-

tively. The fair value of options at date of grant was estimated using

the Black-Scholes method utilizing the following assumptions:

2001 2000 1999

Expected life (years)........ 777

Interest rate................. 2.30% 5.98% 6.19%

Volatility..................... 19.46% 17.9% 16.0%

Dividend yield............... 1.1% 1.0% 1.1%