United Healthcare 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

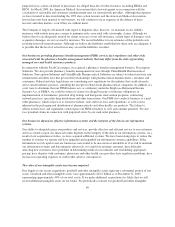

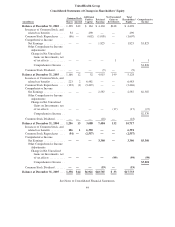

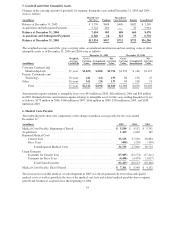

UnitedHealth Group

Consolidated Statements of Changes in Shareholders’ Equity

Common Stock Additional

Paid-in

Capital

Retained

Earnings

Net Unrealized

Gains on

Investments

Total

Shareholders’

Equity

Comprehensive

Income(in millions) Shares Amount

Balance at December 31, 2002 .... 1,198 $12 $ 164 $ 4,104 $148 $ 4,428

Issuances of Common Stock, and

related tax benefits .......... 34 — 490 — — 490

Common Stock Repurchases .... (66) — (602) (1,005) — (1,607)

Comprehensive Income

NetEarnings............... — — — 1,825 — 1,825 $1,825

Other Comprehensive Income

Adjustments:

Change in Net Unrealized

Gains on Investments, net

of tax effects ........... — — — — 1 1 1

Comprehensive Income . . $1,826

CommonStockDividend ....... — — — (9) — (9)

Balance at December 31, 2003 .... 1,166 12 52 4,915 149 5,128

Issuances of Common Stock, and

related tax benefits .......... 223 2 6,481 — — 6,483

Common Stock Repurchases .... (103) (1) (3,445) — — (3,446)

Comprehensive Income

NetEarnings............... — — — 2,587 — 2,587 $2,587

Other Comprehensive Income

Adjustments:

Change in Net Unrealized

Gains on Investments, net

of tax effects ........... — — — — (17) (17) (17)

Comprehensive Income . . $2,570

CommonStockDividend ....... — — — (18) — (18)

Balance at December 31, 2004 .... 1,286 13 3,088 7,484 132 10,717

Issuances of Common Stock, and

related tax benefits .......... 126 1 6,390 — — 6,391

Common Stock Repurchases .... (54) — (2,557) — — (2,557)

Comprehensive Income

NetEarnings............... — — — 3,300 — 3,300 $3,300

Other Comprehensive Income

Adjustments:

Change in Net Unrealized

Gains on Investments, net

of tax effects ........... — — — — (99) (99) (99)

Comprehensive Income . . $3,201

CommonStockDividend ....... — — — (19) — (19)

Balance at December 31, 2005 .... 1,358 $14 $6,921 $10,765 $ 33 $17,733

See Notes to Consolidated Financial Statements.

44