United Healthcare 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

points over 2003. This increase was principally driven by a combination of the improved commercial medical

care ratio and changes in business and customer mix.

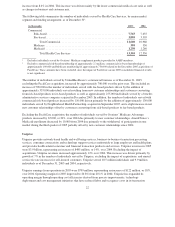

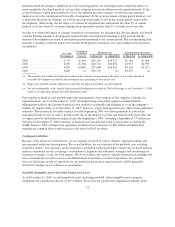

The following table summarizes the number of individuals served by Health Care Services, by major market

segment and funding arrangement, as of December 311:

(in thousands) 2004 2003

Commercial

Risk-based ...................................................... 7,655 5,400

Fee-based ....................................................... 3,305 2,895

Total Commercial ............................................ 10,960 8,295

Medicare ....................................................... 330 230

Medicaid ....................................................... 1,260 1,105

Total Health Care Services ..................................... 12,550 9,630

1Excludes individuals served by Ovations’ Medicare supplement products provided to AARP members.

The number of individuals served by UnitedHealthcare’s commercial business as of December 31, 2004,

increased by nearly 2.7 million, or 32%, over the prior year. Excluding the 2004 acquisitions of Oxford, MAMSI

and a smaller regional health plan, the number of individuals served by UnitedHealthcare’s commercial business

increased by 245,000. This included an increase of 285,000 in the number of individuals served with fee-based

products, driven by new customer relationships and existing customers converting from risk-based products to

fee-based products, partially offset by a decrease of 40,000 in the number of individuals served with risk-based

products resulting primarily from customers converting to self-funded, fee-based arrangements and a competitive

commercial risk-based pricing environment.

Excluding the impact of the Oxford acquisition, the number of individuals served by Ovations’ Medicare

Advantage products increased by 30,000, or 13%, from 2003. AmeriChoice’s Medicaid enrollment increased by

155,000, or 14%, due to organic growth in the number of individuals served and the acquisition of a Medicaid

health plan in Michigan in February 2004, resulting in the addition of approximately 95,000 individuals served.

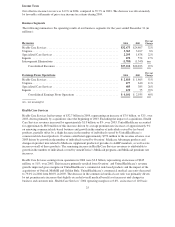

Uniprise

Uniprise revenues in 2004 were $3.4 billion, representing an increase of 8% over 2003. This increase was driven

primarily by growth of 4% in the number of individuals served by Uniprise, excluding the impact of acquisitions,

and annual service fee rate increases for self-insured customers. Uniprise served 9.9 million individuals and

9.1 million individuals as of December 31, 2004 and 2003, respectively.

Uniprise earnings from operations in 2004 were $677 million, representing an increase of 11% over 2003.

Operating margin for 2004 improved to 20.1% from 19.6% in 2003. Uniprise has expanded its operating margin

through operating cost efficiencies derived from process improvements, technology deployment and cost

management initiatives that have reduced labor and occupancy costs in its transaction processing and customer

service, billing and enrollment functions.

Specialized Care Services

Specialized Care Services revenues during 2004 of $2.3 billion increased by $417 million, or 22%, over 2003.

This increase was principally driven by an increase in the number of individuals served by its behavioral health

benefits business, its dental services business and its vision care benefits business; rate increases related to these

businesses; and incremental revenues related to businesses acquired since the beginning of 2003 of

approximately $100 million.

26