United Healthcare 2007 Annual Report Download - page 62

Download and view the complete annual report

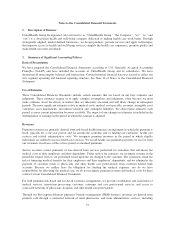

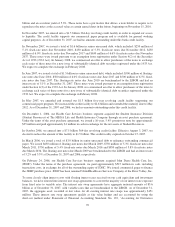

Please find page 62 of the 2007 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In December 2007, the FASB issued FAS No. 160, “Noncontrolling Interests in Consolidated Financial

Statements – An Amendment of ARB No. 51” (FAS 160). FAS 160 requires that accounting and reporting for

minority interests be recharacterized as noncontrolling interests and classified as a component of equity. The

standard is effective for our fiscal year 2009 and must be applied prospectively. We do not expect that the

adoption of FAS 160 will have a material impact on our Consolidated Financial Statements.

In February 2007, the FASB issued FAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities — Including an amendment of FASB Statement No. 115” (FAS 159). FAS 159 expands the use of fair

value accounting but does not affect existing standards that require assets or liabilities to be carried at fair value.

Under FAS 159, a company may elect to use fair value to measure various assets and liabilities including

accounts receivable, available-for-sale and held-to-maturity securities, equity method investments, accounts

payable, guarantees and issued debt. If the use of fair value is elected, any upfront costs and fees related to the

item must be recognized in earnings and cannot be deferred. The fair value election is irrevocable and generally

made on an instrument-by-instrument basis, even if a company has similar instruments that it elects not to

measure based on fair value. At the adoption date, unrealized gains and losses on existing items for which fair

value has been elected are reported as a cumulative adjustment to beginning retained earnings. Subsequent to the

adoption of FAS 159, changes in fair value are recognized in earnings. FAS 159 is effective for our fiscal year

2008. We are currently evaluating the impact, if any, of FAS 159 on our Consolidated Financial Statements.

In September 2006, the FASB issued FAS No. 157, “Fair Value Measurements” (FAS 157). FAS 157 provides

enhanced guidance for using fair value to measure assets and liabilities. It does not require any new fair value

measurements, but does require expanded disclosures to provide information about the extent to which fair value

is used to measure assets and liabilities, the methods and assumptions used to measure fair value, and the effect

of fair value measures on earnings. In February 2008, the FASB issued FASB Staff Position FAS 157-2,

“Effective Date of FASB Statement No. 157” (the FSP). The FSP delayed, for one year, the effective date of FAS

157 for all nonfinancial assets and liabilities, except those that are recognized or disclosed in the financial

statements on at least an annual basis. Consequently, FAS 157 will be effective for our fiscal year 2008 for

financial assets and liabilities recognized or disclosed in our Consolidated Financial Statements. The deferred

provisions of FAS 157 will be effective for our fiscal year 2009. We have evaluated the effects of the initial

adoption of FAS 157 for our 2008 fiscal year and do not expect its adoption will have a material impact on our

Consolidated Financial Statements. We are currently evaluating the impact, if any, of the entirety of FAS 157 on

our fiscal year 2009 Consolidated Financial Statements.

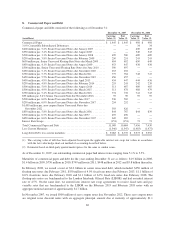

3. Medicare Part D Pharmacy Benefits Contract

Beginning January 1, 2006, the Company began serving as a plan sponsor offering Medicare Part D prescription

drug insurance coverage under contracts with the Centers for Medicare & Medicaid Services (CMS). Under the

Medicare Part D program, there are six separate elements of payment received by the Company during the plan

year. These payment elements are as follows:

•CMS Premium — CMS pays a fixed monthly premium per member to the Company for the entire plan year.

•Member Premium — Additionally, certain members pay a fixed monthly premium to the Company for the

entire plan year.

•Low-Income Premium Subsidy — For qualifying low-income members, CMS pays some or all of the

member’s monthly premiums to the Company on the member’s behalf.

•Catastrophic Reinsurance Subsidy — CMS pays the Company a cost reimbursement estimate monthly to

fund the CMS obligation to pay approximately 80% of the costs incurred by individual members in excess

of the individual annual out-of-pocket maximum of $3,850. A settlement is made based on actual cost

experience subsequent to the end of the plan year.

•Low-Income Member Cost Sharing Subsidy — For qualifying low-income members, CMS pays on the

member’s behalf, some or all of a member’s cost sharing amounts, such as deductibles and coinsurance. The

60