United Healthcare 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

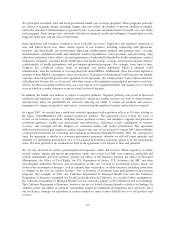

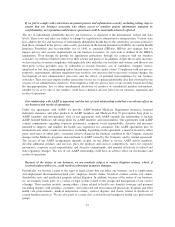

Medical cost PMPM trend factors are the most significant factors we use in estimating our medical costs payable

for the most recent three months. The following table illustrates the sensitivity of these factors and the estimated

potential impact on our medical costs payable estimates for the most recent three months as of December 31,

2007:

Medical Cost PMPM Trend

Increase (Decrease) in Factor

Increase (Decrease) in

Medical Costs Payable (2)

(in millions)

3% ........................................................... $ 258

2% ........................................................... $ 172

1% ........................................................... $ 86

(1)% .......................................................... $ (86)

(2)% .......................................................... $ (172)

(3)% .......................................................... $ (258)

(1) Reflects estimated potential changes in medical costs and medical costs payable caused by changes in

completion factors used in developing medical cost payable estimates for older periods, generally periods

prior to the most recent three months.

(2) Reflects estimated potential changes in medical costs and medical costs payable caused by changes in

medical costs PMPM trend data used in developing medical cost payable estimates for the most recent three

months.

The analyses above include those outcomes that are considered reasonably likely based on our historical

experience in estimating liabilities for incurred but not reported benefit claims.

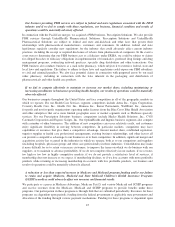

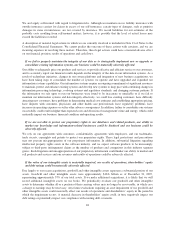

In order to evaluate the impact of changes in medical cost estimates for any particular discrete period, one should

consider both the amount of development recorded in the current period pertaining to prior periods and the

amount of development recorded in subsequent periods pertaining to the current period. The accompanying table

provides a summary of the net impact of favorable development on medical costs and earnings from operations:

Favorable

Development

Increase (Decrease)

to Medical Costs (a)

Medical Costs Earnings from Operations

(in millions) As Reported As Adjusted (b) As Reported As Adjusted (b)

2005 .... $ 400 $ (30) $ 33,669 $ 33,639 $ 5,080 $ 5,110

2006 .... $ 430 $ 10 $ 53,308 $ 53,318 $ 6,984 $ 6,974

2007 .... $ 420 (c) $ 55,435 (c) $ 7,849 (c)

(a) The amount of favorable development recorded in the current year pertaining to the prior year less the

amount of favorable development recorded in the subsequent year pertaining to the current year.

(b) Represents reported amounts adjusted to reflect the net impact of medical cost development.

(c) Not yet determinable as the amount of prior period development recorded in 2008 will change as our

December 31, 2007 medical costs payable estimate develops throughout 2008.

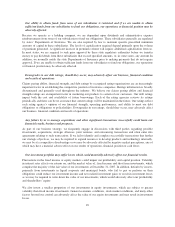

Our estimate of medical costs payable represents management’s best estimate of our liability for unpaid medical

costs as of December 31, 2007, developed using consistently applied actuarial methods. Management believes

the amount of medical costs payable is reasonable and adequate to cover our liability for unpaid claims as of

December 31, 2007; however, actual claim payments may differ from established estimates. Assuming a

hypothetical 1% difference between our December 31, 2007 estimates of medical costs payable and actual

medical costs payable, excluding the AARP business, 2007 earnings from operations would increase or decrease

by $72 million and diluted net earnings per common share would increase or decrease by $0.03 per share.

39