United Healthcare 2007 Annual Report Download - page 72

Download and view the complete annual report

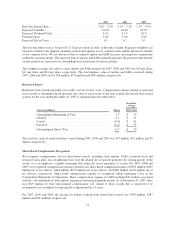

Please find page 72 of the 2007 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.billion and an accretion yield of 5.3%. These notes have a put feature that allows a note holder to require us to

repurchase the notes at the accreted value at certain annual dates in the future, beginning on November 15, 2010.

In November 2007, we entered into a $1.5 billion 364-day revolving credit facility in order to expand our access

to liquidity. The credit facility supports our commercial paper program and is available for general working

capital purposes. As of December 31, 2007, we had no amounts outstanding under this bank credit facility.

In November 2007, we issued a total of $1.6 billion in senior unsecured debt, which included: $250 million of

5.1% fixed-rate notes due November 2010, $450 million of 5.5% fixed-rate notes due November 2012, $250

million of 6.0% fixed-rate notes due November 2017 and $650 million of 6.6% fixed-rate notes due November

2037. These notes were issued pursuant to an exemption from registration under Section 4(2) of the Securities

Act of 1933 (1933 Act). In January 2008, we commenced an offer to allow purchasers of the notes to exchange

each series of these notes for a new issue of substantially identical debt securities registered under the 1933 Act.

We expect to complete the exchange in February 2008.

In June 2007, we issued a total of $1.5 billion in senior unsecured debt, which included: $500 million of floating-

rate notes due June 2010, $500 million of 6.0% fixed-rate notes due June 2017 and $500 million of 6.5% fixed-

rate notes due June 2037. The floating-rate notes due June 2010 are benchmarked to the LIBOR and had an

interest rate of 5.1% at December 31, 2007. These notes were issued pursuant to an exemption from registration

under Section 4(2) of the 1933 Act. In January 2008, we commenced an offer to allow purchasers of the notes to

exchange each series of these notes for a new issue of substantially identical debt securities registered under the

1933 Act. We expect to complete the exchange in February 2008.

In May 2007, we amended and restated our $1.3 billion five-year revolving credit facility supporting our

commercial paper program. We increased the credit facility to $2.6 billion and extended the maturity date to May

2012. As of December 31, 2007 and 2006, we had no amounts outstanding under this credit facility.

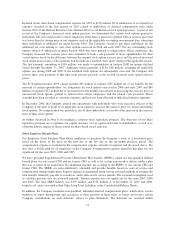

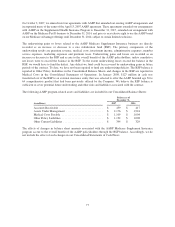

On December 1, 2006, our Health Care Services business segment acquired the Student Insurance Division

(Student Resources) of The MEGA Life and Health Insurance Company through an asset purchase agreement.

Under the terms of the asset purchase agreement, we issued a 10-year, 5.4% promissory note for approximately

$95 million and paid approximately $1 million in cash in exchange for the net assets of Student Resources.

In October 2006, we entered into a $7.5 billion 364-day revolving credit facility. Effective August 3, 2007, we

elected to reduce the amount of this facility to $1.5 billion. This credit facility expired on October 15, 2007.

In March 2006, we issued a total of $3.0 billion in senior unsecured debt to refinance outstanding commercial

paper. We issued $650 million of floating-rate notes due March 2009, $750 million of 5.3% fixed-rate notes due

March 2011, $750 million of 5.4% fixed-rate notes due March 2016 and $850 million of 5.8% fixed-rate notes

due March 2036. The floating-rate notes due March 2009 are benchmarked to the LIBOR and had an interest rate

of 5.2% and 5.5% at December 31, 2007 and 2006, respectively.

On February 24, 2006, our Health Care Services business segment acquired John Deere Health Care, Inc.

(JDHC). Under the terms of the purchase agreement, we paid approximately $515 million in cash, including

transaction costs, in exchange for all of the outstanding equity of JDHC. We issued commercial paper to finance

the JDHC purchase price. JDHC has been renamed UnitedHealthcare Services Company of the River Valley, Inc.

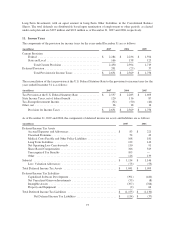

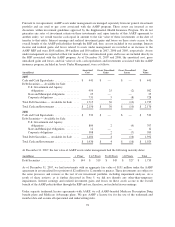

To more closely align interest costs with floating interest rates received on our cash equivalent and investment

balances, we have entered into interest rate swap agreements to convert the majority of our interest rate exposure

from fixed rates to variable rates. The interest rate swap agreements have aggregate notional amounts of $5.6

billion as of December 31, 2007, with variable rates that are benchmarked to the LIBOR. As of December 31,

2007, the aggregate asset, recorded at fair value, for all existing interest rate swaps was approximately $151

million. These interest rate swap agreements qualify as fair value hedges and are accounted for using the

short-cut method under Statement of Financial Accounting Standards No. 133, “Accounting for Derivative

70