Washington Post 2001 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2001 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

THE WASHINGTON POST COMPANY

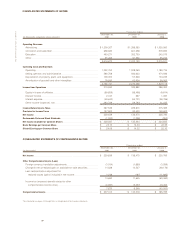

scriber revenue at the cable division. Revenue growth at Kaplan, Inc.

(about two-thirds of which was from acquisitions) accounted for the

increase in education revenue. The decrease in other revenue is pri-

marily due to the disposition of Legi-Slate in June of 1999.

Operating costs and expenses for the year increased 13 percent to

$2,072.3 million, from $1,827.1 million in 1999. The cost and expense

increase is primarily attributable to the charge arising from the early

retirement program at The Post, companies acquired in 2000 and

1999, greater spending for new business development at Kaplan, Inc.

and washingtonpost.com, higher depreciation and amortization

expense, and a reduced pension credit.

Operating income decreased 13 percent to $339.9 million in 2000,

from $388.5 million in 1999.

The Company’s 2000 operating income includes $65.3 million of net

pension credits, compared to $84.4 million in 1999. These amounts

exclude $29.0 million and $2.7 million in charges related to early

retirement programs in 2000 and 1999, respectively.

Division Results

Newspaper Publishing Division. Newspaper division revenue in 2000

increased 5 percent to $918.2 million, from $875.1 million in 1999.

Advertising revenue at the newspaper division rose 5 percent over the

previous year; circulation revenue remained essentially unchanged.

Total print advertising revenue grew 4 percent in 2000 at The

Washington Post newspaper, principally as a result of higher adver-

tising rates. At The Post, higher advertising rates, offset in part by

advertising volume declines, generated a 4 percent and 2 percent

increase in full run retail and classified print advertising revenue,

respectively. Other print advertising revenue (including general and

preprint) at The Post increased 5 percent due mainly to increased

general advertising volume and higher rates.

Newspaper division operating margin in 2000 decreased to 12 per-

cent, from 18 percent in 1999. Excluding the $27.5 million pre-tax

charge for the early retirement program completed at The Washington

Post, the 2000 newspaper division operating margin totaled 15 per-

cent. The decline in operating margin resulted mostly from increased

spending on marketing and sales initiatives at washingtonpost.com,

an 8 percent increase in newsprint expense, and a reduced pension

credit, offset in part by higher advertising revenues.

Daily circulation remained unchanged at The Washington Post;

Sunday circulation declined 1 percent.

Revenue generated by the Company’s online publishing activities, pri-

marily washingtonpost.com, totaled $27.1 million for 2000, versus

$15.6 million for 1999.

Television Broadcasting Division. Revenue at the broadcast division

increased 7 percent to $364.8 million, from $341.8 million in 1999.

Political and Olympics advertising in the third and fourth quarters of 2000

totaled approximately $42 million, accounting for the increase in 2000

revenue.

Competitive market position remained strong for the Company’s

television stations. WJXT in Jacksonville, KSAT in San Antonio, and

WDIV in Detroit were all ranked number one in the latest ratings period,

sign-on to sign-off, in their respective markets; WPLG was tied for first

among English-language stations in the Miami market; and KPRC in

Houston and WKMG in Orlando ranked third in their respective mar-

kets, but continued to make good progress in improving market share.

Operating margin at the broadcast division was 49 percent for both

2000 and 1999. Excluding amortization of goodwill and intangibles,

operating margin was 53 percent for 2000 and 1999.

Magazine Publishing Division. Magazine division revenue was $416.4

million for 2000, up 4 percent over 1999 revenue of $401.1 million.

Operating income for the magazine division totaled $49.1 million for

2000, a decrease of 21 percent from operating income of $62.1 mil-

lion in 1999. The 21 percent decrease in operating income occurred

primarily at Newsweek, where reduced pension credits and higher sub-

scription acquisition costs at the domestic edition outpaced revenue

and operating income improvements at the international edition.

Operating margin at the magazine publishing division decreased to 12

percent for 2000, compared to 15 percent in 1999.

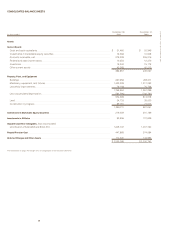

Cable Television Division. Revenue at the cable division rose 7 percent

to $358.9 million in 2000, compared to $336.3 million in 1999. Basic,

tier, and advertising revenue categories each showed improvement over

1999. The increase in subscriber revenue is attributable to higher rates.

The number of basic subscribers at the end of 2000 totaled 735,400, a

1 percent decline from 739,850 basic subscribers at the end of 1999.

Cable operating cash flow (operating income excluding depreciation

and amortization expense) increased 2 percent to $143.7 million, from

$140.2 million in 1999; operating cash flow margins totaled 40 per-

cent and 42 percent, for 2000 and 1999, respectively.

Operating income at the cable division for 2000 and 1999 totaled $66.0

million and $67.1 million, respectively. The decline in operating income

is primarily attributable to an increase in programming expense, addi-

tional costs associated with the launch of new services, and higher

depreciation expense, offset in part by higher revenue.

The increase in depreciation expense is due to capital spending for con-

tinuing system rebuilds and upgrades, which will enable the cable divi-

sion to offer new digital and high-speed cable modem services to its

subscribers. The cable division began its rollout plan for these services

in the second and third quarters of 2000. The rollout plan for the new dig-

ital cable services includes an offer to provide services free for one year.