United Healthcare 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

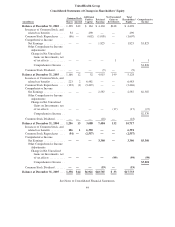

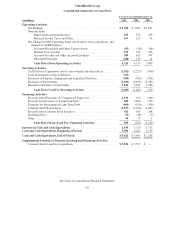

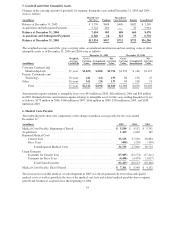

UnitedHealth Group

Consolidated Statements of Cash Flows

For the Year Ended December 31,

(in millions) 2005 2004 2003

Operating Activities

NetEarnings ................................................... $ 3,300 $ 2,587 $ 1,825

Noncash Items

Depreciation and Amortization ................................ 453 374 299

Deferred Income Taxes and Other .............................. 167 125 91

Net Change in Other Operating Items, net of effects from acquisitions, and

changes in AARP balances:

Accounts Receivable and Other Current Assets .................... (83) (30) (46)

Medical Costs Payable ....................................... 193 322 276

Accounts Payable and Other Accrued Liabilities ................... 580 623 547

Unearned Premiums ......................................... (284) 134 11

Cash Flows From Operating Activities ........................ 4,326 4,135 3,003

Investing Activities

Cash Paid for Acquisitions, net of cash assumed and other effects ......... (2,562) (2,225) (590)

Cash Transferred on Sale of Business ............................... (363) ——

Purchases of Property, Equipment and Capitalized Software ............. (509) (350) (352)

Purchases of Investments ......................................... (5,876) (3,190) (2,583)

Maturities and Sales of Investments ................................. 5,821 4,121 2,780

Cash Flows Used For Investing Activities ...................... (3,489) (1,644) (745)

Financing Activities

Proceeds from (Payments of) Commercial Paper, net ................... 2,556 194 (382)

Proceeds from Issuance of Long-Term Debt .......................... 500 2,000 950

Payments for Retirement of Long-Term Debt ......................... (400) (150) (350)

Common Stock Repurchases ...................................... (2,557) (3,446) (1,607)

Proceeds from Common Stock Issuances ............................. 423 583 268

DividendsPaid ................................................. (19) (18) (9)

Other ......................................................... 90 75 4

Cash Flows From (Used For) Financing Activities ............... 593 (762) (1,126)

Increase in Cash and Cash Equivalents ................................ 1,430 1,729 1,132

Cash and Cash Equivalents, Beginning of Period ........................ 3,991 2,262 1,130

Cash and Cash Equivalents, End of Period ............................. $ 5,421 $ 3,991 $ 2,262

Supplemental Schedule of Noncash Investing and Financing Activities

Common Stock Issued for Acquisitions .............................. $ 5,696 $ 5,557 $ —

See Notes to Consolidated Financial Statements.

45