Under Armour 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

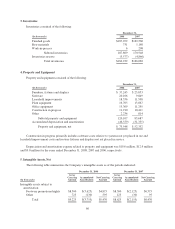

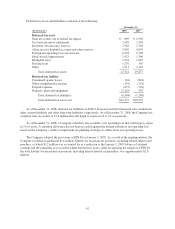

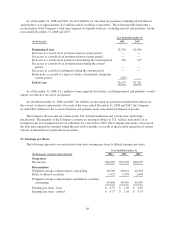

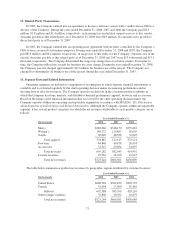

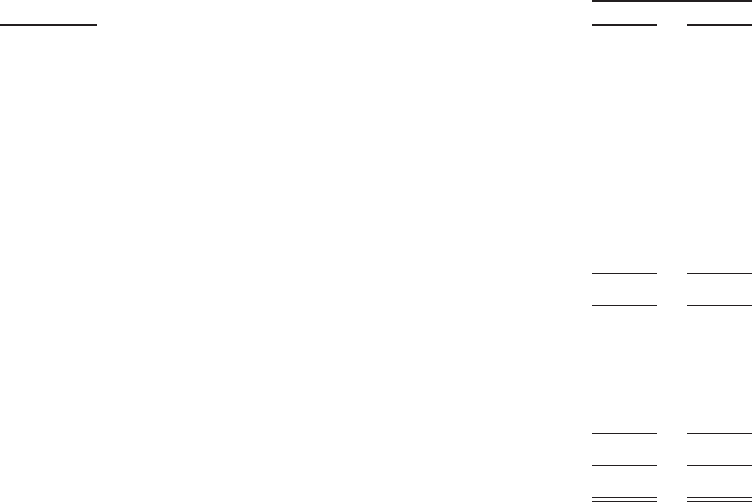

Deferred tax assets and liabilities consisted of the following:

December 31,

(In thousands) 2008 2007

Deferred tax asset

State tax credits, net of federal tax impact $ 899 $ 2,950

Tax basis inventory adjustment 2,495 2,336

Inventory obsolescence reserves 1,985 1,769

Allowance for doubtful accounts and other reserves 7,802 4,879

Foreign net operating loss carryforward 6,378 2,798

Stock-based compensation 3,425 1,366

Intangible asset 1,354 1,047

Deferred rent 1,292 585

Other 1,911 2,147

Total deferred tax assets 27,541 19,877

Deferred tax liability

Unrealized (gains) losses (81) (818)

Other comprehensive income (101) (201)

Prepaid expenses (837) (701)

Property, plant and equipment (5,285) 434

Total deferred tax liabilities (6,304) (1,286)

Total deferred tax assets, net $21,237 $18,591

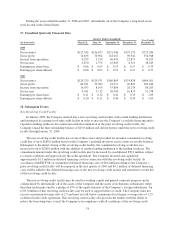

As of December 31, 2008, deferred tax liabilities of $260.3 thousand and $14.0 thousand were included in

other current liabilities and other long term liabilities, respectively. As of December 31, 2008, the Company has

available state tax credits of $1.4 million that will begin to expire in 12 to 13 year periods.

As of December 31, 2008, a Company subsidiary has available a net operating loss that will begin to expire

in 7 to 9 years. A valuation allowance has not been recorded against the foreign subsidiary net operating loss

based on the Company’s ability to implement tax planning strategies to utilize these net operating losses.

The Company adopted the provisions of FIN 48 on January 1, 2007. As a result of the implementation, the

Company recorded an additional $1.6 million liability for uncertain tax positions, including related interest and

penalties, of which $1.2 million was accounted for as a reduction to the January 1, 2007 balance of retained

earnings and the remainder was recorded within deferred tax assets. After recognizing the adoption of FIN 48,

the total liability for uncertain tax positions, including related interest and penalties, was approximately $2.0

million.

67