United Healthcare 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

deficit we fund could be recovered by underwriting gains in future periods of the contract. To date, we have not

been required to fund any underwriting deficits. The RSF balance is reported in Other Policy Liabilities in the

accompanying Consolidated Balance Sheets. We believe the RSF balance is sufficient to cover potential future

underwriting or other risks associated with the contract.

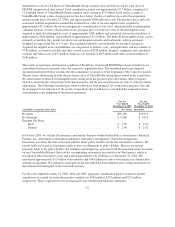

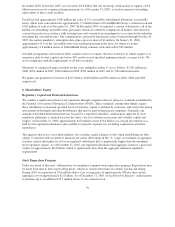

The following AARP program-related assets and liabilities are included in our Consolidated Balance Sheets:

Balance as of

December

(in millions) 2005 2004

Accounts Receivable ................................................. $ 414 $ 389

Assets Under Management ............................................ $1,792 $1,883

Medical Costs Payable ............................................... $1,001 $ 899

Other Policy Liabilities ............................................... $ 939 $1,162

Other Current Liabilities .............................................. $ 266 $ 211

The effects of changes in balance sheet amounts associated with the AARP program accrue to the overall benefit

of the AARP policyholders through the RSF balance. Accordingly, we do not include the effect of such changes

in our Consolidated Statements of Cash Flows.

Pursuant to our agreement, AARP assets under management are managed separately from our general investment

portfolio and are used to pay costs associated with the AARP program. These assets are invested at our

discretion, within investment guidelines approved by AARP. We do not guarantee any rates of investment return

on these investments and, upon transfer of the AARP contract to another entity, we would transfer cash equal in

amount to the fair value of these investments at the date of transfer to that entity. Interest earnings and realized

investment gains and losses on these assets accrue to the overall benefit of the AARP policyholders through the

RSF. As such, they are not included in our earnings. Interest income and realized gains and losses related to

assets under management are recorded as an increase to the AARP RSF and were $90 million, $103 million and

$101 million in 2005, 2004 and 2003, respectively. Assets under management are reported at their fair market

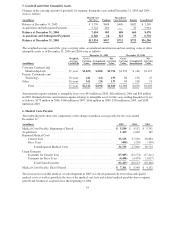

value, and unrealized gains and losses are included directly in the RSF associated with the AARP program. As of

December 31, 2005 and 2004, the amortized cost, gross unrealized gains and losses, and fair value of cash, cash

equivalents and investments associated with the AARP insurance program, included in Assets Under

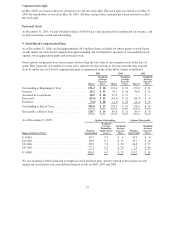

Management, were as follows (in millions):

Amortized

Cost

Gross Unrealized

Gains

Gross Unrealized

Losses

Fair

Value

2005

Cash and Cash Equivalents ....................... $ 409 $ — $ — 409

Debt Securities — Available for Sale ............... 1,390 6 (13) 1,383

Total Cash and Investments .................. $1,799 $ 6 $ (13) $1,792

2004

Cash and Cash Equivalents ........................ $ 184 $ — $ — $ 184

Debt Securities — Available for Sale ................ 1,664 37 (2) 1,699

Total Cash and Investments .................... $1,848 $ 37 $ (2) $1,883

As of December 31, 2005 and 2004, respectively, debt securities consisted of $779 million and $809 million in

U.S. Government and Agency obligations, $19 million and $20 million in state and municipal obligations and

$585 million and $870 million in corporate obligations. At December 31, 2005, the AARP assets under

management included debt securities of $149 million with maturities of less than one year, $459 million with

maturities of one to five years, $435 million with maturities of five to 10 years and $340 million with maturities

of more than 10 years. As of December 31, 2005, we had no investments under the AARP agreement in a

continuous unrealized loss position for 12 months or greater.

60