United Healthcare 2005 Annual Report Download - page 22

Download and view the complete annual report

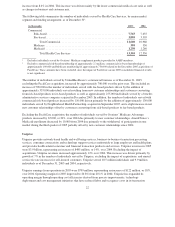

Please find page 22 of the 2005 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the medical care ratio decreased from 79.5% in 2004 to 78.6% in 2005. These medical care ratio decreases

resulted primarily from changes in product, business and customer mix and an increase in favorable medical cost

development related to prior periods.

Each period, our operating results include the effects of revisions in medical cost estimates related to all prior

periods. Changes in medical cost estimates related to prior fiscal years, resulting from more complete claim

information, identified in the current year are included in total medical costs reported for the current fiscal year.

Medical costs for 2005 include approximately $400 million of favorable medical cost development related to

prior fiscal years. Medical costs for 2004 include approximately $210 million of favorable medical cost

development related to prior fiscal years. The increase in favorable medical cost development in 2005 was driven

primarily by lower than anticipated medical costs as well as growth in the size of the medical cost base and

related medical payables due to organic growth and businesses acquired since the beginning of 2004.

On an absolute dollar basis, 2005 medical costs increased $5.7 billion, or 21%, over 2004. Excluding the impact

of acquisitions, medical costs increased by approximately 9% driven primarily by a 7% to 8% increase in

medical cost trend due to both inflation and a slight increase in health care consumption as well as organic

growth.

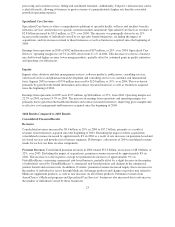

Operating Costs

The operating cost ratio (operating costs as a percentage of total revenues) for 2005 was 15.0%, down from

15.4% in 2004. This decrease was primarily driven by revenue mix changes, with premium revenues growing at

a faster rate than service revenues largely due to recent acquisitions. Operating costs as a percentage of premium

revenues are generally considerably lower than operating costs as a percentage of fee-based revenues.

Additionally, the decrease in the operating cost ratio reflects productivity gains from technology deployment and

other cost management initiatives.

On an absolute dollar basis, operating costs for 2005 increased $1.1 billion, or 19%, over 2004. Excluding the

impact of acquisitions, operating costs increased by approximately 11%. This increase was driven by an 8%

increase in total individuals served by Health Care Services and Uniprise during 2005, excluding the impact of

acquisitions, growth in Specialized Care Services and Ingenix and general operating cost inflation, partially

offset by productivity gains from technology deployment and other cost management initiatives.

Depreciation and Amortization

Depreciation and amortization in 2005 was $453 million, an increase of $79 million, or 21%, over 2004.

Approximately $32 million of this increase was related to intangible assets acquired in business acquisitions

since the beginning of 2004. The remaining increase is primarily due to additional depreciation and amortization

from higher levels of computer equipment and capitalized software as a result of technology enhancements,

business growth and businesses acquired since the beginning of 2004.

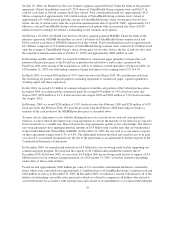

Income Taxes

Our effective income tax rate was 35.7% in 2005, compared to 34.9% in 2004. The increase was mainly driven

by favorable settlements of prior year tax returns during 2004. Excluding these settlements, the 2004 effective tax

rate would have been approximately the same as the 2005 effective tax rate.

20