Under Armour 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

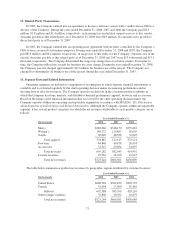

15. Related Party Transactions

In 2005, the Company entered into an agreement to license a software system with a vendor whose CEO is a

director of the Company. During the years ended December 31, 2008, 2007 and 2006 the Company paid $3.2

million, $1.8 million and $1.4 million, respectively, in licensing fees and related support services to this vendor.

Amounts payable to this related party as of December 31, 2008 were $0.9 million. No amounts were payable to

this related party as of December 31, 2007.

In 2007, the Company entered into an operating lease agreement with an entity controlled by the Company’s

CEO to lease an aircraft for business purposes. During years ended December 31, 2008 and 2007, the Company

paid $0.6 million and $0.4 million, respectively, in usage fees to this entity for the Company’s business use of the

aircraft. Amounts payable to this related party as of December 31, 2008 and 2007 were $13.6 thousand and $13.5

thousand, respectively. The Company determined the usage fees charged are at or below market. From time to

time, the Company utilized the aircraft for business use at no charge. During the year ended December 31, 2008,

the Company was not charged approximately $0.2 million for business use of the aircraft. The Company was

charged for substantially all business use of the aircraft during the year ended December 31, 2007.

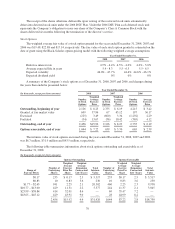

16. Segment Data and Related Information

Operating segments are defined as components of an enterprise in which separate financial information is

available and is evaluated regularly by the chief operating decision maker in assessing performance and in

deciding how to allocate resources. The Company operates exclusively in the consumer products industry in

which the Company develops, markets, and distributes branded performance apparel, footwear and accessories.

Based on the nature of the financial information that is received by the chief operating decision maker, the

Company operates within one operating and reportable segment in accordance with SFAS No. 131, Disclosures

about Segments of an Enterprise and Related Information. Although the Company operates within one reportable

segment, it has several product categories for which the net revenues attributable to each product category are as

follows:

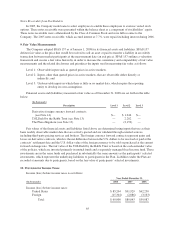

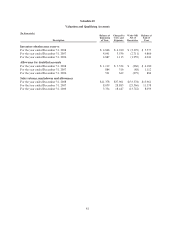

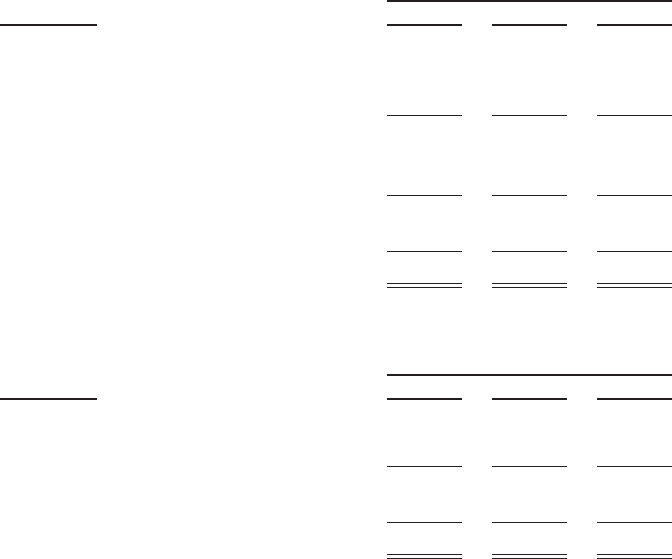

Year Ended December 31,

(In thousands) 2008 2007 2006

Men’s $382,066 $348,150 $255,681

Women’s 140,772 115,867 85,695

Youth 56,049 48,596 31,845

Total apparel 578,887 512,613 373,221

Footwear 84,848 40,878 26,874

Accessories 31,547 29,054 14,897

Total net sales 695,282 582,545 414,992

License revenues 29,962 24,016 15,697

Total net revenues $725,244 $606,561 $430,689

The table below summarizes product net revenues by geographic regions attributed by customer location:

Year Ended December 31,

(In thousands) 2008 2007 2006

United States $660,784 $562,439 $403,725

Canada 31,604 23,360 16,485

Subtotal 692,388 585,799 420,210

Other foreign countries 32,856 20,762 10,479

Total net revenues $725,244 $606,561 $430,689

73