United Healthcare 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cautionary Statements Relating to Our Historical Stock Option Practices

Matters relating to or arising out of our historical stock option practices, including regulatory inquiries,

litigation matters, and potential additional cash and noncash charges could have a material adverse effect

on the Company.

In early 2006, our Board of Directors initiated an independent review of the Company’s historical stock option

practices from 1994 to 2005. The independent review was conducted by an independent committee comprised of

three independent directors of the Company (Independent Committee) with the assistance of independent counsel

and independent accounting advisors. On October 15, 2006, we announced that the Independent Committee had

completed their review of the Company’s historical stock option practices and reported the findings to the

non-management directors of the Company. As a result of our historical stock option practices, we restated our

previously filed financial statements, we are subject to various regulatory inquiries and litigation matters, and we

may be subject to further cash and noncash charges, the outcome of any or all of which could have a material

adverse effect on us.

Regulatory Inquiries

As previously disclosed, the SEC and the U.S. Attorney for the Southern District of New York are conducting

investigations into the Company’s historical stock option practices and the Company has received requests for

documents from the Minnesota Attorney General and various Congressional committees in connection with these

issues and the Company’s executive compensation practices. We have not resolved these matters. We cannot

provide assurance that the Company will not be subject to adverse publicity, regulatory or criminal fines,

penalties, or other sanctions or contingent liabilities or adverse customer reactions in connection with these

matters. In addition, we may be subject to additional regulatory inquiries arising out of the review of the

Independent Committee, the review of a special litigation committee, consisting of two former Minnesota

Supreme Court Justices, appointed by our Board of Directors to review claims asserted in federal and state

shareholder derivative claims relating to our historical stock option practices (Special Litigation Committee), and

the related restatement of our historical financial statements. Regulatory inquiries may be time consuming,

expensive and distracting from the conduct of our business. The adverse resolution of any regulatory inquiry

could have a material adverse effect on our business, financial condition and results of operations.

Litigation Matters

We and certain of our current and former directors and officers are defendants in a consolidated federal securities

class action, an Employment Retirement Income Security Act of 1974, as amended (ERISA) class action, and

state and federal shareholder derivative actions relating to our historical stock option practices. We also have

received shareholder demands relating to those practices.

In addition, following our announcement that we would delay filing our Quarterly Report on Form 10-Q for the

quarter ended June 30, 2006, we received a purported notice of default from persons claiming to hold our 5.8%

Senior Unsecured Notes due March 15, 2036 alleging a violation of the indenture governing those debt securities.

We cannot provide assurance that the ultimate outcome of these actions will not have a material adverse effect on

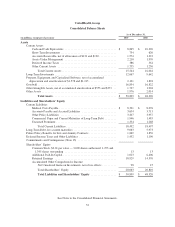

our business, financial condition or results of operations. See Note 13 of Notes to the Consolidated Financial

Statements for a more detailed description of these proceedings and shareholder demands.

In addition, we may be subject to additional litigation, proceedings or actions arising out of the Independent

Committee’s review, the Special Litigation Committee’s review and the related restatement of our historical

financial statements. Litigation regulatory proceedings or actions may be time consuming, expensive and

distracting from the conduct of our business. The adverse resolution of any specific lawsuit or any potential

regulatory proceeding or action could have a material adverse effect on our business, financial condition and

results of operations.

42