United Healthcare 2005 Annual Report Download - page 52

Download and view the complete annual report

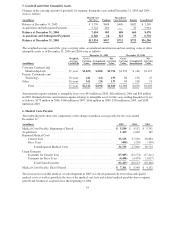

Please find page 52 of the 2005 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.recognized over the life of the agreements as an adjustment to interest expense in the Consolidated Statements of

Operations. Our existing interest rate swap agreements convert a majority of our interest rate exposure from a

fixed to a variable rate and are accounted for as fair value hedges. Additional information on our existing interest

rate swap agreements is included in Note 7.

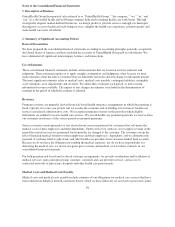

Recently Issued Accounting Standards

In November 2005, the FASB issued Staff Position No. 115-1, “The Meaning of Other-Than-Temporary

Impairment and Its Application to Certain Investments” (FSP 115-1). FSP 115-1 provides accounting guidance

for evaluating and recording other-than-temporary impairment losses on certain debt and equity investments.

FSP 115-1 nullifies certain provisions of Emerging Issues Task Force Issue No. 03-1 while retaining its

disclosure requirements, which had already been adopted. The Company has adopted FSP 115-1 and its adoption

did not have any impact on our consolidated financial position or results of operations.

In June 2005, the FASB issued an exposure draft of a proposed standard entitled “Business Combinations — a

replacement of FASB Statement No. 141.” The proposed standard, if adopted, would provide new guidance for

evaluating and recording business combinations and would be effective on a prospective basis for business

combinations whose acquisition dates are on or after January 1, 2007. Upon issuance of a final standard, the

Company will evaluate the impact of this new standard and its effect on the process for recording business

combinations.

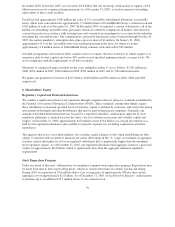

3. Acquisitions and Divestitures

On December 20, 2005, the company acquired PacifiCare Health Systems, Inc. (PacifiCare). PacifiCare provides

health care and benefit services to individuals and employers, principally in markets in the Western United

States. This merger significantly strengthened our resources by enhancing our capabilities on the Pacific Coast

and in other Western states and broadening the scope of our product offerings for a host of specialized services.

The operations of PacifiCare reside primarily within our Health Care Services and Specialized Care Services

segments. Under the terms of the agreement, PacifiCare shareholders received 1.1 shares of UnitedHealth Group

common stock and $21.50 in cash for each share of PacifiCare common stock they owned. Total consideration

issued for the transaction was approximately $8.8 billion, composed of approximately 99.2 million shares of

UnitedHealth Group common stock (valued at approximately $5.3 billion based upon the average of

UnitedHealth Group’s share closing price for two days before, the day of and two days after the acquisition

announcement date of July 6, 2005), approximately $2.1 billion in cash, $960 million cash paid to retire

PacifiCare’s existing debt and UnitedHealth Group vested common stock options with an estimated fair value of

approximately $420 million issued in exchange for PacifiCare’s outstanding vested common stock options. The

purchase price and costs associated with the acquisition exceeded the preliminary estimated fair value of the net

tangible assets acquired by approximately $7.1 billion. Pending completion of an independent valuation analysis,

we have preliminarily allocated the excess purchase price over the fair value of the net tangible assets acquired to

finite-lived intangible assets of $1.0 billion and associated deferred tax liabilities of $392 million, and goodwill

of approximately $6.5 billion. The finite-lived intangible assets consist primarily of member lists, health care

physician and hospital networks and trademarks, with an estimated weighted-average useful life of 13 years. The

acquired goodwill is not deductible for income tax purposes. Our preliminary estimate of acquired net tangible

assets and liabilities are categorized as follows: cash and cash equivalents of $810 million; investments of $2.4

billion; accounts receivable and other current assets of $750 million; property, equipment and capitalized

software and other assets of $380 million; medical costs payable of $1.4 billion and other liabilities of $1.2

billion.

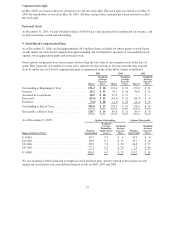

On February 24, 2006, our Health Care Services business segment acquired John Deere Health Care, Inc. (John

Deere Health). John Deere Health serves employers primarily in central and eastern Iowa, western Illinois,

eastern Tennessee and southwestern Virginia. This acquisition will strengthen our market position in these areas.

We paid approximately $500 million in cash in exchange for all of the outstanding equity of John Deere Health.

Due to the timing of the acquisition, management is still in the process of estimating the acquired net tangible

assets, intangible assets and goodwill resulting from this acquisition.

50