United Healthcare 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We are largely self-insured with regard to litigation risks. Although we maintain excess liability insurance with

outside insurance carriers for claims in excess of our self-insurance, certain types of damages, such as punitive

damages in some circumstances, are not covered by insurance. We record liabilities for our estimates of the

probable costs resulting from self-insured matters, however, it is possible that the level of actual losses may

exceed the liabilities recorded.

A description of material legal actions in which we are currently involved is included in Note 13 of Notes to the

Consolidated Financial Statements. We cannot predict the outcome of these actions with certainty, and we are

incurring expenses in resolving these matters. Therefore, these legal actions could have a material adverse effect

on our financial position, results of operations and cash flows.

If we fail to properly maintain the integrity of our data or to strategically implement new or upgrade or

consolidate existing information systems, our business could be materially adversely affected.

Our ability to adequately price our products and services, to provide effective and efficient service to our customers,

and to accurately report our financial results depends on the integrity of the data in our information systems. As a

result of technology initiatives, changes in our system platforms and integration of new business acquisitions, we

have been taking steps to consolidate the number of systems we operate and have upgraded and expanded our

information systems capabilities. Our information systems require an ongoing commitment of significant resources

to maintain, protect and enhance existing systems and develop new systems to keep pace with continuing changes in

information processing technology, evolving systems and regulatory standards, and changing customer patterns. If

the information we rely upon to run our businesses were found to be inaccurate or unreliable or if we fail to

maintain our information systems and data integrity effectively, we could lose existing customers, have difficulty

attracting new customers, have problems in determining medical cost estimates and establishing appropriate pricing,

have disputes with customers, physicians and other health care professionals, have regulatory problems, have

increases in operating expenses or suffer other adverse consequences. In addition, failure to consolidate our systems

successfully could result in higher than expected costs and diversion of management’s time and energy, which could

materially impact our business, financial condition and operating results.

If we are not able to protect our proprietary rights to our databases and related products, our ability to

market our knowledge and information-related businesses could be hindered and our business could be

adversely affected.

We rely on our agreements with customers, confidentiality agreements with employees, and our trademarks,

trade secrets, copyrights and patents to protect our proprietary rights. These legal protections and precautions

may not prevent misappropriation of our proprietary information. In addition, substantial litigation regarding

intellectual property rights exists in the software industry, and we expect software products to be increasingly

subject to third-party infringement claims as the number of products and competitors in this industry segment

grows. Such litigation and misappropriation of our proprietary information could hinder our ability to market and

sell products and services and our revenues and results of operations could be adversely affected.

If the value of our intangible assets is materially impaired, our results of operations, shareholders’ equity

and debt ratings could be materially adversely affected.

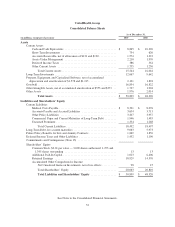

Due largely to our recent acquisitions, goodwill and other intangible assets represent a substantial portion of our

assets. Goodwill and other intangible assets were approximately $18.6 billion as of December 31, 2007,

representing approximately 37% of our total assets. If we make additional acquisitions, it is likely that we will

record additional intangible assets on our books. We periodically evaluate our goodwill and other intangible

assets to determine whether all or a portion of their carrying values may no longer be recoverable, in which case

a charge to earnings may be necessary. Any future evaluations requiring an asset impairment of our goodwill and

other intangible assets could materially affect our results of operations and shareholders’ equity in the period in

which the impairment occurs. A material decrease in shareholders’ equity could, in turn, negatively impact our

debt ratings or potentially impact our compliance with existing debt covenants.

48