Washington Post 2001 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2001 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

THE WASHINGTON POST COMPANY

At December 30, 2001 and December 31, 2000, the Company’s own-

ership of 2,634 shares of Berkshire Hathaway Inc. (“Berkshire”) Class

Acommon stock and 9,845 shares of Berkshire Class B common stock

accounted for $219,039,000, or 93 percent, and $210,189,000, or 95

percent, respectively, of the total fair value of the Company’s invest-

ments in marketable equity securities. The remaining investments in

marketable equity securities at December 30, 2001 and December 31,

2000 consisted of common stock investments in various publicly

traded companies, most of which have concentrations in Internet busi-

ness activities. In most cases, the Company obtained ownership of

these common stocks as a result of merger or acquisition transactions

in which these companies merged or acquired various small Internet-

related companies in which the Company held minor investments.

Berkshire is a holding company owning subsidiaries engaged in a

number of diverse business activities; the most significant of which

consist of property and casualty insurance business conducted on both

a direct and reinsurance basis. Berkshire also owns approximately 18

percent of the common stock of the Company. The chairman, chief

executive officer, and largest shareholder of Berkshire, Mr. Warren

Buffett, is a member of the Company’s Board of Directors. Neither

Berkshire nor Mr. Buffett participated in the Company’s evaluation,

approval, or execution of its decision to invest in Berkshire common

stock. The Company’s investment in Berkshire common stock is less

than 1 percent of the consolidated equity of Berkshire. At December

30, 2001 and at December 31, 2000, the gross unrealized gain

related to the Company’s Berkshire stock investment totaled

$34,121,000 and $25,271,000, respectively. The Company presently

intends to hold the Berkshire common stock investment long term;

thus the investment has been classified as a non-current asset in

the Consolidated Balance Sheets.

During 2001, 2000, and 1999 proceeds from sales of marketable

equity securities were $145,000, $6,332,000, and $54,805,000,

respectively, and gross realized (losses) gains on such sales were

($354,000), $4,929,000, and $38,799,000, respectively. Gross

realized gains or losses upon the sale of marketable equity secu-

rities are included in “Other income (expense), net” in the

Consolidated Statements of Income. For purposes of computing

realized gains and losses, the cost basis of securities sold is deter-

mined by specific identification.

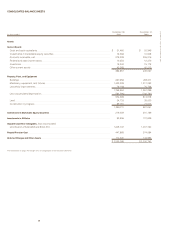

Investments in Affiliates. The Company’s investments in affiliates at

December 30, 2001 and December 31, 2000 include the following:

(in thousands) 2001 2000

BrassRing.................................. $ 19,992 $ 73,310

Bowater Mersey Paper Company ........ 45,822 40,227

International Herald Tribune............... 14,480 17,561

Other....................................... 642 531

$ 80,936 $ 131,629

The Company’s investments in affiliates consist of a 39.7 percent

common equity interest in BrassRing LLC, which provides recruit-

ing, career development, and hiring management services for

employers and job candidates; a 49 percent interest in the common

stock of Bowater Mersey Paper Company Limited, which owns and

operates a newsprint mill in Nova Scotia; a 50 percent common stock

interest in the International Herald Tribune Newspaper, published

near Paris, France; and a 50 percent common stock interest in the

Los Angeles Times-Washington Post News Service, Inc.

Summarized financial data for the affiliates’operations are as follows:

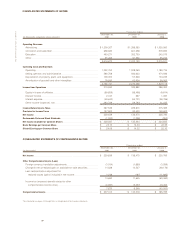

(in thousands) 2001 2000 1999

Financial Position:

Working capital........... $ (8,767) $ 29,427 $ 69,155

Property, plant, and

equipment ............. 126,682 143,749 133,425

Total assets .............. 246,321 432,458 365,694

Long-term debt........... ———

Net equity ................ 125,211 291,481 236,597

Results of Operations:

Operating revenues...... $ 317,389 $ 345,913 $ 267,788

Operating loss............ (14,793) (27,505) (37,889)

Net loss................... (157,409) (77,739) (40,035)

The following table summarizes the status and results of the

Company’s investments in affiliates:

(in thousands) 2001 2000

Beginning investment ..................... $131,629 $ 140,669

Issuance of stock by BrassRing, Inc...... — 21,973

Additional investment ..................... 21,112 12,480

Equity in losses ........................... (68,659) (36,466)

Dividends and distributions received ..... — (940)

Foreign currency translation .............. (3,122) (1,685)

Other ...................................... (24) (4,402)

Ending investment ........................ $ 80,936 $ 131,629