Under Armour 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

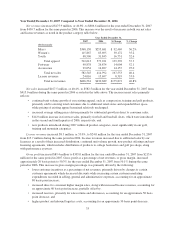

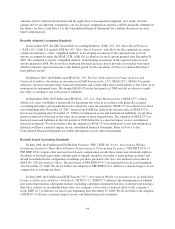

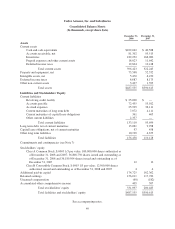

Contractual Commitments and Contingencies

We lease warehouse space, office facilities, space for our retail stores and certain equipment under

non-cancelable operating and capital leases. The leases expire at various dates through 2019, excluding

extensions at our option, and contain various provisions for rental adjustments. The operating leases generally

contain renewal provisions for varying periods of time. Our significant contractual obligations and commitments

as of December 31, 2008 are summarized in the following table:

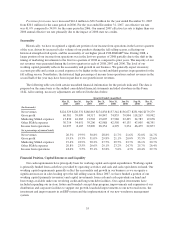

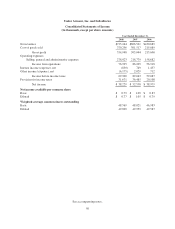

Payments Due by Period

(in thousands) Total

Less Than

1 Year 1 to 3 Years 3 to 5 Years

More Than

5 Years

Contractual obligations

Long term debt obligations (1) $ 20,133 $ 7,072 $10,814 $ 2,247 $ —

Capital lease obligations 477 378 99 — —

Operating lease obligations (2) 77,120 12,758 23,480 18,570 22,312

Product purchase obligations (3) 138,250 138,250 — — —

Sponsorships and other (4) 76,420 26,170 39,637 9,633 980

Total $312,400 $184,628 $74,030 $30,450 $23,292

(1) Excludes a total of $1.8 million in interest payments on long term debt obligations.

(2) Includes the minimum payments for operating lease obligations.

(3) We generally place orders with our manufacturers at least three to four months in advance of expected

future sales. The amounts listed for product purchase obligations primarily represent our open production

purchase orders for our apparel, footwear and accessories, including expected inbound freight, duties and

other costs. These open purchase orders specify fixed or minimum quantities of products at determinable

prices. The reported amounts exclude product purchase liabilities included in accounts payable as of

December 31, 2008.

(4) Includes footwear promotional rights fees, sponsorships of individual athletes, sports teams and athletic

events and other marketing commitments in order to promote our brand. Some of these sponsorship

agreements provide for additional incentives based on performance achievements while wearing or using

our products. It is not possible to determine the amounts we may be required to pay under these agreements

as they are primarily subject to certain performance based variables. The amounts listed above are the fixed

minimum amounts required to be paid under these agreements.

The table above excludes a $2.5 million liability for uncertain tax positions, including the related interest

and penalties, recorded in accordance with the Financial Accounting Standards Board (“FASB”) Interpretation

(“FIN”) No. 48 “Accounting for Uncertainty in Income Taxes,” (“FIN 48”) as we are unable to reasonably

estimate the timing of settlement (see Note 10 to the Consolidated Financial Statements for a further discussion

on FIN 48).

Off-Balance Sheet Arrangements

In connection with various contracts and agreements, we have agreed to indemnify counterparties against

certain third party claims relating to the infringement of intellectual property rights and other items that fall under

the scope of FIN No. 45, Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including

Indirect Guarantees of Indebtedness of Others. Generally, such indemnification obligations do not apply in

situations in which our counterparties are grossly negligent, engage in willful misconduct, or act in bad faith.

Based on our historical experience and the estimated probability of future loss, we have determined that the fair

value of such indemnifications is not material to our financial position or results of operations.

41