United Healthcare 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

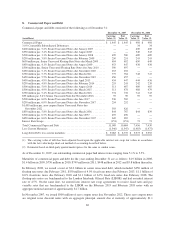

price and the associated income tax effects of the pro forma adjustments. The following unaudited pro forma

results have been prepared for comparative purposes only and do not purport to be indicative of the results of

operations that would have occurred had the acquisition been consummated at the beginning of the period.

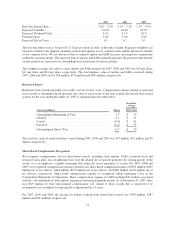

(in millions, except per share data)

For the

Year Ended

December 31, 2005

Pro forma - unaudited

Revenues ................................................ $ 60,486

Net Earnings ............................................. $ 3,351

Earnings Per Share:

Basic ............................................... $ 2.46

Diluted ............................................. $ 2.33

We record liabilities related to integration activities in connection with business combinations when integration

plans are finalized and approved by management within one year of the acquisition date in accordance with the

requirements of EITF Issue No. 95-3, “Recognition of Liabilities in Connection with a Purchase Business

Combination.” Liabilities recorded relate to activities that have no future economic benefit to the Company and

represent contractual obligations. These liabilities result in an increase to goodwill acquired. At each reporting

date, we evaluate our liabilities associated with integration activities and make adjustments as appropriate.

Integration activities relate primarily to severance costs for certain workforce reductions largely in the Health

Care Services segment, costs of terminated or vacated leased facilities and other contract termination costs. The

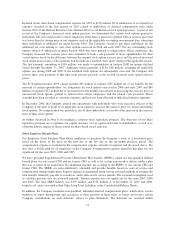

following table illustrates the changes in employee termination benefit costs and other integration costs related to

the PacifiCare acquisition as of December 31, 2007:

(in millions)

Employee

Termination

Benefit Costs

Other Integration

Activities Total

Accrued integration liabilities at December 31, 2006 .... $ 27 $ 28 $ 55

Estimate adjustments ............................. (13) (3) (16)

Payments made against liability ..................... (12) (23) (35)

Accrued integration liabilities at December 31, 2007 .... $ 2 $ 2 $ 4

For the years ended December 31, 2007, 2006 and 2005, aggregate consideration paid, net of cash assumed and

other effects, for smaller acquisitions was $262 million, $276 million and $196 million, respectively. These

acquisitions were not material to our Consolidated Financial Statements.

64