United Healthcare 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

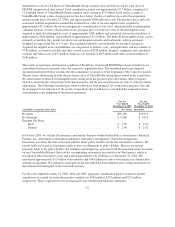

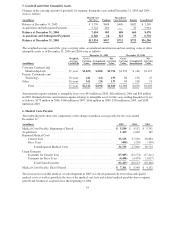

To determine compensation expense related to our stock-based compensation plans under the fair value method,

the fair value of each option grant is estimated on the date of grant using an option-pricing model. For purposes

of estimating the fair value of our employee stock option grants, we utilized a binomial model. The principal

assumptions we used in applying the option pricing models were as follows:

2005 2004 2003

Risk-Free Interest Rate ..................................................... 4.3% 3.3% 2.6%

Expected Volatility ........................................................ 23.5% 28.5% 30.9%

Expected Dividend Yield ................................................... 0.1% 0.1% 0.1%

Expected Life in Years ..................................................... 4.1 4.2 4.1

Information regarding the effect on net earnings and net earnings per common share had we applied the fair value

expense recognition provisions of FAS 123 is included in Note 2.

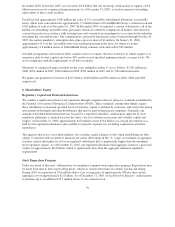

In December 2004, the Financial Accounting Standards Board (FASB) issued FAS 123R, which amended

FAS 123 and 95. FAS 123R requires all companies to measure compensation expense for all share-based

payments (including employee stock options) at fair value and recognize the expense over the related service

period. Additionally, excess tax benefits, as defined in FAS 123R, are recognized as an addition to paid-in-capital

and are reclassified from operating cash flows to financing cash flows in the Consolidated Statements of Cash

Flows. We adopted this standard as of January 1, 2006, and the adoption did not result in any change to the pro

forma compensation amounts historically disclosed under FAS 123.

10. Income Taxes

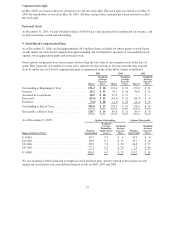

The components of the provision for income taxes are as follows:

Year Ended December 31, (in millions) 2005 2004 2003

Current Provision

Federal .......................................................... $1,638 $1,223 $ 932

State and Local .................................................... 106 78 46

Total Current Provision ......................................... 1,744 1,301 978

Deferred Provision ..................................................... 88 85 37

Total Provision for Income Taxes ................................. $1,832 $1,386 $1,015

The reconciliation of the tax provision at the U.S. Federal Statutory Rate to the provision for income taxes is as

follows:

Year Ended December 31, (in millions) 2005 2004 2003

Tax Provision at the U.S. Federal Statutory Rate ............................. $1,796 $1,391 $ 994

State Income Taxes, net of federal benefit ................................... 77 54 29

Tax-Exempt Investment Income .......................................... (40) (33) (30)

Other,net ............................................................ (1) (26) 22

Provision for Income Taxes .......................................... $1,832 $1,386 $1,015

58